Put your house on China

IT'S one thing to accept that China looks set to be the key investment theme of our times, another to work out how to play it.

IT'S one thing to accept that China looks set to represent the key investment theme of our times, but quite another to work out how to play it.

It’s certainly pretty easy to go the other way and show how not to play it. Apart from the regulatory barriers involved, direct investment in China is an uncertain game indeed. In theory, if China is the world’s greatest economic story, then China’s stockmarket should be too. But that is not that case at all.

An indexed investment in the Australian stockmarket against the same amount placed on the Shanghai stock exchange during the past three years (see graph) would have seen the Australian investment easily outpace its China-based rival.

And for the moment at least, that goes for many earnestly constructed China-focused funds or other financial products.

But just because China’s early-stage public markets are not achieving the sort of returns you may reasonably expect does not mean the underlying growth is not there. Just days ago, China delivered a powerful 7.4 per cent GDP growth in the first quarter of the year.

Sure, that’s a smidgen lower than the corresponding quarter last year of 7.7 per cent, but look at it this way: China’s target is 7.5 per cent and in a command economy targets tend to be met by hook or by crook. So the chances are that yet again China will deliver 7 per cent-plus annual GDP growth and that will do nicely, thank you.

Perhaps then the easiest — and certainly more transparent and reliable — pathway into tapping the rise of China is through investing in the Australia-based assets that China is chasing.

The big opportunity has to be Australian residential property. Already we’ve seen indications of what might be the first trophy residential property deal with China — the potential sale of a key stake in the Meriton group to Chinese interests.

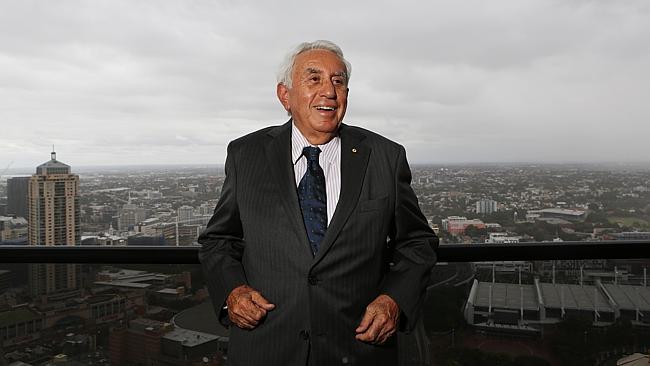

Meriton is one of the biggest apartment landlords and developers in Australia, its CEO and founder Harry Triguboff is speculating he might sell up to 50 per cent in the company to an unnamed China-based consortium — a deal that would be worth around $3 billion.

If the deal goes through, it will be milestone in the history of China’s commercial advance in Australia, akin perhaps to the sale of the Rockefeller Centre in New York to Japan’s Mitsubishi.

Triguboff is alert to the same potential reaction here: He has already been seeking to smooth the path for a China consortium at Meriton, suggesting “we would be silly to be afraid of the Chinese’’ along with making the point that China investors are roaming the world right now and can spend their money in many countries other than Australia.

He should know: he was born in China to White Russian emigre parents.

In fact as Triguboff mulls his Chinese offer, the rest of us have at last been given something better than real estate agent anecdotes to help put some numbers around China’s appetite for domestic residential property.

National Australia Bank has released a report on foreign buying activity in the local market and though foreign buying is not exclusively from China, it is easily the most important category.

NAB says up to one in four new residential property sales in Queensland are going to foreign buyers. The bank estimates that 13.5 per cent of new residential property demand is now from foreign buyers, up from 11 per cent a year earlier.

It’s hardly surprising that the outlook for property prices is best where this demand is keenest. NAB says the forecasts for house prices is strongest in Queensland. Brisbane is up an expected 6.4 per cent in the next 12 months.

If the regions of the national market that have the strongest foreign buying interest are likely to have the best price rises, then within individual cities, the same would go for individual districts popular with foreign purchasers.

Using the city of Melbourne as an example: Residential property prices in eastern districts such as Balwyn ran more or less in tandem with Bayside areas such as Hampton for decades. But Balwyn prices have more recently decoupled as the eastern suburbs moved ahead of their Bayside rivals, which are notably less attractive to foreign buyers.

How long will it all last? Well, it’s a megatrend: the desire of a segment of China’s population to have hard assets in locations such as Australia is expected to last for years.

Australia is sitting pretty. The Chinese have made plenty of money out of their own market — the Knight Frank Global Property index says China was the second fastest growing property market in the world after Dubai in recent times. Australia, with a more stable outlook and a dollar drifting lower over the past two years, is automatically an attractive alternative.

As an investment theme, follow the money rarely lets you down. We may look back on this decade as a period of peak activity but like all trends, even megatrends, it won’t last forever.

As it turned out, the US never did get sold to the Japanese and two decades later, Mitsubishi no longer owns the Rockefeller Centre, in fact it’s controlled once again by a US company, Tishman Speyer, which has close family links to the Rockefellers.

James Kirby is managing editor of the Eureka Report. Trial the Eureka Report FREE for 21 days. Register now at www.eurekareport.com.au