GDP numbers narrowly avoid a recession, but for many it’s here

By one key measure, Australia is battling through a long-running recession, and new economic numbers suggest it’s getting worse.

New national accounts numbers show why it’s no wonder that households and businesses are worried about their finances and the nation’s future.

The last time Australia’s economy grew faster than our population was the September quarter of 2022.

That clearly puts us in a per capita recession, which is when the economy is shrinking per head of population. Shrinking growth. Shrinking productivity. And shrinking confidence.

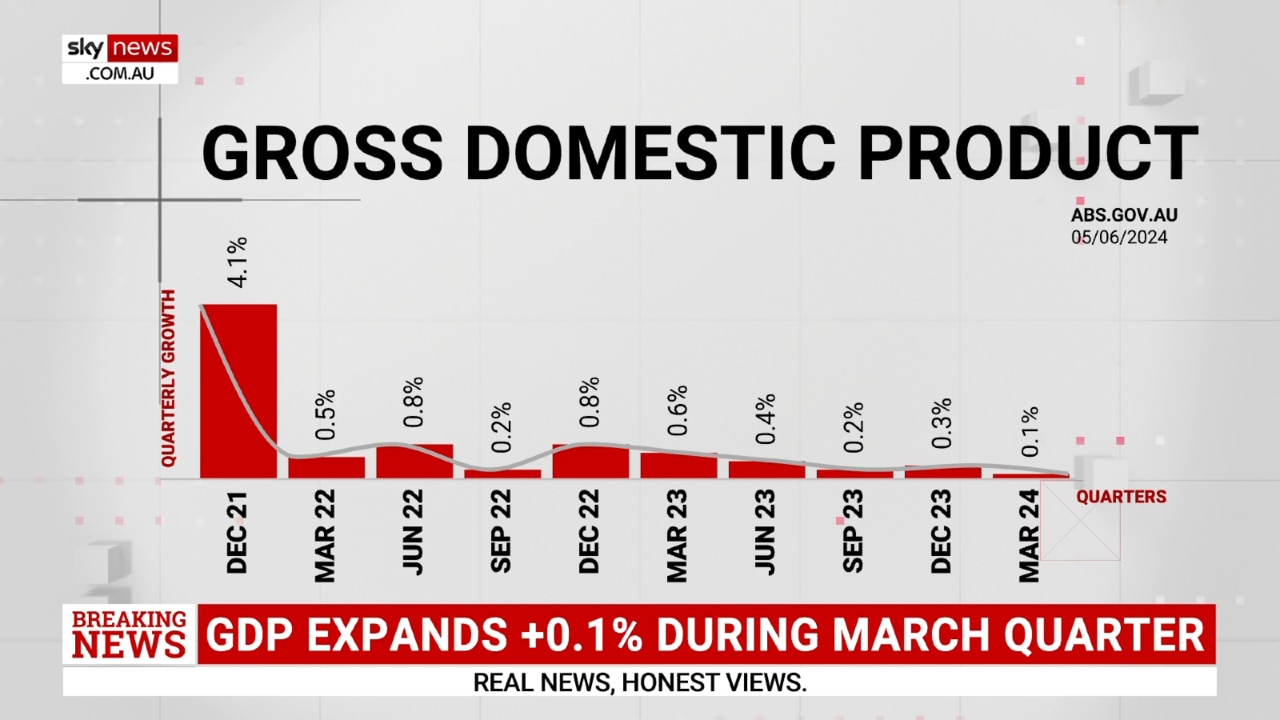

While Wednesday’s GDP numbers for the March quarter showed a meagre 0.1 per cent quarterly rise, propped up by government spending, separate figures from the Australian Bureau of Statistics suggest the nation’s net population since September last year has grown 1.75 per cent to 27.3 million.

The headline GDP number gives Australia annual economic growth of 1.1 per cent. This growth rate, if you don’t include Covid when the whole world shut down and went into recession, is the weakest since 1992 – or 32 years.

Only Australia’s huge migration since the pandemic has kept the official GDP data above water, and it masks the painful impact that high inflation and high interest rates have had on households and businesses everywhere.

Company collapses are surging, retail theft is at record high levels, job losses are growing and consumer confidence remains very weak.

It’s crazy that we are in this precarious financial position but the Reserve Bank of Australia is still discussing interest rate rises rather than interest rate cuts.

That’s what it did at its recent board meeting, after previously hitting borrowers with 13 rate rises since May 2022.

Interest rates are the key reason Australia’s economy is struggling. People with home loans have faced a 62 per cent jump in repayment costs since mid-2022, and business owners have faced a similar rate rise and also have to deal with customers having less money to buy things.

Interest rates are the RBA’s sledgehammer approach to get annual inflation back under control, after it surged above 8 per cent in late 2022, and they are the only tool the RBA has.

Persistently high inflation, currently at 3.6 per cent and well above the RBA’s target range of 2-3 per cent, has meant that forecasts for rate cuts have been pushed back from mid-2024 to late-2024, and many economists now say we shouldn’t expect a cut until 2025.

RBA governor Michele Bullock told a Senate committee on Wednesday that “we won’t hesitate to move and raise interest rates again” if inflation will not go down.

This is the reason why Australia’s economic weakness will continue, and the nation will continue to split into the financial haves and have-nots. Older and wealthier people who don’t have mortgages but have big bank accounts continue to benefit from higher interest rates, while borrowers and renters continue to battle high living costs.

And then, when interest rates eventually start falling again, there’s a chance that will push property prices even higher – pushing housing more out of reach for those struggling to pay their bills and scrape together a home deposit.

The solution is more housing, quickly, but sadly houses don’t just spring up overnight. We need more skilled tradespeople, and there are calls to bring in more tradies from overseas. Just as there are calls to curb migration growth.

This cycle of financial confusion continues, and this long-running per capita recession is likely to remain for a while yet.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout