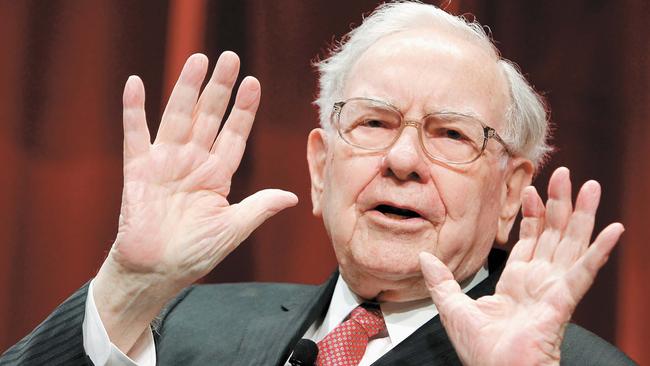

Buffett buys into Japanese giants

Warren Buffett’s Berkshire Hathaway took stakes in five of Japan’s most venerable corporate names with investments in energy.

Warren Buffett’s Berkshire Hathaway took stakes of slightly more than 5 per cent in five of Japan’s most venerable corporate names with big investments in energy.

Berkshire disclosed the investments in Mitsubishi Corp, Mitsui, Sumitomo, Itochu and Marubeni just before the Tokyo stockmarket opened Monday.

Shares in the five companies surged at least 5 per cent and in some cases more than 10 per cent, helping drive the Nikkei Stock Average up 2 per cent in intraday trading.

Berkshire didn’t say how much it spent to acquire the stakes. Based on the companies’ Friday closing prices, a 5 per cent stake in each would collectively be worth about $US6bn ($8.2bn).

The five are often called trading companies, but investment company might be a more precise description. All have stakes in a variety of businesses including interests in energy and mining. Mitsubishi and Itochu each control a major convenience-store chain in Japan.

“I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment,” said Mr Buffett in a statement. He said the five “have many joint ventures throughout the world and are likely to have more of these partnerships”.

The five companies all have long histories — dating back to the 17th century in Sumitomo’s case — and are considered prestigious employers in Japan. Mitsubishi, Mitsui and Sumitomo sit at the centre of keiretsu, loosely affiliated networks of companies that sometimes invest in each other or have joint projects. Mitsubishi Corp held 20 per cent of Mitsubishi Motors as of March.

Berkshire Hathaway said it could increase its stake up to 9.9 per cent in any of the five companies, but would make no purchases beyond that unless the board of the company receiving the investment approved.

The trading companies generally have low stockmarket valuations relative to their profits, partly owing to their exposure to energy investments such as oil and natural-gas fields. That may have made them attractive to a value investor like Mr Buffett.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout