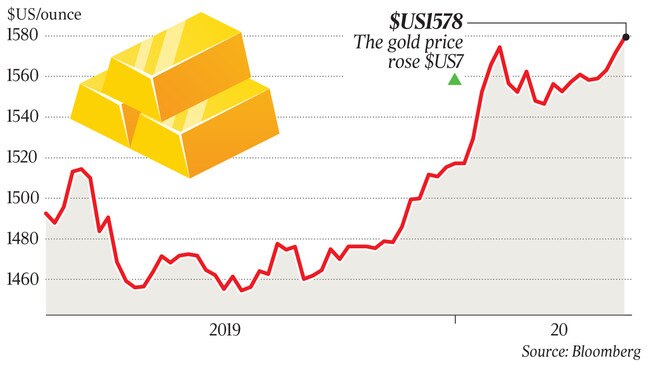

Gold bulls pushing a new record metal high

Despite the price of gold rising 18 per cent last year, it might not be too late to join the rally.

Investors who didn’t own gold in 2019 could be kicking themselves after an 18 per cent rise for the year. But it might not be too late to join the rally.

Some bulls even see the price of bullion breaking the record high set in 2011, when it briefly topped $US1900 an ounce, roughly 25 per cent higher than current levels. Robust buying by central banks, a weakening of the US dollar, and growing political tensions could combine to fuel further gains.

“If we think about it in percentage terms, to imagine gold making a new all-time high some time in 2020 doesn’t seem like such a stretch,” says John Roque, a technical analyst with Wolfe Research in New York.

Roque and his colleagues see a repeat of historical chart patterns in prices playing out. “We believe gold will (a) break out above resistance at $US1557, (b) work to $US1650, and then (c) make a new all-time high,” says a recent Wolfe Research report. Gold is currently trading near $US1555.

Other firms see higher prices. Swiss bank UBS has a base-case scenario of $US1600. New York-based commodities consulting company CPM Group and asset-management company State Street Global Advisors see potential highs of $US1600 and $US1650.

Investors looking to capitalise on the likely continued rally should consider buying the gold-focused exchange traded funds.

A big part of the bulls’ case is that buying by central banks will continue to absorb a lot of the metal. Collectively, central banks have purchased an average of more than 500 tonnes of the metal each year from 2011 through to 2018, according to World Gold Council data.

Initial data suggests a similar pace for 2019. Better still, the trend looks set to continue in 2020, says George Milling-Stanley, chief gold strategist at State Street. Central banks “feel they are seriously overweight in dollar assets”, he says.

For now, the path for gold prices looks to be heading up.

Barrons