Mid-year ASX float looms for Bruce Mathieson’s empire

Woolworths and pub baron Bruce Mathieson is plotting a July listing of hotels and liquor group Endeavour Group.

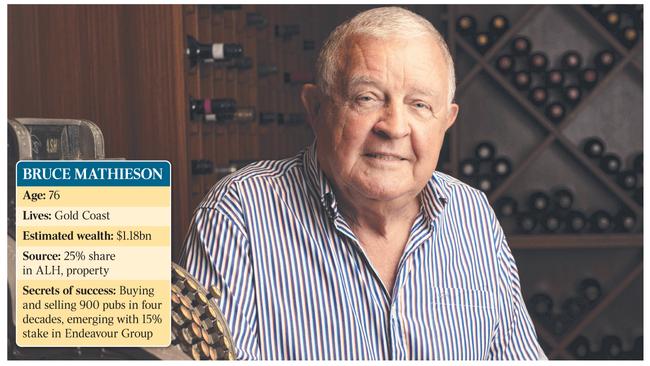

Bruce Mathieson looks likely to make a big return to the ASX in the middle of the year, in what will be one of the biggest stockmarket listings of 2020.

Mathieson, a pub and pokies baron for more than 40 years, will be a cornerstone shareholder along with Woolworths in the spun-out Endeavour Group business.

Endeavour is likely to have a valuation of about $10bn and both Mathieson and Woolworths will each have a stake of close to 15 per cent, meaning both parties will initially have about $1.5bn worth of shares in the new business.

It is likely that Endeavour lists on the ASX just after the end of the current financial year, which could mean a float around July, and that Mathieson and Woolworths spurn several offers from private equity parties said to have been sniffing around the group since Woolworths announced its intention to spin out its hotels and liquor businesses in July last year.

Mathieson has veto rights over any sale and, while the business and its huge cash flows would undoubtedly be extremely attractive to private equity, Mathieson is said to want to keep his family’s hold on the business for the long term.

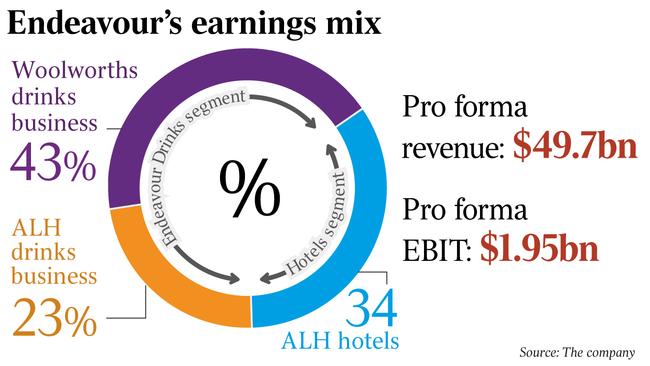

Endeavour is the result of the merger of ALH Group — the joint venture between Mathieson and Woolworths that started after the billionaire met former Woolies boss Roger Corbett at the 2000 Sydney Olympics — and the Endeavour Drinks liquor concern featuring bottle shop chains such as BWS and Dan Murphy’s.

Woolworths has long copped grief from some investors and shareholders due to its link to poker machines via its majority ownership of ALH Group and, while that investment will be in a newly listed entity, Woolworths will at least for the time being keep a shareholding.

Woolworths has already announced that Endeavour Drinks chief executive Steve Donohue will be CEO of the wider Endeavour Group and Telstra and Santos non-executive director Peter Hearl will be its chairman. Mathieson could take a director role or be represented on the board by his son Bruce Mathieson Jr or other ALH management.

But Endeavour’s likely listing will mean a big chunk of his wealth will now be held in publicly traded shares by Mathieson, who has made his considerable fortune from pubs, pokies and property since entering the industry in the mid-1970s.

Mathieson has bought and sold more than 900 pubs in his career. Not only has he refurbished and revamped plenty of pubs in his time — they are prime property assets given their locations in CBDs and suburbs — but he personally owns huge areas of land in Melbourne’s north and other holdings in Queensland and beyond.

There are even rumours that Mathieson may have just as much wealth tied to city-fringe holdings that are being sold to property developers to build master-planned communities than he has in Endeavour.

But he also has long dabbled in smaller ASX stocks, including one he has a great passion for in Mayne Pharma.

Mathieson has had a rollercoaster ride with the developer and maker of branded and generic pharmaceutical products, where he has been a board member for almost 13 years. Roger Corbett, Mathieson’s good friend, is also on the Mayne Pharma board and its shareholders include another friend and fellow member of The List — Australia’s Richest 250 in PFD Foods owner Richard Smith, and billionaire Alan Wilson of plumbing business Reece.

Mayne Pharma had a market capitalisation of more than $1bn in 2015, but is worth about two-thirds of that mark now. Its shares have fallen about 9 per cent since January 1 and have halved in value over the past 12 months.

Mathieson’s private investment vehicle also has shareholdings in small caps such as Talisman Mining, which counts The List member Kerry Harmanis as its biggest shareholder.

Talisman is primarily exploring for gold in western NSW, near mining town Cobar, and also has a nickel project in Western Australia. Talisman shares are down about 9 per cent this year and have lost about 65 per cent of their value in the past 12 months.

Mathieson also has shares in Invictus Energy, which is exploring for oil and gas in the Cabora Bassa Basin in Zimbabwe. Invictus shares have fallen about 8 per cent since January 1 and are down about 50 per cent since this time last year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout