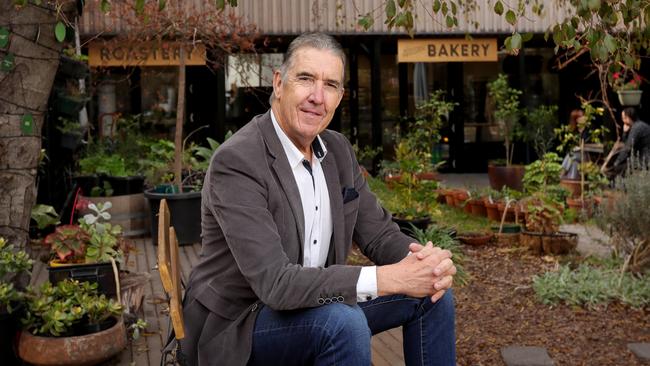

Flight Centre co-founder Geoff Harris’s 4 key investment principles and why he backs vaccine passports

The Flight Centre co-founder has an eclectic range of investments, and says business needs some certainty to open up again as soon as possible.

Flight Centre co-founder Geoff Harris wholeheartedly supports the idea of vaccine passports, saying says they are vital for several customer-facing industries as Australia seeks to emerge from Covid lockdowns.

Harris is best known as being a co-founder of Flight Centre, the travel agency chain that has become a global success story.

He still owns a big stake in the group, which underpins his wealth, and also has an eclectic mix of investments and philanthropic interests.

Harris was an early investor in the successful Boost Juice retail chain and has a family office investment group, which has stakes in businesses such as live auction app Gavl, Mexican restaurant chain Fonda and shared office space start-up CreativeCubes.

Harris says he gets offered plenty of investments, but usually has four criteria that he uses to judge what he will put his money into.

The prospective investment has to be in a growth industry; be profitable already or close to having a profitable model; have the right cultural fit for him and his family; and the management team has to have the skills to take their business to the next level.

Fonda is now part of a wider chain of a food retail business that has at least 40 outlets around the country under the Signature Hospitality Group, including brands like TGI Fridays and The Sporting Globe, in which Harris and his family have a stake.

–

Geoff Harris

- Age: 69

- Lives: Melbourne

- Estimated wealth: $578m

- Source: Travel, investment

- Secrets of success: Keeping his Flight Centre shares while investing in food retail and other fast-growing private interests

Source: the List – Australia’s Richest 250

–

Harris has been keeping a close eye on the unfolding debate on when hospitality will open up – and what the vaccination requirements will be.

“We totally endorse the vaccine passport,” he tells The Australian.

“It is the only way for businesses in hospitality and the services industry to get going again.

“It gives us certainty and it is also an incentive for people to get the jab.”

But Harris says business needed simple technology to deal with consumers who want to visit their stores or outlets.

“We would like the national cabinet to come up with a better way for the passports to be downloaded for people, and for there to be the same software for individual store visitations around the country. At the moment it can differ state by state, and that is an added complication for business, especially for those that operate across borders.”

Harris says trade has been as low as 10 per cent of normal levels at some of the outlets in states such as Victoria and NSW, where retail is shut – aside from limited takeaway services.

Yet in states such as Western Australia and Queensland, where there are no lockdowns, business is booming.

It is a similar story for the STREAT social enterprise group he supports in a commercial property he owns in inner-city Melbourne, which has also been restricted to takeaways only. Given the challenges of operating in Covid, what is the biggest lesson for aspiring entrepreneurs from the pandemic?

“I think it has been resilience and optimism,” Harris says.

“At the end of the day we have to get the model right to get through it all together, and I tell my people our parents in World War II had to face something like this for six years.

“This has been 18 months.

“Having said that, there has been a lot of stress and anxiety, and a lot of mental health issues we have to deal with.”

Harris is optimistic that once lockdowns end, and with vaccination requirements for consumers and likely for staff members, the economy and his businesses should bounce back reasonably quickly.

Similarly, he sees a brighter future for Flight Centre – under the long-term leadership of Graham Turner – once international travel is allowed again for more Australians, given the increase in activity in Europe and North America in recent months.

Flight Centre shares are up 33 per cent in the past 12 months after being hit hard at the start of Covid in March 2020.

The stock has had a rollercoaster ride of sorts throughout 2021 but is up about 12 per cent since the beginning of the year. However, it is still trading below pre-Covid levels.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout