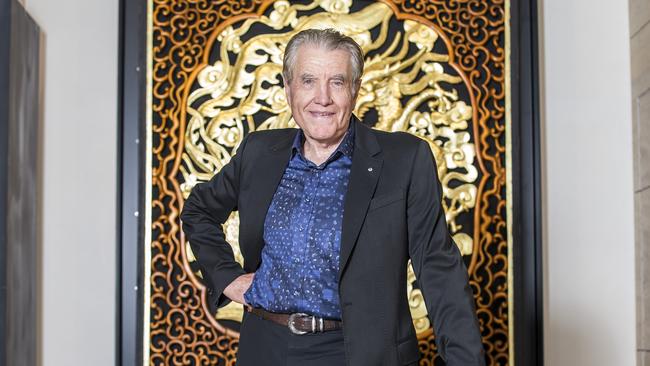

Market ‘right at the top’ says Melbourne Property veteran Max Beck

Melbourne real estate doyen Max Beck has severe doubts that the residential property market can maintain its hot streak.

The residential property market may be on a tear, but Melbourne real estate doyen Max Beck questions how long the hot run can continue.

Beck, a veteran of more than five decades in residential and commercial property, made his fortune from a series of canny deals and being ahead of market trends.

He has built upmarket apartment blocks in St Kilda, high-quality residential projects on the old Jolimont railyards and the swanky 333 Collins office tower in the Melbourne CBD, to name just a few of his developments.

He questions how long the property market can keep rising in value without significant inbound migration and says investors will avoid the apartment market until international students return to Australia in decent numbers.

“Generally I think the market is either at the top right now or it has got to be near the top. Affordability is crazy at the moment. There’s only so many buyers out there. What people don’t often realise is there’s only a certain amount of buyers,” Beck says, adding that there is going to be a shortage of decent housing and apartment stock.

- Name: Max Beck

- Age: 79

- Lives: Melbourne

- Estimated wealth: $723m

- Source: Property

- Secrets of success: Building quality residential and commercial projects, mostly in Melbourne

- Data: The List – Australia’s Richest 250

“If you look at downsizers, they might be looking to buy a nice apartment. But if you wanted to find a good sub-penthouse anywhere near St Kilda at the moment you’d be hard pressed. I know people who would buy in South Yarra or St Kilda Road and it’s not really there.”

Beck’s family also has other interests, including the $1.5bn mixed-use Caulfield Village in Melbourne’s east. US giant Blackstone has agreed to a build-to-rent project there as part of the next phase of a development that sits adjacent to Caulfield Racecourse.

But Beck is cautious about moving ahead with more precincts at Caulfield, which is ideally located near transport links and a Monash University campus. But with a lack of international students, Beck is concerned about the short-term outlook for apartments.

“Investors are just not around at the moment. I’d wait [to buy], depending on the location. We’ve got the next stage at Caulfield but we’re waiting until the flag goes down on the return of students from overseas – that’s when investors will return to those sorts of locations.

“If they said they’d be back in 2022 we could start building and be ready by the end of 2022. We could get going now with some certainty, but there’s no positive news about immigration and students at the moment.”

Another issue with apartment projects has been the retail element on the ground floors, often a requirement from local councils in an effort to activate the street frontage of the buildings.

Beck describes the retail component as “a real conundrum” given the difficulties smaller retailers have experienced during Covid, with many shopfronts vacant and available for lease.

He says new towers may be built in the future with coworking space designed for the use of residents who won’t want to commute to their office regularly.

Industrial property has been hot in the past year, with the rise in e-commerce and home delivery of parcels, and warehouses and logistics centres remain a favourite of investors.

Beck says industrial is starting to “look fully priced” but predicts Australia will follow some overseas trends.

“There is a movement for ‘the last mile’ where they will come in and turn an old warehouse into a distribution centre and operate out of that. So you’ll have deliveries to local areas being made from them.

“Some of the lesser quality neighbourhood shopping centres that aren’t working could also be converted into distribution centres with little or no retail there. Online has killed a lot of that sort of stuff, so the not so great buildings could be used that way instead.”

Beck and his family also own 50 per cent of Essendon Airport, north of Melbourne’s CBD, with the family of his long-time friend, billionaire Lindsay Fox, owning the other half.

It has been a huge success for the duo, who have built a sprawling commercial property precinct on what was once under-utilised land owned by the federal government before they bought it for $22m two decades ago. The deal has proved to be a bargain, with the land now valued at $1bn before debt.