How the Bank of Mum and Dad can react to rising interest rates

Parents who use gifts, loans or other financial measures to help children buy homes are being urged to double-check the deal.

The Bank of Mum and Dad is one of Australia’s 10 largest lending institutions, and is coming under more financial pressure than traditional banks as home loan interest rates rise rapidly.

A generation of young homeowners had never experienced interest rate rises until May this year, and parents who helped them out – via loans, gifts or going guarantor – are being urged to help their children navigate these new stresses.

Beyond Bank Australia’s general manager customer experience, Nick May, says many parents are juggling paying off their own home loan, trying to help their children enter the housing market, saving for their own retirement and caring for ageing parents.

“Many well-meaning mums and dads are sacrificing things for themselves to help get their kids in to first homes,” he says.

May says parents can help ease current or future pressure by:

• Encouraging their adult children to start small, perhaps with a unit or a home further from the CBD. “As we know in time as cities grow the undesirable often becomes the desirable”.

• Examining an investment property as a first purchase if they are happy with the children being at home longer, as this uses tenants to help repay the mortgage.

• Considering downsizing their own home: “Some parents are doing this to give their adult children a lump sum to start off with”.

May says before helping, parents should trust their child’s employment stability and partner, and seek legal and financial advice.

“With many relationships not lasting, you could find yourself in a sticky situation if you have put your equity into your kids first home and their relationship doesn’t stand the test of time,” he says.

BNL principal and family law specialist Will Stidson says there is a “perfect storm brewing” amid rising interest rates, living costs and tighter lending conditions, with loans from parents at increased risk if children are forced to sell properties as prices fall.

“Before entering into any loan, parents need to carefully consider the scenario that they lose the money entirely,” he says.

“The Bank of Mum and Dad will potentially be the last in the creditors’ line in the event housing prices fall dramatically and children can no longer service the mortgage. The commercial banks will be the first to be repaid.”

Australian Family Lawyers practice leader Barry Frakes says many parents would rather help their children before both parties get too old.

“Your kids get a first step in the rising property market earlier than if they waited until they had saved a big deposit on their own – while they are saving, the price of a home just gets further and further away,” he says.

Frakes says parents can be more flexible than banks about lending amounts and repayment terms, but any loans to children should be in writing, with both parties seeking independent legal advice.

“Don’t lend more money than you can afford, and remember if you lend money to one child then the other kids might come looking for a loan, too,” he says.

“Don’t create family disharmony by over-committing to one child so you can’t help the others when the time comes.”

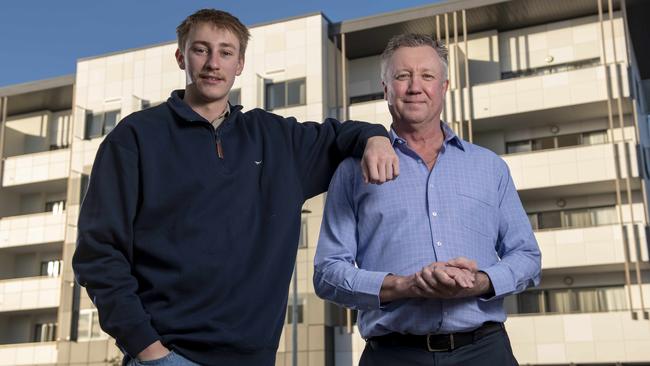

Tony Symonds plans to help his son Clayton with a home deposit and says rising interest rates should be expected and planned for.

“Not every parent has the ability to help their children out in terms of being the bank – however, I think all parents would like to help given the opportunity,” he says.

“Encouraging your children to save regularly demonstrates that they are serious about purchasing real estate.

“Given that scenario I think a donation from the Bank of Mum and Dad, particularly in terms of a deposit, is very helpful and can perhaps be the difference between entering the real estate market or not getting that opportunity.”

WHAT PARENTS SHOULD KNOW

• Treat loans to children as a business deal – a handshake and a hug is not good enough.

• Get independent legal advice so agreements will be recognised by courts.

• Cover all the bases, in case one day there is disagreement about the loan’s terms.

• Understand that if there is an economic disaster such as job loss or business collapse, parents have no priority in the queue to get money back.

Source: Australian Family Lawyers

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout