Investment traps to avoid after share market’s January surge

Australian shares soared in January amid a flurry of positive news, prompting a warning for investors to beware of pitfalls.

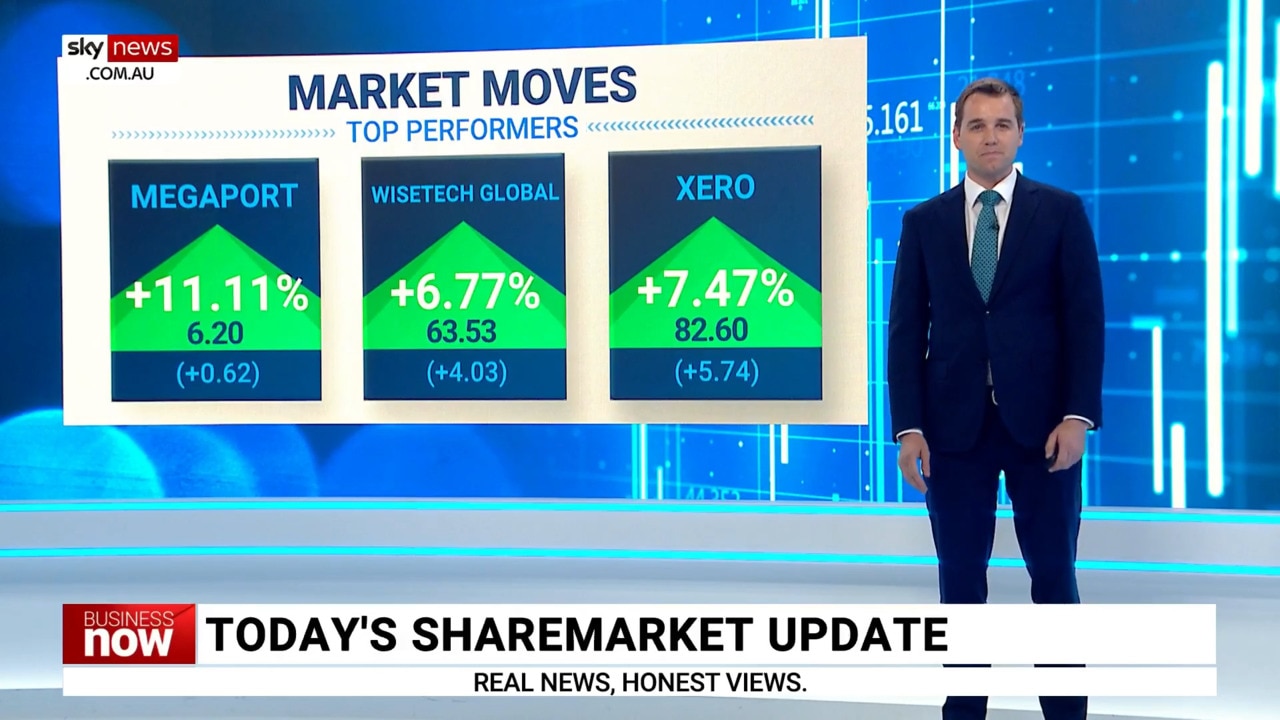

A stellar 6.2 per cent gain in January by Aussie shares erased all of the stock market’s 2022 losses, but also sparks questions about investment traps.

Buying in market peaks could be a costly move, especially for investors who chase past performance rather than focus on good long-term performers.

Shaw and Partners senior investment adviser Jed Richards says January’s bounce reflected China’s reopening from Covid lockdowns and optimism that inflation was cooling in the US and globally, but inflation everywhere is “still too high”.

“Quite often there is optimism around people returning from their Christmas break, but I think it will be short-lived,” he says.

“On the flip side, we are not expecting doom and gloom.” Australian companies have been aware of higher inflation and interest rates for a long time and any businesses “that have not prepared for that have rocks in their head”, Richards says.

Buying into shares and other investments after the horse has bolted is a potentially painful financial trap, and there are plenty of others to be wary about. Here’s five.

1. FOLLOWING FADS

“Every single time we see hype about a particular theme – it may be electric vehicles, green energy or marijuana – and every single time they come to a screaming halt,” Richards says.

Catapult Wealth director Tony Catt says the “FOMO effect” – fear of missing out – was in full swing in 2021 and early 2022 around cryptocurrencies and buy now, pay later stocks “and that’s imploded now to different degrees”.

2. LACK OF KNOWLEDGE

Not understanding what you are buying is a big trap for investors and “it happens over and over again,” Catt says.

There is research available online about companies everywhere, plus professional analysts and advisers who follow stocks for a living.

3. TRYING FOR PERFECT TIMING

The old saying “time in the market is more important than timing the market” still holds true and people who stay invested over decades generally do well. However, successful investors do time their purchases and sales.

“The trap is trying to time it perfectly,” Catt says.

“You just have to buy good quality assets over time,” he says. “The share market is a forward-looking machine – it doesn’t care what happened yesterday, it only cares what happens tomorrow and in a year’s time.”

4. TOO NARROWLY FOCUSED

Buying just one or two stocks is dangerous because it lacks diversification and increases your risk.

Catt says anyone who is not financially able to invest in 12-15 stocks should instead consider exchange traded funds or listed investment companies that spread every dollar over many shares.

5. KNEE-JERK REACTIONS

Share price movements are volatile. In the global financial crisis in 2008 and 2009 Aussie stocks sunk 55 per cent, and many people panicked and sold out – only to watch them bounce back 55 per cent in six months.

A similar thing happened in the Covid crash of 2020. Keeping emotions in check and having a long-term focus is crucial.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout