After decades of Buffett ridiculing gold as a poor investment choice, Berkshire Hathaway stunned investors in August when it took a stake in the Canadian miner, which is the world’s biggest gold company.

The move was seen by many as confirmation the 90-year-old Buffett had changed his position on the yellow metal, but after selling down 42 per cent of the Berkshire Holding this month, the dalliance looks over.

“I expect it was a way to play an option on gold. If you were looking for a liquid option on gold — as a trade — one of the easiest ways is to buy a listed goldmining stock,” says fund manager Manny Pohl, who is a director of the ASX-listed Global Masters Fund that was created to mirror Berkshire Hathaway’s performance.

Buffett has long berated investors in the “barbarous relic” for putting money into something that does not pay income. “I have no idea where gold will be in the next five years, but one thing I can tell you is it won’t do anything between now and then … except look at you,” he once said.

Buffet’s move into a listed gold miner rather than into bullion was also read as a sign the value investor would take comfort in Barrick’s dividend and cashflows.

The move into Barrick was greeted with wide acclaim by gold “bugs”. Nova Gold chairman Thomas Kaplan said at the time: “He’s made it safe for anyone interested in gold to be looking at the gold narrative.”

Which begs the question: what does it mean if he sells almost half the stake three months later?

“It may not even have been Buffett who made the initial investment,” Pohl says.

“There is a squad of younger managers coming through the ranks at Berkshire Hathaway and they are unleashing moves which we would not have seen in earlier years.”

Though it is increasingly looking like Buffett has not changed his stripes and suddenly revised his position on gold, the yellow metal is by no means friendless when it comes to attracting some of the global and local investors. Legendary Australian fund manager David Paradice has taken stakes in three goldminers: Northern Star, Westgold and Silver Lake.

Wall Street investor and author Ray Dalio has reportedly placed more than $400m into gold this year through his hedge fund group.

Similarly, Michael Hintze, the London-based Australian hedge fund billionaire, has announced investments in Australian-listed goldminers Resolute and Ausgold.

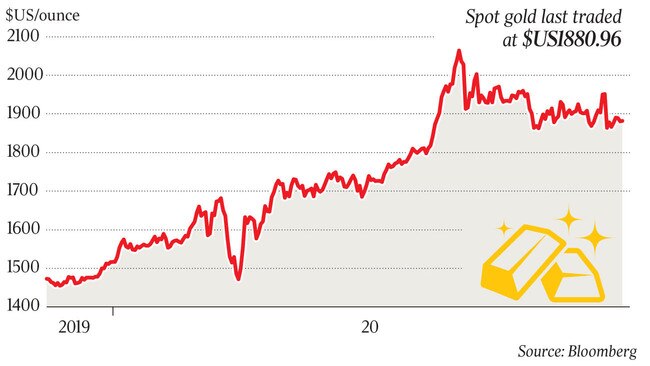

With widespread fears that money printing by global central banks ultimately will stoke inflation, gold has had a very strong year. The metal pushed higher during both the first phase of COVID-19 and the lead-up to the US elections and was last trading close to $US1881 — up from $US1450 a year ago.

Meanwhile, gold’s digital cousin, bitcoin, has also been trading up — and even stronger than gold in recent days.

After peaking near $US20,000 in Christmas 2017, bitcoin rebounded above $US15,000 this month, and was last trading above $US17,000.

Warren Buffett’s “conversion” to investing in gold is looking more like an illusion after his Berkshire Hathaway group announced a massive selldown in Barrick Gold, just three months after the high-profile investment had the gold sector buzzing.