Mark Bouris’s Yellow Brick Road exits wealth

Yellow Brick Road will now ‘focus 100pc’ on its loan business after shifting 56 advisers to a rival group.

Mark Bouris’s struggling mortgage broker Yellow Brick Road says it will now be able to “focus 100 per cent” on its loan business after shifting more than 50 financial planners to a rival group as its exits the wealth management industry.

InterPrac Financial Planning, a subsidiary of Sydney-based wealth management group Sequoia Financial Group, has spent $2.5m to take over 56 financial advisers currently operating under the Yellow Brick Road banner.

The deal will give InterPrac the rights to recurring revenue streams, such as commissions and service fees, currently paid by YBR customers from its wealth management and life insurance sales businesses.

Mr Bouris, the former founder of Wizard Home Loans, close confidant of Prime Minister Scott Morrison, and host of Australia’s Celebrity Apprentice, has been under pressure to turn around his underperforming company, which has had its business model and share price smashed in recent years, and is now under threat from further reforms aimed at curtailing lucrative trailing commissions for mortgage brokers.

YBR shares have lost 90 per cent of their value over the last five years, and the company was recently targeted for a hostile takeover by Mercantile Investment Company, formerly led by accused businessman Sir Ron Brierley.

YBR unveiled a net after tax loss of $37.39m this year, compared to a loss of $658,000 the prior year.

The company blamed market forces for a 19 per cent drop in lending volumes in the 2019 financial year, but the loss included non-cash writedowns of $33.95m on the carrying value of the company’s wealth management and lending business.

Mr Bouris said the decision to exit the wealth management business was “driven by YBR’s recent strategic pivot away from wealth management, in which it lacked scale in an increasingly regulated environment, to focus on the mortgage market”.

“YBR is 100 per cent focused on its mortgage business and is committed to the implementation of its mortgage securitisation initiative,” he said.

As part of the agreement with InterPrac, Sequoia will get wealth management referrals from YBR’s mortgage broking businesses, including the Resi and Vow branded channels, and vice versa.

InterPrac is hoping to get an additional $10m of revenue next year from the agreement, and earnings of about $600,000.

The 56 advisers must stay with InterPrac for three years to get the full $2.5m benefit.

Sequoia chief executive Garry Crole said the deal was a “positive change” for all parties.

“From Sequoia’s perspective, this gives us the opportunity to significantly enhance our core existing advisory and wealth management business,” Mr Crole said. “YBR achieves its goal of being able to focus 100 per cent on its mortgage business.”

Mr Bouris recently celebrated his own achievements in derailing one of royal commissioner Kenneth Hayne’s recommendations to ban trailing commissions, which provide an ongoing commission to mortgage brokers over the life of a loan.

YBR is heavily reliant on trailing commissions, but after a heavy campaign of lobbying from Mr Bouris and the mortgage broking sector, the government backed away from implementing the proposal.

YBR sits on net trail commission income of about $50m, and trail commission income accounts for about 20 per cent of the group’s revenue.

The Productivity Commission found trailing commissions offer “no evident link to customer best interests” and recommended they be banned from the mortgage broking industry. The PC found some brokers were earning $6000 for an average home loan of about $350,000, which created “perverse incentives” for brokers to stop borrowers switching banks and resulted in about $3bn in bonuses being paid to brokers each year.

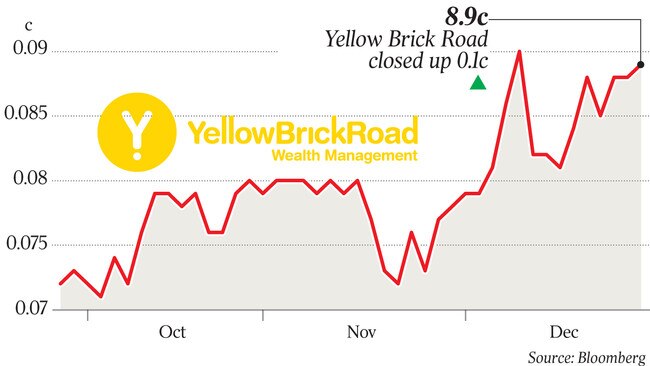

Shares in Sequoia climbed 4.65 per cent on Friday to 22.5c, while Yellow Brick Road rose 1.1 per cent to 8.9c.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout