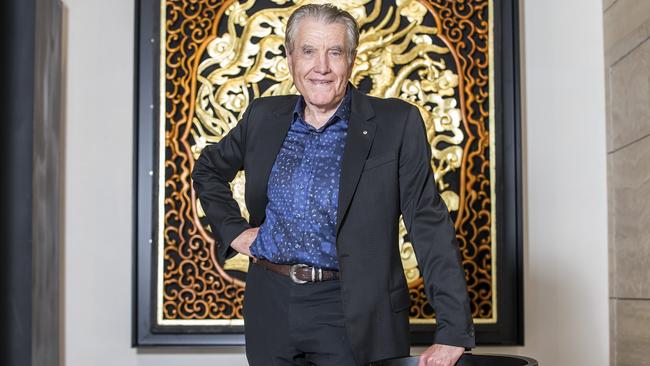

Essendon Airport puts Max Beck on flight path to success

The Essendon Airport land Max Beck co-owns with Lindsay Fox now also houses a hotel, retail centres and car yards.

Max Beck has plenty of opinions and knowledge about all facets of the property sector, but first he reveals some surprising news about another industry he has some exposure to.

Beck, a Melbourne property doyen, and his family own 50 per cent of Essendon Airport north of the city’s CBD, with the family of his long-time friend, billionaire Lindsay Fox, owning the other half.

Essendon Airport has been a huge success for the duo, who have built a sprawling commercial property precinct on what was once under-utilised land owned by the federal government before the duo bought it for $22m two decades ago.

It has proved to be a bargain, with the land now valued at $1bn before debt, as it’s also boasting a Hyatt Hotel and conference centre, a retail precinct and large LaMannas supermarket, and plenty of other businesses.

The precinct also includes the largest collection of car yards and motor vehicle sellers in the country, a sector of the economy that has not been without its issues since COVID-19 struck this year and shut down most of Australia in March.

Yet Beck reports that car sales in the precinct recorded their best month ever in April, as various government stimulus packages combined to make it a good time for buyers.

“It was our best result yet out there. We sold more than 500 cars there in a month. It was better than any month last year as well,” Beck tells The Australian.

Beck is a veteran of the Melbourne property scene who has seen it all in a career spanning more than five decades.

He has experienced the highs and lows and booms and busts in that time, almost going under during the credit crunch of the 1970s when he lost the construction business, only to later recover and build many of Melbourne’s best known buildings in the next three decades at the Becton group with former business partner Michael Buxton.

Beck is now spending more of his time on the Mornington Peninsula during the COVID-19 pandemic, and is often seen cycling up the steep road of Arthur’s Seat.

While Essendon Fields, the precinct around Essendon Airport, accounts for a big part of his wealth, Beck’s family also has other interests, which include the $1.5bn mixed-use Caulfield Village in Melbourne’s east.

US giant Blackstone has agreed to a build-to-rent project there, as part of the next phase of a development that sits adjacent to Caulfield Racecourse.

While there are fears the coronavirus pandemic could cause property prices in Melbourne to fall by as much as 30 per cent under one worst-case scenario, Beck says different parts of the market will perform better or worse than others.

“The top of the market, the prestige end, I don’t think individual houses will be off more than 5 per cent,” he says. “You might not see as many buyers out there as the economy is tougher and maybe there won’t be as many Chinese buyers around — and they have kept that market up a lot in recent years — but I think overall it won’t be too bad.

“The rest of the market I think will be off 10-12 per cent at worst. So that middle to lower end won’t be as good.”

Beck says there will be mixed performances across other property classes, though he doesn’t think yields will change markedly.

For industrial property, spending on infrastructure and the shift to more home deliveries from e-commerce ordering should mean logistics and warehouse facilities hold up reasonably well as an investment.

Beck says commercial property might find things harder, but he believes the better quality stock won’t immediately plunge in value and yields will hold up all right.

For retail property, though, Beck says many investors will find it tougher and some of the bigger properties could suffer. “But the neighbourhood centres that have supermarkets in there should still be reasonable,” Beck says.