Just how steep is the negative equity cliff?

As property prices continue to drop, a serious split has emerged over just how many people are facing negative equity.

As property prices continue to drop, a serious split has emerged over just how many people are facing negative equity — where their house price is lower than the value of their mortgage.

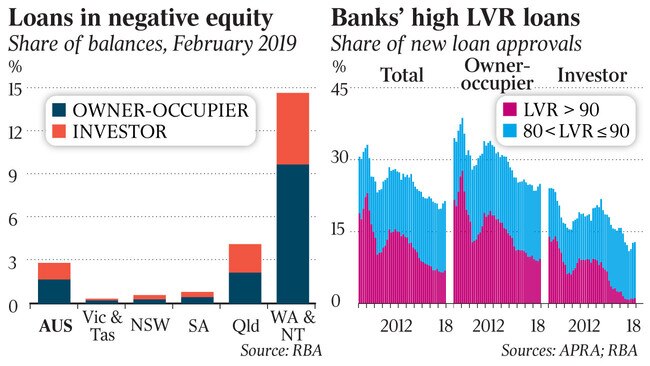

According to the Reserve Bank of Australia, it is just two borrowers in every hundred. But private researchers are generally pencilling in a figure closer to one in 10.

Negative equity is little known in Australia, where decades of rising house prices insulated the wider population from the corrosive effect of sliding prices. But a spike in numbers could quickly hit consumer spending and ultimately shares in banks and construction companies.

The alarming gap between private estimates and the RBA on the issue has prompted LF Economics founder Lindsay David to suggest the RBA figure — released last week as part of its regular financial stability review — is “fabricated”.

Lindsay says that even while the RBA is citing a figure of 2 per cent, in reality the number is heading above 10 per cent and that new instances occur every day. A 10 per cent figure would imply there are more than 400,000 borrowers in the distinctly uncomfortable position that if they sold their house they would still owe the bank money.

“A closer look at the figures is going to reveal a lot of people who bought at or near the peak are now facing this problem” Lindsay says.

Why, then, the huge discrepancy between the central bank and the rest of the market?

In October last year, a Roy Morgan survey put the number of borrowers facing negative equity at 386,000, about 9 per cent of borrowers.

“If house prices fall further the number of mortgage holders with no real equity will most likely increase,” the report said.

Lindsay says one of the key issues is that the RBA can read loan-to-valuation ratios as a cumulative figure, which can combine a family home (which does not have a mortgage) with a mortgaged investment property. Lindsay suggests this practice makes the leverage among many families look lower than it actually is.

“In other countries where we have seen negative equity hit 25 per cent, such as the US, they are looking at the figure on a property by property basis,” Lindsay says.

The RBA also aims to clarify the discrepancy in its own report by suggesting private research agencies are underestimating the prepayment of mortgages and the strong level of mortgage offset accounts.

Even allowing for the discrepancy with the private sector, the RBA figures also reveal one in 10 of those facing negative equity are on interest-only borrowing arrangements.

The RBA says that for interest-only borrowers, “the increase in repayments from moving to principal and interest may be difficult”.

It is the second time in a matter of days where the RBA has been left out on a limb in assessing the state of the residential property market.

In its latest report on high-rise apartment construction, released yesterday, National Australia Bank estimates a severe fall in construction volume is coming in the apartment market.

The NAB economic team says “the unwinding of the construction boom underpins our forecast that residential investment will fall by nearly 20 per cent by the end of 2020, almost double the decline anticipated by the Reserve Bank in February”.

As to where the negative equity effect will hit across the market, it is undoubtedly at its worst in Western Australia, where the residential market has been the weakest of the capital cities.

The RBA says 90 per cent of the negative equity situations faced to date have been either in Western Australia or the Northern Territory.

The RBA says “loans in negative equity are already more likely to be in arrears”.

“Having more borrowers in this scenario is distressing for the borrowers themselves and for the communities they live in,” it says.

“However, it is unlikely to represent a risk to broader financial stability, given it remains largely restricted to mining-exposed regions that represent a very small share of total mortgage debt.”