Intervention may be necessary: Reserve warns on red-hot housing

The Reserve Bank has warned regulators would be forced to act on Australia’s heated housing market if there were another ‘very dramatic loosening’ of lending standards.

The Reserve Bank has warned regulators would be forced to act on Australia’s heated housing market if there were a “very dramatic loosening” of lending standards as seen in previous property booms over the past decade.

But while home lending standards were “sensible and reasonable”, RBA governor Philip Lowe noted fast-growth in interest-only loans was adding risk to the financial system.

His comments came even as the RBA said it was looking through the current wave of Covid-19 lockdowns across eastern Australia and was tipping strong economic recovery.

While signalling a preparedness to provide more monetary policy support if the pandemic worsens enough to hurt the outlook for the year ahead, the central bank, expects a rebound to start before year end amid vaccinations and fiscal support.

However he noted housing - which has seen prices rise at their fastest rate in more than 17 years, was coming under attention from the nation’s top financial regulators.

“The issue that we’re turning our attention to through the Council of Financial Regulators is the sustainability of trends in household borrowing,” he said.

“While the household credit growth of 5 or 6 per cent in the last year is manageable, the rate of growth is picking up...so we’re now thinking about under what circumstances would some regulatory intervention be required if lending growth was too strong.”

“Certainly if credit growth were to pick up materially from where it is now and look like it was going to stay at that high level…let’s say we’re talking double-digit credit growth that’s sustained for a period of time and income growth was running at 4 or 5 (per cent), that would be problematic in my view, and at some point APRA would be considering interventions.”

The first step would be to raise the “minimum interest rate” or floor rate.

Other steps would include loan-to-value or debt-to-income restrictions.

“We are not at the point where those restrictions are needed but I couldn’t rule out that point emerging within the next year,” Dr Lowe said.

National prices increased a further 1.6 per cent across Australia last month, making for a 16.1 per cent increase over the past year, according to figures from property research firm CoreLogic.

In his opening statement to the House of Representatives economics committee, Dr Lowe indicated that the central bank decided against a delay in lessening its bond purchases next month - so-called tapering - based on its expectation of a return to strong economic growth next year.

“Any additional bond purchases would have their maximum effect at that time and only a very small effect right now when the extra support is needed most,” he said.

“The (RBA) also recognised that fiscal policy is the more appropriate instrument for providing support in response to a temporary and localised hit to income, and the (RBA) Board welcomes the substantial fiscal response by governments in Australia.”

But the RBA is “prepared to act in response to further bad news on the health front that affects the outlook for the economy over the year ahead”.

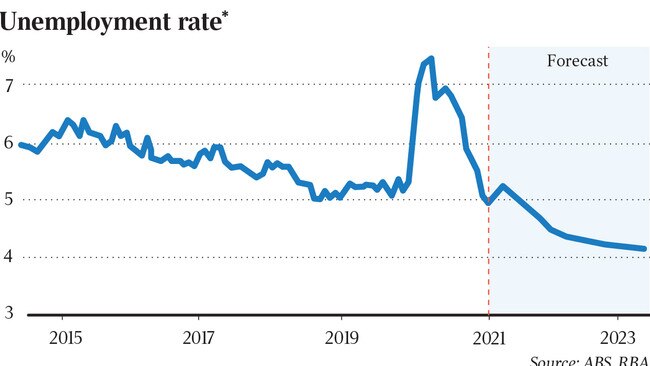

Revised forecasts in its quarterly Statement on Monetary Policy showed the Bank expects the current Covid outbreaks will trim economic growth in the year to December to 4 per cent versus 4.75 per cent previously expected. However, its unemployment rate forecast remained at 5 per cent.

Dr Lowe noted that the recovery in the jobs market so far has been “remarkable.”

Economic growth for next year was revised up to 4.25 per cent from 3.5 per cent, and the unemployment rate was expected to hit 4.25 per cent before reaching 4 per cent in 2023.

Importantly for monetary policy, the RBA’s inflation forecasts don’t move into the 2-3 per cent target band until late 2023, and in parliamentary testimony, Dr Lowe remained extremely dovish.

“We want to see results on inflation before we move, not a forecast of inflation in the target range,” he told lawmakers. “It will not be enough for inflation to just sneak across the 2 per cent line for a quarter or two. We want to see inflation well within the target band and be confident that it will stay there, paying close attention to growth in wages and broader labour costs.”

“The condition for an increase in the cash rate is not expected to be met before 2024.”

While acknowledging the possibility of vaccine-resistant virus strains and uncertainty over how society will “to live with Covid on an ongoing basis”, “once vaccination rates are high enough, we will be living with a virus that is endemic rather than living through a pandemic,” he added.

“What this endemic phase looks like is still to be determined.”

“On the upside, it is possible the Australian economy will again experience a run of positive surprises, as it did earlier this year,” he said.

“If we are successful in containing the virus over the months ahead, it is possible there will be stronger upswings in both investment and consumption than envisaged in our central scenario.”

Also, while predicting September quarter economic growth to fall “at least 1 per cent”, Dr Lowe said the economy was “quite unlikely” to experience two consecutive quarters of negative growth.

“I think we can’t rule out two quarters of negative GDP, but I think it’s quite unlikely at this stage.”

But Commonwealth Bank's head of Australian economics, Gareth Aird, says the RBA was “too optimistic” and “likely to be surprised at how significantly the economic data deteriorates over coming months.”

The RBA “doubled down” on its upbeat assessment of the medium term outlook by lowering its end‑2022 forecast for the unemployment rate when the economy is going through a “big and potentially prolonged negative economic shock” from Covid lockdowns.

The downward revision to the unemployment rate forecast for next year was “a little bit unusual” since lockdowns across the country to contain Covid delta are having a “big negative impact”.

“We broadly share the RBA’s optimism about the economy over the medium term,” Mr Aird said.

“But we are more concerned about the economy over the near term and think that it will take a while to regain economic momentum again once lockdowns are over. Indeed the RBA’s central scenario for the economy over the near term looks incredibly rosy compared to our forecasts.”

Mr Aird said the RBA’s emphasis on economic conditions and the health situation meant that there is a “clear risk” it still reverses its decision to taper its bond purchases.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout