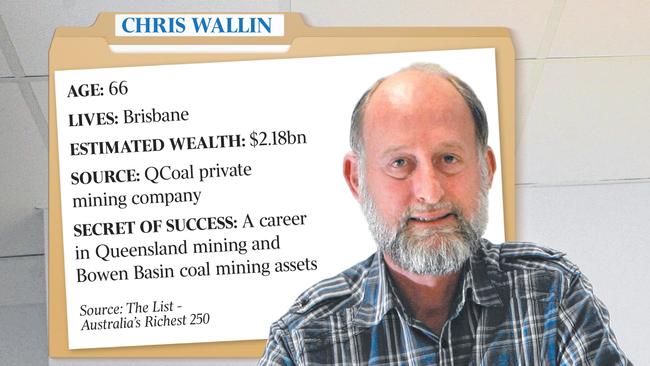

Queensland coal king tries some gold prospecting

Queensland coal baron Chris Wallin is very strategic in digging for a bright future.

Queensland coal baron Chris Wallin keeps making huge profits with his private mining interests, but has also been active in the ASX-listed junior mining space.

Wallin’s billionaire status is mainly through his privately held QCoal, which he established after a career in the Queensland state’s Mines Department as chief coal geologist. QCoal’s assets include the $1.7bn Byerwen Coal Mine and the nearby Drake open-cut hard coking and thermal coal mine.

QCoal had a huge 2019 financial year, according to documents recent lodged with the corporate regulator. Wallin is the sole director and owner of the company, which saw its net profit more than double as coal exports soar from about $51m last year to $120.8m, with revenue reaching $419m.

READ MORE: Mining barons ride resources resurgence |

That result include a $50m share of profits of subsidiaries of the QCoal business, which has ramped up coal export shipments after commencing mining there during the first half of the 2018 financial year after which the first coal was shipped in January 2018.

Wallin is forecasting the mine’s performance to be even better this year, according to the notes in QCoal’s accounts.

“The current financial year was the first full year of coal shipments for the mine,” the report says.

“The completion of [a] second coal handling and processing plant in the first half of 2020 is expected to further enhance production and output volumes.”

Another matter QCoal is dealing with in the current 2020 financial year is the ASX-listed Bounty Mining, which Wallin’s company has entered into a facility agreement with to provide cash funding of $60m and lend it another $30m in return for securing an offtake agreement for 5 million tonnes of coking coal from Bounty’s Cook Colliery facility in Queensland.

Wallin owns 6.54 per cent of Bounty shares, which are down 44 per cent this year. Bounty was recently hit by rock falls in October that stopped production at Cook Colliery.

Bounty, which has market capitalisation of about $19m, is one of several emerging ASX-listed mining stocks that Wallin has shares in.

One is Strategic Minerals Corporation. Wallin contributed about $2.6m as part of the company’s renounceable rights issue in April to raise funds for further work on its projects, which include the Woolgar Gold holding in Queensland.

Wallin’s private holding company QGold holds almost 89 per cent of Strategic’s shares but was stymied last year in a bid to take over the company by the Takeovers Panel, and he later elected not to go ahead with the deal. Strategic shares have risen 62 per cent since January 1.

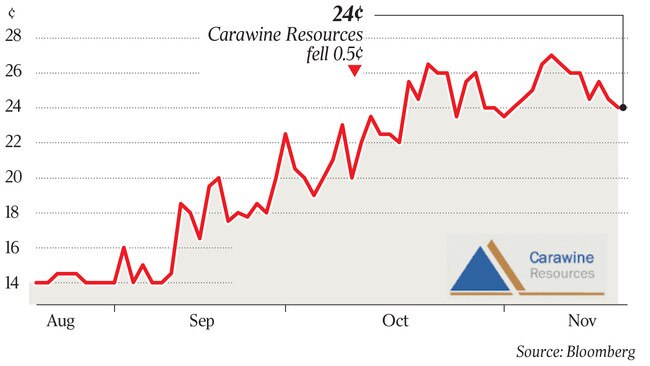

Another good performer for Wallin has been Carawine Resources, which has exploration projects for numerous metals, including gold, in Victoria and Western Australia. Carawine shares up 44 per cent since the beginning of 2019, but have almost doubled since June.

Oil and gas explorer Central Petroleum has been on a similar run since the middle of the year, though its stock has increased only about 9 per cent since January 1. Central Petroleum is the largest onshore gas producer in the Northern Territory.

Venus Metals is another gold explorer in the Wallin portfolio. Venus has the Youanmi gold project in WA, as well as associated vanadium and lithium projects. Its shares are up 20 per cent this year.

Wallin has not has as much success with minnow Coppermoly, which is exploring for gold and other metals in Papua New Guinea. Its shares are down 14 per cent this year.

A bigger company in Wallin’s portfolio in the mining services provider MacMahon Holdings, which is up about 4 per cent since January 1 but has risen almost 50 per cent since June. Macmahon’s market capitalisation is almost $500m.

Some of Wallin’s other private company balance sheets also reveal the resurgence in coal exports. His Jax Mining, which operates the Jax mine about 15km south of Collinsville in Queensland, started mining again in August last year and ship its first coal in January. Jax made a net profit of $8.9 million for 2019 from $59m revenue.

Another Wallin concern is Drake Coal. Its Drake coal mine in the Bowen Basin delivered a $30m net profit from $120m revenue in 2019, its private financial accounts revealed.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout