Industry funds top super comparison ranking tool

Industry super funds have topped the investment return rankings in the government’s new YourSuper comparison tool.

Industry super funds have topped the investment return rankings in the government’s new YourSuper comparison tool.

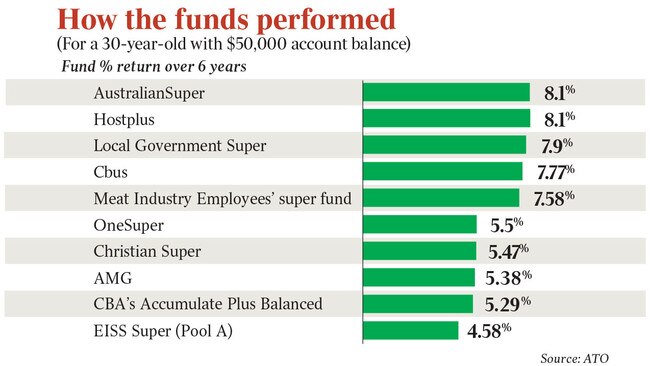

AustralianSuper and Hostplus beat out the competition to be named joint first, with 8.1 per cent annual returns over the past six years, according to the comparison tool launched on Thursday.

They were followed by Local Government Super, which returned 7.9 per cent over the same period, Cbus, which delivered annual returns of 7.77 per cent, the Meat Industry Employees’ super fund, at 7.58 per cent, and UniSuper, at 7.52 per cent.

All of the return figures are based on a 30-year-old worker with a balance of $50,000 in their super fund.

The rankings vary depending on the product offered to different age groups, with Local Government Super dropping out of the top five for a 50-year-old member, pushing Cbus, the Meat Industry fund and UniSuper up one, with Statewide Super rounding out the top five for this age group.

While the top five funds achieved annual returns above 7.5 per cent, members in the worst-performing funds got annual returns of 5.5 per cent or below over the six-year period.

The named-and-shamed funds were led by the Energy Industry super fund, which returned 4.58 per cent annually, and CBA’s Accumulate Plus Balanced offering, only open to employees of the bank, which delivered an annual return of just 5.29 per cent.

These were followed by AMG, with a 5.38 per cent return, Christian Super’s 5.47 per cent return and OneSuper’s 5.5 per cent. The rankings were the same for members across the 30 to 50-year-old age group.

The tough new performance test also allows users to see the fees their funds are charging and how they compare with their peers.

Superannuation Minister Jane Hume has previously called on funds to reduce costs for members, warning that underperforming super funds must be held to account.

“For those super funds that are consistently delivering poor value to members, there will no longer be an excuse for high fees,” Senator Hume told The Australian earlier this year.

“It doesn’t matter if it’s high investment fees or high administration fees, the signal is clear: trustees need to focus on reducing high costs and delivering better outcomes to members if they expect to continue to receive compulsory contributions from Australians.”

Of the funds open to the public on the YourSuper list, UniSuper fared best with a $326 annual fee, followed by Bendigo’s SmartStart Super, with a $333 annual fee and AMG Super’s $350 fee.

AustralianSuper wasn’t far behind with its $387 annual fee.

On the other end, members of Mercer’s SmartPath offering are slapped with an $820 annual fee – nearly $500 more than cheapest offering in the market.

Qantas members, meanwhile, are slugged $693 in annual fees.

The YourSuper comparison tool, rolled out as part of the government’s Your Future, Your Super reforms, ranks 80 MySuper products by fees and net returns and is updated quarterly. From September, it will also show APRA’s assessment of the annual performance of each fund, allowing users to easily identify underperforming funds.

Funds will be forced to tell members if they fail the performance test and won’t be able to take on new members if they don’t improve.

While currently limited to MySuper products, the comparison tool is expected to be expanded in mid-2022 to trustee-directed products.