How the Biden presidency will affect your investments

Investment markets could change quickly under a new free spending, big taxing Biden regime.

We might make assumptions about a new Democrat administration: that it will be free-spending, higher-taxing, potentially more pragmatic in its economic dealings with China and potentially more severe on bad behaviour among “big tech” stocks.

But perhaps the most important change will be a move towards what fund managers tag as “a more coherent economic policy” than we saw under the Trump administration. On this basis alone — separate to the steady progress of COVID-19 vaccination programs and improved corporate earnings — there are reasons to be optimistic about the investment year ahead.

What’s more, it’s not as if the global markets are waiting to see what might happen under Biden. There are crucial changes inside the markets that already point clearly to what could be coming.

Let’s just take two key issues: What might happen to interest rates and, which direction might the Australian dollar move?

The market’s key signal on the future direction of interest rates are bond yields, and they have been rising in a convincing fashion — in both the US and Australia they are now comfortably above 1 per cent. Putting that another way, they have doubled since the lows of March last year. The rate that matters most, the US 10-year bond yield, has gone from 0.5 per cent to about 1.1 per cent now.

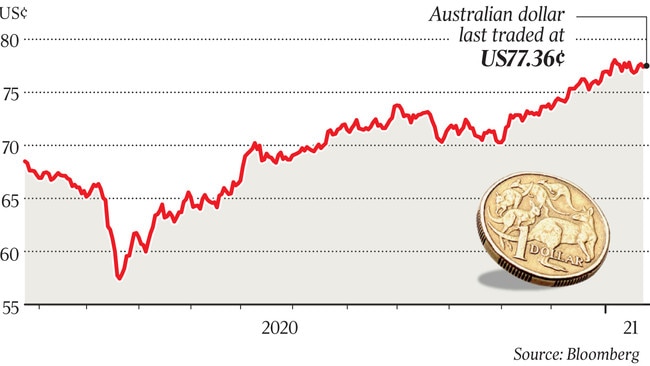

As for the dollar … the only way seems to be up. There are many reasons for this, especially the big lifts in commodity prices.

But the “new” factor is the arrival of Biden, armed with a new stimulus plan that is expected to push the US dollar lower. The Australian dollar is now at around US77c, and it has risen faster than the ASX 200 over the past three months. Analysts suggest US80c is now easily within reach.

Biden’s arrival does not entirely explain a lower US dollar or higher bond yields, nor does it mean these changes are irreversible. But the likely course from here is that his presidential economic regime, led by former Federal Reserve chair Janet Yellen (as new US Treasury Secretary), will extend these trends.

Beyond those macro changes, there are five outstanding areas where the new US administration will affect your investment plans in near term.

ASX top stocks currency outlook

Keep in mind our dollar has lifted nearly 40 per cent to US77c quite quickly in recent times. John Lockton at Wilsons Investment Strategy has transposed this currency change onto the Australian sharemarket and hand-picked top shares that will be affected. Put simply, a higher dollar is good for miners and industrial companies, but bad for a range of companies with big US interests. Lockton points to tailwinds especially for miners BHP, Northern Star, and OZ Minerals. But he sees headwinds for companies that must translate US earnings into Australian dollars, such as CSL, James Hardie, Transurban and ResMed.

Higher taxes on the international earnings

The nation’s big super funds have much more invested overseas than individual investors — the majority of those interests are in the US. The Biden regime is going to lift corporate and individual taxes. Australian super funds will pay higher taxes on US earnings under the new administration.

Tighter controls on climate change

The freewheeling Trump administration had little time for climate change considerations, but the Biden regime will be different.

One of the first “executive orders” from Biden was to halt the Keystone XL project aimed at expanding the transport of oil from Canada to the US.

Ultimately, this change of stance will play out to favour “green” investments and weigh against some elements of mining activity such as coal and oil.

Better outlook for ‘big iron’

Crucially for Australia, the single most important segment of the domestic economy just now is mining and specifically iron ore. BHP and Rio Tinto have become de facto iron ore companies: James Gerrish at Shaw and Partners points out that BHP now receives 60 per cent of its earnings from iron ore, and Rio gets 70 per cent.

Any improvement whatsoever in the US-China trade relationship should stabilise the outlook for big iron’s access to China. The Biden regime is likely to at least return trade relationships to a traditional negotiation framework.

Bad news for the big tech stocks?

The most favoured overseas shares among Australian investors are US tech stocks. There are fears Biden will crimp big tech and the new regime may move to split up the bigger players.

But the Biden administration has been well backed by big tech, with Vice-President Kamala Harris having close ties with Silicon Valley. Moreover, even if the Biden regime was to push to split up the biggest tech companies, the component parts may still be very profitable stocks.

The inauguration of a president in the US is always relevant to Australian investors, but this week’s ascendancy of Democrat Joe Biden is of particular importance — it is a major change at a genuinely “pivotal” time for investment markets.