Our assessment of the winners and losers from reporting season so far

Now that we have the results from the top companies, we can see which ones are bargains and which are likely overpriced. Here’s the top six to ponder:

The annual reporting season is up and running, and the winners and losers are pretty clear already.

Just take a look at the contrasting fortunes of Commonwealth Bank and Telstra – two dominant local players whose enduring ability to pay dividends has put them front and centre of retail investment activity. CBA has about 880,000 shareholders, Telstra has more than a million.

Both companies reported a modest decline in profits and both offered a modest lift in dividends. But the comparison stops there. A closer look at the numbers shows CBA utterly dominates the banking system and drives quality earnings from sticking to its knitting. Telstra has tried but failed to follow through on a range of big experiments, from breaking itself into parts to becoming an energy retailer.

Both stocks pay good dividends of close to 4 per cent. But here’s the thing; over the past five years CBA is up 70 per cent and Telstra is up 6 per cent – yet CBA pays out less of its profit to shareholders.

Every reporting season offers a message from major stocks. If you tie the results to the market consensus target for the same companies, then we can see whether the stocks (post results) are overpriced or underpriced. (Assume any stock within 5 per cent of its target can be read as fair value). Here’s the lowdown:

JB Hi Fi

Retail spending is soft as inflation and higher interest rates crimp shopping at every level. It’s tough out there.

In many ways the JB Hi Fi result reflected the external pressures. This is a top retail stock but revenue slid ever so slightly, by 0.4 per cent to $9.6bn.

When revenue drops, profit tends to drop even faster – and net profit fell 16 per cent at the retailer which is a bellwether for the wider sector.

Oddly though, reporting flat revenues in our battered retail sector is seen as nothing short of heroic, especially when you can produce a dividend (even when the dividend is down, in line with the profit decline).

By the end of the week JB Hi Fi was trading for more than it was at the beginning which was no mean feat under the circumstances.

Message: Slightly overpriced. Retail is bad, but the very best companies can do better than the market expects. And when they do, the stocks can surprise on the upside.

Goodman Group

In one of the true curiosities of the local market, the Goodman Group – a property trust – is our biggest proxy for the artificial intelligence boom. Under Greg Goodman this A-REIT has been an exceptional investment for decades. Goodman has deftly steered the group over hurdles which have been too much for rivals (See Mirvac).

Goodman offered a full-year result this week. It did not actually report a profit; indeed after last year’s $1.56bn it was a statutory net loss of $98m, reflecting adjustments to property values. But the market loves what the company is doing with its 97 per cent occupancy rate and a development pipeline laced with cloud computing and data facilities spread around the world. The annual distribution was unchanged at 30c.

Goodman is only up 10 per cent over the year to date which is modest by its standards but among the six stocks we are looking at today any company can reference AI to try to stimulate investors’ interest. Goodman walks the talk.

Message: Fair value. Always keeping one step ahead of bigger changes in the economy, from the advent of online retailing to the current excitement around AI-fuelled data centres.

Telstra

Profits fell 13 per cent at the telco but in common with other blue chips this year the group pushed the dividend higher anyway.

