Myer’s rally not enough for Solomon Lew

The department store is back from the brink as it becomes one of the standout stocks this year.

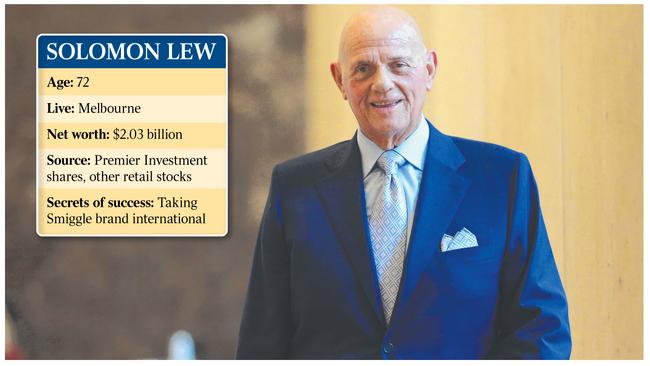

You would be hard-pressed to ever get billionaire retailer Solomon Lew to say his investment in struggling department store group Myer Holdings has been a good one, though at least things are looking up.

Mr Lew’s Premier Investments had spent about $100 million buying a 10.77 per cent stake in Myer in late May 2017 at an average of almost $1.15 a share, and at those levels his investment is still under water.

But the situation has been improving rapidly of late for Mr Lew, a prominent member of The List — Australia’s 250 Richest, published by The Australian, and Myer shareholders.

Myer shares hit a 12-month high of 66c on Friday, only about two months after the stock had hit its lowest level in the previous year at 36c. It has introduced about 20 brands under chief executive John King, including labels from Britain and Denmark, replacing the likes of Saba, Nike and Politix that have pulled out of Myer.

The company’s share price is up 54 per cent since January 1, making it one of the top 25 best performing stocks on the All Ordinaries Index.

Though given Mr Lew has previously described Myer as an “absolute disgrace” and said action was needed to “save Myer from the dustbins of history”, it may be some time until he changes his mind about the department store company.

While he has been a constant critic, he has stopped short of making a full takeover bid for a company he has a long history with. He was removed from the board of what was then Coles Myer in 2002.

Mr Lew’s wealth is mostly found in his shares in the ASX-listed Premier Investments, though he and his family have other substantial retail and property assets and he most often appears in the headlines regarding his ongoing battle with the management of Myer.

Premier owns brands including children’s stationery and accessories chain Smiggle, Peter Alexander, Dotti and Just Jeans, while Lew owns hotels and commercial property in the US.

Smiggle in particular has been a stellar brand for Premier, growing rapidly for the best part of a decade and expanding quickly into overseas markets.

But in the latest Premier financial results, for the six months to December, Premier management attributed issues in Britain regarding Brexit as a major reason for the slowest pace of Smiggle sales for 10 years.

Mr Lew’s stake in Premier is worth about $830m. Premier itself is the holder of the Myer stake, which is now close to $60m.

Premier shares are up about 6 per cent since January 1, with Mr Lew holding slightly more than 40 per cent of the company’s shares. Mr Lew also announced plans to take Smiggle into six new markets overseas, including Canada, Korea and The Philippines.

Other stocks in Mr Lew’s portfolio include another retailer in Breville, a manufacturer of kitchen and household appliances that has also been a stellar performer this year.

Breville shares are up 62 per cent this year, making it an even better performer than Myer, and its market capitalisation of about $2.2 billion has been closing in on Premier’s $2.46bn.

Breville is among the best performing top 20 stocks on the All Ordinaries Index.

Both Mr Lew personally and Premier have stock in Breville, which in February announced a bumper half-year profit of about $43.5m and said it had experienced double-digit sales growth in an otherwise sluggish retail market in Australia.

Breville also notched up similar sales growth rates in the US and Britain.

But the billionaire has not had as much good fortune with another of his holdings, surf and streetwear brand Globe International.

In 2018, Globe recorded an impressive rise in net profit and a 20 per cent lift in its dividend thanks to good sales for its FXD workwear and boots brand. The company’s shares doubled in value over the course of the year.

Globe has not had a good start to 2019, however. Shares are down 22 per cent since January 1, and Globe management said the strength of the US dollar and continuing retail uncertainty was likely to have an adverse effect on sales in the second half.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout