The average house price is rising faster annually than the average national wage. If you make more than the average wage, don’t worry, you are most likely ahead too – the system adapts to all salary levels.

At its most extreme, Sydney and Canberra median prices were rising more than $1000 a day over the last three months.

We have see time periods where this happened before. Historically, house prices can jump ahead and salaries cannot keep up.

This time, however, it is very different.

Cut to the chase, we may be looking at a double-dip recession.

We are certainly facing a negative GDP in the three months to September. As for the three months to the end of the calendar year — with three quarters of the national economy in lockdown — the forecasters simply don’t know what on earth to put in their modelling.

The great paradox of our times, economically, is that house prices are shooting the lights out not because things are so great, but rather because of the lockdown environment.

That’s the environment where people seek the security of bricks and mortar and families need more room to work from home.

Most importantly, it’s all happening on the back of artificially low mortgage rates underpinned by money printing.

The phenomenon is of course worldwide. Home purchasers and investors are acting similarly in most countries. Some markets have even pushed prices much higher — in Australia we had a 16 per cent lift in prices over the last year, in New Zealand it was 29 per cent.

Oliver Hartwich, executive director of The New Zealand Initiative, is trying to explain the sheer mania gripping Auckland’s residential boom by offering a smorgasbord of statistics but then he nails the issue by saying: “Look it’s crazy, something just happened in our local school which symbolises the whole thing. The principal has just resigned to become a property developer!”

“The issue here - and in Australia - is clear, we have got to get the market back under control because when you get phases like this, they don’t end well. At least there are efforts being made in this market, the central bank here just stepped in - again - trying to cool things down.”

As Hartwich explains, housing markets cannot keep this up – it’s a danger for homeowners and investors alike, especially for those who come to the party too late.

How hot is the market? Clearance rates for auctions are running at their highest level for four years – at 75 per cent they are stronger now than they were pre-pandemic.

And the banks are dishing out the loans as fast they can: the proportion of new loans being made at loan-to-valuation (LVR) ratios of 80 per cent or more has more than doubled, from less than 14 per cent in the first half of 2018 to over 31 per cent in the first three months of 2021.

How will it all end? There are two likely scenarios – either the market ultimately sorts it out with a sharp correction which punishes indiscriminately or the regulators step in to cool things down before it goes off the rails. The second scenario is better for everyone.

But here’s the thing: In Australia just now the RBA can’t move on rates – it has committed to keeping them where they are to try and revive the economy and employment.

In the context of a lockdown economy, the Coalition is certainly not going to do anything to temper prices in fact it may do the opposite.

As independent economist Saul Eslake puts it: “The emphasis of government housing policies has gradually shifted away from boosting the supply of housing, instead to inflating the

demand for it.”

By a process of elimination the key operator in the policing of the housing market is the Australian Prudential Regulation Authority which put the brakes on back in 2015, the last time prices ran hot.

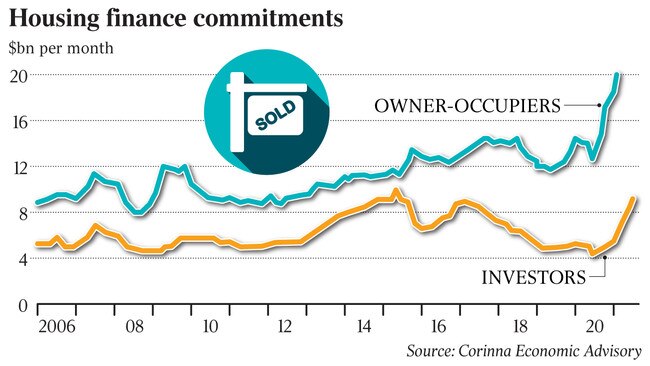

Those moves to cool investor lending volumes and clampdown on interest only loans seven years ago were seen to be a success. But that was a different world – a pre-pandemic economy where investors dominated, this time around the picture is very different. The housing market is dominated by owner occupiers: We are talking about people’s homes not their investment portfolios.

“APRA is asleep at the wheel, where are they? Where are the moves to signal to the market that it needs to be cooled?,” says independent economist Saul Eslake.

At Yarra Capital, head of macro and strategy Tim Toohey, echoes Eslake: “I think that under any other circumstance we would have seen the regulators move by now on the housing market.”

The obvious way to limit the damage is for regulator to put in new lending limits. Or even to introduce loan to income limits, if such numbers are even collected – they are certainly not published.

With every passing week the trouble down the road looms larger. But the regulators are nowhere to be seen, petrified perhaps in the headlights of an economic conundrum unprecedented at home or abroad.

It doesn’t really matter whether you worked last week, walked around the local park or sat and watched the Olympics for hours every day either way, the chances are your home — if you own it — made more money than you did.