Kerry Stokes’ towering vision for the west

Tycoon Kerry Stokes wants to develop a residential and commercial project worth $1bn in western Sydney.

Name: Kerry Stokes

Age: 77

Lives: Perth

Estimated wealth: $4.93bn

Source: Seven Group, shares and property

Secrets of success: The combinations of media assets and mining services companies

Kerry Stokes could add $1 billion to his already burgeoning wealth, should a planned but little-known residential and commercial property project in Sydney’s west come to fruition.

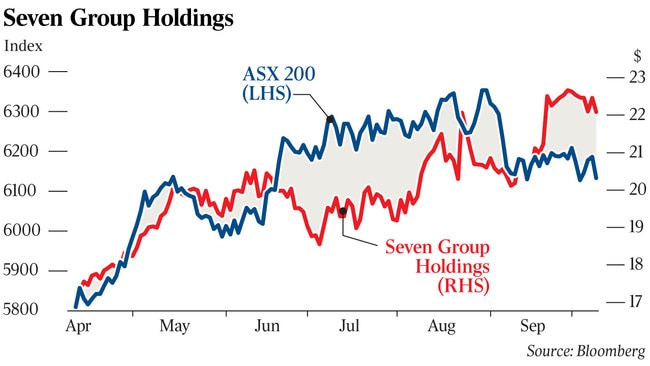

A long-time billionaire and perennial rich list member, Stokes has most of his wealth in the listed and stellar performing Seven Group Holdings. SGR owns about 35 per cent of Seven West Media and mining services assets such as WesTrac and Coates Hire. The company’s share price is up about 43 per cent since January 1 and has recently been trading at an all-time record high.

WesTrac is a Caterpillar truck and mining equipment dealer. Until recently it had its Sydney headquarters situated on a 3.87ha area in the western Sydney suburb of Holroyd.

It’s on this land that Stokes has private development plans for what could be a $1 billion worth of residential, shopping and other commercial property, as well as a large amount of public space on a site adjacent to the M4 Motorway and Parramatta Road.

Also nearby is the fast-growing Parramatta town centre, as well as two train stations within a walk of about 800 metres and several bus routes.

Documents seen by The Australian show Stokes is planning six residential towers with 1850 apartments on the precinct. Half of the units would have two bedrooms; another 45 per cent will have one bedroom and the remainder three bedrooms. The highest tower could be 35 storeys and at least another two would be 25 storeys.

There would also be about 13,000sq m of retail, community and commercial space, which could include a supermarket, specialty retail, gym, childcare, medical facilities, and cafes and restaurants in a plaza that would open on to the public space. The plan includes about 7714sq m of public space and claims about 400 jobs would be created for a project that would take several years to complete.

Up to 10 per cent of the apartments will be set aside for affordable housing, depending on negotiations with planning authorities.

The project is being considered by a NSW Planning Panel, ahead of a decision on the rezoning of the land for residential use as well as the exact heights of towers and size of commercial areas and affordable housing numbers.

In the meantime, Stokes’s private Australian Capital Equity has appointed agents to rent out the Holroyd property that includes a 1880sq m warehouse, a 3329sq metre office and 160 carparks.

The WesTrac workshop, warehouse and office complex in Holroyd, which is one of Caterpillar trucks’ largest authorised dealers, was vacated when the business relocated to AMP Capital’s Crossroads Logistics Centre further west in Casula, earlier this year.

If Stokes’s vision for the site comes to fruition, it would represent a large foray into an industry that provided his first fortune in the Perth real estate boom in the 1960s. Stokes then went on to make even more money building shopping centres and then mining and construction and later the media.

He is best known in business now as chairman of Seven West Media, the owner of the Seven television network and other newspaper and media assets in Western Australia. SWM shares have performed impressively this year, rising 63 per cent since January 1.

Stokes also has a diversified portfolio of stocks, ranging from mining assets to the honey manufacturing company Capilano. Shares in Capilano have risen 13 per cent this year, with the company subject to a $190m takeover bid by a private-equity consortium led by Roc Partners and Wattle Hill. Stokes is the biggest shareholder in Capilano and has indicated his family investment firm would retain a stake in any privatised company, though the listed Bega Cheese has also been buying shares a possible suitor.

Stokes’s other shareholdings include Bubs Australia, a maker of infant formula and organic baby food that has fallen about 25 per cent in value since January 1, and junior iron ore miner BCI Minerals, which is down about 26 per cent in the same time.

Newly listed wealth and financial management firm Evans has also been a relative disappointment for Stokes, falling about 25 per cent since floating on the ASX in May.

Stokes has had better luck with gold producer Saracen Mineral Holdings, which is up 18 per cent this year, and Perth debt collector Pioneer Credit, up 14 per cent, though aged care provider Estia Health has fallen 34 per cent and hit a 12-month low on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout