High rises add up to high risks for buyers

It’s not just the poor economics of high rise towers working against you — the law is loaded against you, too.

Buying an apartment in a new high-rise tower brings risk. But you know that already.

What you might not have guessed is that the legal system is actually loaded against apartment blocks that rise above three storeys. The bitter battle now in full swing over the notoriously “cracked” Mascot Towers project in Sydney has put this issue in the national spotlight.

The debacle at Mascot Towers has prompted several questions. How could such poor building standards occur? Why does the law favour smaller buildings?

More to the point: why would you bother buying in a high-rise tower?

There has always been strong arguments against investments in towers. The most persuasive by far is elementary — property is all about land, the underlying land matters more than the building placed upon it. The less land you own, the less your exposure to the upside,

Look at it this way: if you own one of 10 apartments in a development, you own 10 per cent of the opportunity presented by that land. If you own one of 200 apartments, you have a 0.5 per cent stake in the land.

After that, there is a string of ongoing concerns — the body corporate fees can be higher, the ability to manage and maintain a big block to high standards is difficult. As an investor, you are paying for all that marketing done by the developer before you arrived on the scene.

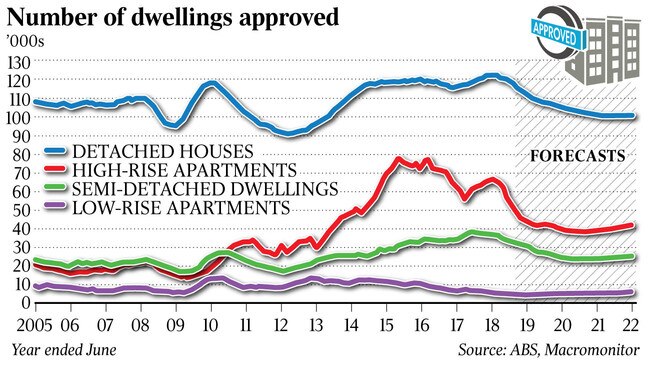

Worse still, industry researchers such as MacroMonitor will tell you that there is an excess of 40,000 apartments across the metropolitan capitals — supply has exceeded demand.

Yet once demand and supply return to equilibrium, it is very likely the ratio will quickly go against the investor again as developers unleash a new wave of tower developments in the same area. Think of Alexandria in Sydney, or Southbank in Melbourne, or the riverside districts in Brisbane.

As lawyer Adam Merlehan or Merlehan Group says: “The law discriminates against apartment owners over homeowners and on top of that the protections vary from state to state.”

To recap on the Mascot Towers saga — the towers showed cracks in June and the residents were told to evacuate. Those residents and owners have been bounced from pillar to post since as lawyers and insurers figure out what to do next.

A deal has been fixed whereby the apartment owners pay $7m across the 132 apartments to bring the building back to acceptable standards. It is reported that at least a third of the owners cannot come up with the funds, which could cost as much as $14,000 a month per apartment. A residents association is trying to get the NSW state government to aid the rescue. In turn, the state government is criticising the owners group for trying to maximise any remediation agreement.

But the essential flaw in the property investment framework is that if a builder goes broke or refuses to fix a defect in a high-rise tower, the owners are on their own. Specifically, home warranty defect insurance — which covers the cost of rectifying defects in homes if the builder goes broke, dies or disappears before fixing them — does not apply for new apartment buildings over three storeys in any state or territory.

Separately, Mascot’s “cracked” tower highlights the yawning gap in building regulations that were detailed comprehensively in a key report last year called the Shergold Weir report, which called for the appointment of an independent structural engineer unrelated to any parties connected to a development who would issue a report on the construction.

There are tricky issues in play here. Who would pay for the engineer? How often would they report? Daily? Monthly? Nobody has a clear answer to this.

Of course, there are arguments for buying in high-rise towers, or nobody would do it. Spurred by negative gearings, apartment can be a first step on the property ladder for many people. For the resident, a new apartment is often more attractive than an old one. The views, no doubt, are invariably better.

The initial sense of value for money is enhanced by a shiny new tower in what will often be a choice location. The promotional content underpinned by videos etc created for a new tower will beat the hastily composed real estate agent notices on a “for sale” older apartment every time.

And there is always exceptions, all property is local. There will be very good new towers and hopeless older blocks.

But Mascot shows how a new apartment tower can be a nightmare for all concerned. It is a warning for anyone — in any state — about what can go wrong in an apartment project.

Mascot is a long way from being sorted out, but it throws up two shocks.

First, residential buildings — even high-rise towers accommodating hundreds of people — can be built badly and there is no third party monitoring the progress. Inspection will occur afterwards, when it can be too late. Second, the legal protections on high-rise towers are weaker than houses.