Modern monetary theory: Get ready to crank up the presses

Now we have a potential new thing — modern monetary theory.

As an investor you were surely intrigued at RBA governor Philip Lowe earlier the week telling business it had to change long-held assumptions about “normal” interest rates.

Echoing modern monetary theory, Lowe asked the leaders of big companies to reassess the long-held numbers they may have used behind key investment decisions.

The RBA is saying investment hurdles are too high and we all assume rates are going back up. But MMT contradicts that — it tells everyone from the CEO to the private investor it’s time to redo your numbers.

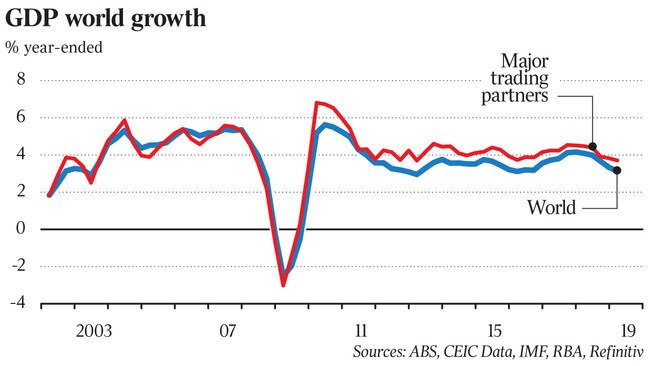

It all fits into a highly contestable narrative that says the options for firing growth through monetary policy have simply been exhausted. If interest rate cuts are not having the desired outcome especially and we see the Australian banks unable to pass the full effects to the customer, where can we go next?

MMT can be understood to be a macroeconomic framework, where when it comes to federal government spending, countries such as the US, Britain, Japan, Australia and Canada are not operationally constrained by revenues.

Such governments do not need taxes or borrowing for spending since they can print as much currency as they need.

Lowe has recently made it very clear that the RBA stands willing and ready to launch an Australian version of this notion if the economy does not improve.

Pendal Group, a leading fund manager, recently characterised this as “switching from unconventional monetary policy to unconventional fiscal policy”. In other words, flagging tax cuts, infrastructure spending and fiscal reform but instead of a government issuing and buying its own debt, this is about printing money. Hence, there is the need to have a freely traded currency, you must control it, and be able to print it.

MMT challenges the fundamental way we think, about money, an economy and how an economy works.

At the basic level, fiscal policy is used to reduce idle capacity while spending is used to target full employment. When the approach is about printing money, deficits become irrelevant.

MMT theorists argue that unemployment is the result of governments spending too little while, at the same time, collecting taxes. MMT theorists also believe those looking for work and unable to find a job in the private sector should be given minimum-wage, transition jobs funded by the government and managed by the local community.

Pendal described this as the delivery of a job-guarantee program. Labour, through employment, acts as a buffer in order to help a government control inflation in the economy.

According to MMT theorists, government debt or deficit isn’t the big negative we have traditionally been led to believe. Indeed, one of its tenets is that countries that control their own currencies can sustain printing money.

Where does it lead?

MMT theorists argue that comparing a government’s budgets to that of an average household is a mistake and that the national debt is simply money the government put into the economy and didn’t tax back.

The key issue is the potential of a weaker currency. Of course, if every country does it the use of MMT becomes less relevant. If one large economy was to go this way, it would force others to follow based on the currency implications.

Inflation does occur, though, when true resource capacity is reached.

Taxation is treated differently, as you must remember governments or central banks are printing money. Taxation, therefore, creates an ongoing demand for a currency and is a tool to take money out of an economy that is getting overheated. This runs counter to the conventional idea that taxes are a means of providing the government with revenue or money to spend on projects.

Therefore, when a government is in deficit as it is printing money it doesn’t need to sell bonds to fund that deficit: this upends a lot of the principles investors assume.

I have held the view that we have needed a good recession to clean out the system, such as occurs when an individual does a detox.

Governments and central banks have been determined to prevent this happening, with the resulting focus on unconventional monetary policy.

There is no doubt we will hear more about the failure of monetary policy, the need to use fiscal policy, and the idea of implementing infrastructure spending programs. We may even see countries like the US go down this route as the deficit looks to exceed 5 per cent of GDP this year.

Essentially, MMT challenges us on how an economy and money can work and takes us into new ways of thinking about old problems.

As monetary policy continues to lose its effect, maybe we will start to hear a great deal more about unconventional fiscal policy, or MMT — especially as governments and central banks continue the hunt for the appropriate next step to fire growth.

Meanwhile, it looks like most people still think rates are unnaturally low, except for the theorists and various central banks. Just now they say rates will remain low by historic standards and, as they say in Wall Street, don’t fight the Fed, even if this time around the Fed and its peers such as the RBA might be hard to take seriously.

Will Hamilton is the managing partner of Hamilton Wealth Management.

Every now and again an economic theory grips the wider world and investors who “get it” early have a clear advantage. Think of deregulation and its path to privatisation or quantitative easing, which unleashed the hunt for income that dominates our world today.