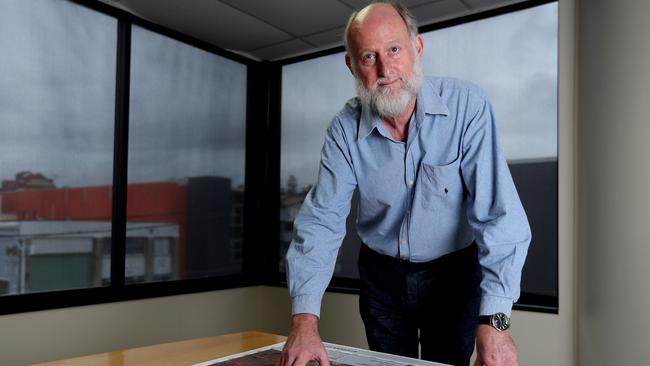

How the rich invest: Chris Wallin

Rising commodity prices are helping to fatten the wallet of reclusive Queensland billionaire and mine owner Chris Wallin.

Reclusive Queensland billionaire Chris Wallin is making huge profits at his coal mines thanks to rising commodity prices, documents recently lodged with the corporate regulator reveal.

- Name: Chris Wallin

- Age: 66

- Lives: Brisbane

- Estimated wealth: $1.79 billion

- Source: ownership of QCoal

- Secrets of success: An intimate knowledge of Queensland’s mining scene and ownership of Bowen Basin coal assets

Wallin owns QCoal, which has coal mines in Queensland’s Bowen Basin such as the $1.7 billion Byerwen Coal Mine where construction has started after the granting of mining leases last year.

Yet while Byerwen gets up to speed, Wallin’s other assets are already making big money as financial reports lodged for the first time with the Australian Securities and Investments Commission show.

QCoal made a pre-tax profit of $131 million from $419m revenue in the year to June 30, 2017, according to documents lodged last month — when Wallin provided several years of financial reports for his company. QCoal’s net profit after tax was $95.7m.

The 2017 profit and revenue compared with a $43m net loss from $288m income in the 2016 financial year.

QCoal also had retained earnings of $203m on its balance sheet, the accounts show, and about $100m in cash and cash equivalents.

Wallin has made his fortune in Queensland after a career in the state’s Mines Department as chief coal geologist.

Wallin sold a 45 per cent stake in the 97 million tonne Sonoma mine to US steelmaker Cleveland Cliffs for $140m in 2007 and has a range of mining assets under his QCoal banner.

Byerwen is projected to produce up to 10 million of hard coking coal per year once it is fully operational, and another asset in the nearby Drake open cut hard coking and thermal coal mine started producing up to 6 million tonnes annual in 2014.

Drake’s assets are accounted for in a separate and recently lodged financial statement for Drake Coal Pty Ltd, with that company recording a net profit of $74m from revenue of $139m for the 2017 financial year.

All of the income was derived from the export of coal, the accounts say, and Drake has about $30m worth of cash at hand.

As well as his extensive private interests, Wallin also owns shares in a string of small listed mining companies including one he launched an unsuccessful takeover bid for last year.

Wallin is the major shareholder, and until July a non-executive director, of Strategic Minerals Corporation, via his privately-owned QGold Pty Ltd.

Strategic (SMC) shares have fallen 13 per cent since January 1 but Wallin’s bid to take over the company was stymied by the Takeovers Panel in February when it made a declaration of unacceptable circumstances regarding the bid.

The Takeovers Panel has been concerned about Wallin’s role as a director of Strategic and after preparing a supplementary bidders statement in March, Wallin elected in June not to go ahead with the bid.

Wallin also has shares in oil and gas explorer Central Petroleum (CTP), which has risen 32 per cent this year, and engine company Orbital Corporation (OEC), which is up 18 per cent.

His other holding in Coppermoly (COY) is down 40 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout