Only some winners from ASX revival

Yes, the overall market is almost back to where it was a year ago and Afterpay, Fortescue and Webjet have shot out the lights. But many shares held by many investors have not come to the party.

In fact, almost half of Australia’s biggest companies by market value have underperformed the broader market so far this year.

In the top 50 ranks, a total of 22 companies had unperformed the market as at June 15, with the share prices of 17 of those having fallen substantially by between 24 and 43 per cent.

Only 13 had delivered positive returns overall since the start of 2020. A further 15 have lost money, though they have “outperformed” the negative return from the broader market.

In any period, irrespective of wider market volatility, companies will perform differently for a wide range of reasons. This year, it has obviously been all about the impact of COVID-19, which has helped some, but hindered others.

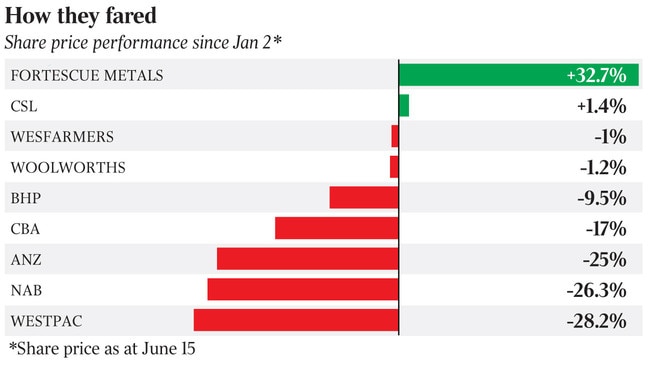

Of the 10 largest companies, only two had achieved positive returns since the start of the year.

The shares of blood products group CSL, now Australia’s largest company, have risen by 1.4 per cent since January. Now ranked the ninth-biggest stock on the market, miner Fortescue Metals has been a much stronger performer, aided by a surge in iron ore prices, with its shares up by 33 per cent.

The poorest performers in the top 10 have been the big four banks — Commonwealth, ANZ, NAB and Westpac — whose share prices have dropped by between 17 and 28 per cent since January. That’s a reflection of declining returns and expectations of big rises in bad and doubtful debts linked to COVID-19.

Oil price hit

Separately, the recent sharp fall in oil prices has wiped 40 per cent off the value of producer Woodside, and 37 per cent from Santos, while the diverse business impacts arising from the virus pandemic have resulted in big price falls across listed commercial property companies.

What’s more, analysis shows that over the past six months, funds tracking indexes with larger numbers of company holdings outperformed those covering a narrower field.

For example, the ASX 50 index (comprising the 50 biggest ASX companies) has fallen 14 per cent for the year to date. By comparison, the S&P/ASX 300 index has fallen by about 13 per cent.

On the other hand, there have been some very strong performers across different sectors. Buy now, pay later company Afterpay is up a stunning 275 per cent, and gold producer Evolution Mining is more than 43 per cent higher.

Other large gainers in the top 50 include Fisher & Paykel Healthcare (24.5 per cent) and a2 Milk Company (23 per cent).

Picking the winners

Trying to pick winners in this environment has been extremely challenging, and what’s clear is that outperforming the broader market with a selection of individual companies would have been difficult for many.

That’s especially the case for those with portfolios skewed towards the very top end of the Australian sharemarket (incorporating the big banks).

No doubt that difficulty in stock picking explains why large amounts of investor capital continued to flow into index-tracking exchange traded funds and managed funds that track the broader Australian market.

ETF data shows almost $4bn of inflows went into Australian-listed ETFs alone. Indeed one of the major themes so far this year on the local market and globally is the rising presence of retail investors in shares while institutional investors sit on the sidelines.

The rush of retail money into the sharemarket after the crash in March has been seen by many as adventurous, with the Australian Securities & Investments Commission forced to issue a warning that investors should be careful when markets are as volatile as we have seen this year.

Even the International Monetary Fund this week has warned of the exceptional “disconnect” we have seen this year between the so-called real economy and the wider sharemarket.

However, it looks like many retail investors have actually been spreading their risk in a very diversified fashion through buying index products rather than individual stocks and just now that practice seems to have been well rewarded.

Tony Kaye is senior personal finance writer with Vanguard Investments Australia.

The rebound on the ASX has been stunning this year, but a closer look at the nature of the recovery might surprise you.