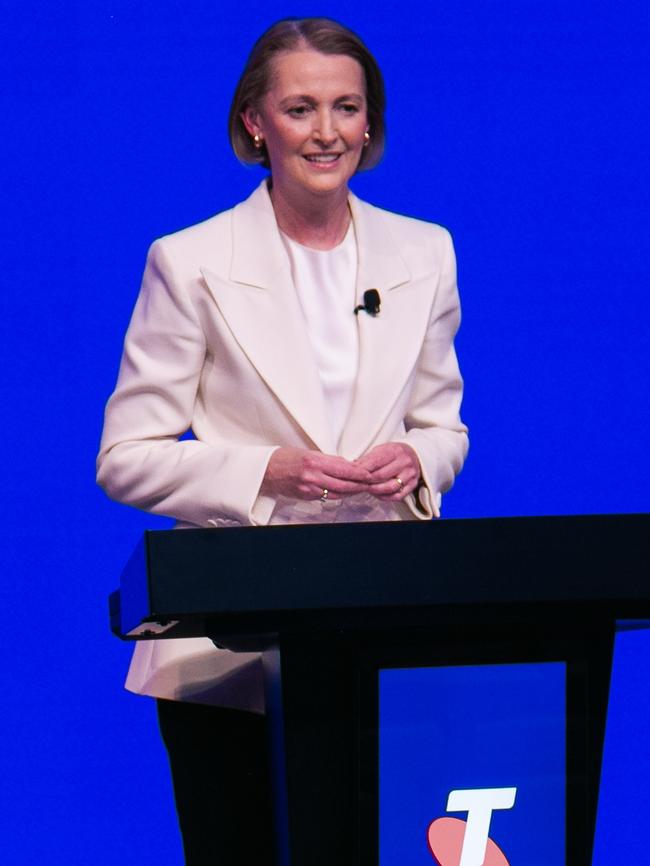

At 18c a share it is 6 per cent higher than last year. Chief executive Vicki Brady is making tough decisions, but Telstra is a dividend stock challenged by results which are peppered with writedowns, redundancy provisions and the miserable prospect of 2800 job cuts this year.

Revenues were actually up and earnings from mobile were strong so overall the group did slightly better than expected.

Message: Fair value. The new CEO may be rewarded down the line. But the revival of this stock as a backbone of retail portfolios is still a long way off.

Mirvac

The diversified developer has been heavily exposed to the most negative trends of late such as elevated interest rates, labour shortages, working from home – and it shows.

If you think Telstra had writedown problems, have a look at this A-REIT which racked up writedowns of $1.1bn inside a year. Yes the office market is not what it was.

Even if we look at Mirvac’s operating profit it was 5 per cent down on the previous year and worse than expected. Guidance was little changed which means that the distribution for the year comes to 10.5c against 14c a year earlier.

Mirvac chief executive Campbell Hanan was left with little to hang his hat on except that slimmest of upsides “green shoots”, which he sees across the business. But a slowdown in the residential area where costs have become seriously overheated tells you all you need to know about the reality of big-scale commercial property.

Message: Slightly overpriced. The headwinds against traditional property trusts are still very strong.

CBA

The best blue-chip stock in Australia? The nation’s biggest bank (and market’s largest stock) simply obliterated the other banks among the “big four” this year. The result, which was in line with expectations, saw a profit slide of 6 per cent and a small lift in the dividend.

But look under the hood. One in three Australians now bank with CBA. It has a cost-to-income ratio of 42 per cent and net interest margins are nudging the magic number of 2 per cent.

Chief executive Matt Comyn continues to squeeze the lemon by driving profits from the dominance of the bank inside national borders but with no strategic experiments. It’s predictable and it pays big time.

Message: Very overpriced. The consensus suggests CBA is a whopping 27 per cent too high – no wonder there are hedge funds taking up short positions – but the doubters have been wrong for a long time.

CSL

It’s a mighty world beater of the local exchange with a business that very few really understand except those who are paid to do so. The expectations were high for CSL this time around and the company delivered with a powerful 20 per cent lit in income. Also profit was up 15 per cent.

The results were generally regarded as outstanding but, with almost half of revenue now coming from immunoglobulin (Ig) therapy (whatever that is!) traders marked down the stock this week.

The group even lifted its dividend by 12 per cent but the market still did not get behind the company and local retrial investors don’t get excited by a dividend yield below 1 per cent.

CSL stock hit above $320 four years ago and it can’t seem to break that ceiling, ending the week softer than it started at a pip over $300.

Message: Slightly overpriced. For Australian investors the issue is that CSL is not a big dividend payer; it’s all about price and the price refuses to do much.

James Kirby hosts the twice-weekly Money Puzzle podcast

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout