Diversity behind Schwartz empire

Carol Schwartz is one of the most powerful and respected directors on the Australian corporate scene.

Carol Schwartz is one of the most powerful and respected directors on the Australian corporate scene, and is a successful investor as well.

Schwartz and husband Alan are members of the inaugural edition of The List — Australia’s Richest 250, published last Saturday in The Weekend Australian, with combined wealth of $409 million to have them placed at numbers 230 and 231.

Carol and Alan Schwartz

- Ages: 63 and 66

- Live: Melbourne

- Net worth: $409 million

- Source: Qualitas real estate management, shares and other property

- Secrets of success: Real estate financing contributed to a $28m profit in 2018.

The husband-and-wife team manage their wealth through their Trawalla Group, which has a diverse range of property investments as well as other interests including ownership of the food and pharmaceutical specialty transport company BagTrans.

Schwartz is a prominent company director, sitting on the board of ASX-listed company Stockland Group as well as the Reserve Bank, while Alan Schwartz was a lawyer who built legal software and publishing business Anstat Group before its $30m sale to SAI Global in 2005.

She also has a small parcel of shares in Stockland, which is one of the country’s biggest property companies with assets and interests across all facets of the real estate sector. Schwartz has sat on the Stockland board since 2010 and is a non-executive director.

Stockland shares are up about 10 per cent since January 1, recovering since taking a dip when the group announced its half-year financial results in February. At the time, it said its profits had taken a hit due to a steep decline in the residential property market. Stockland also said it expected further price declines in residential housing of about 5 per cent this year, mostly in the Melbourne and Sydney markets.

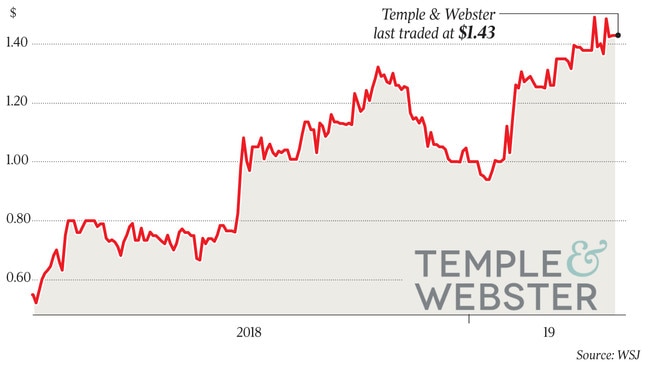

Schwartz and her family also maintain a shareholding in ASX-listed Temple & Webster Group, which sells homeware, furniture and other related products online.

The company was regarded as one of the worst floats of 2016, having debuted on the ASX in December of the previous year at an issue price of $1.10 only for its share price to fall as low as 13c within the following 12 months.

Schwartz was chairman at the time of the float, but resigned at the company’s annual general meeting in October 2016. She is still among the company’s top 20 shareholders, according to company filings. She had stepped down at the AGM after the company had revealed that its financial losses were much larger than its prospectus forecasts.

Happily for Temple & Webster’s shareholders though, the company’s share price has bounced back of late. It has risen 43 per cent since January 1, making it one of the better performers on the ASX, and is now trading about 30c above its original issue price. The shares are currently worth about $1.43, with a market capitalisation of about $161m.

In February, Temple & Webster reported a net profit of $3m in the six months to December, compared with an $890,000 loss in the previous corresponding period.

Otherwise, Schwartz and husband Alan’s property interests include the Qualitas real estate financier and investment manager, which made a net profit of $28m in 2018 according to documents lodged with the corporate regulator.

Qualitas has made about $2 billion worth of investments on behalf of its owners and investors, across a range of commercial, industrial and residential assets, and is run by their partner Andrew Schwartz.

It also has the Qualitas Real Estate Investment Fund, which is listed on the ASX and targets a return of 8 per cent on its funds per annum. Units in the fund have risen about 7c since issuing at $1.60 in November last year. The fund raised about $230m from investors and generates its returns from commercial real estate loans.

Trawalla Property, meanwhile, has ownership stakes or management interests in The Tasman Hotel in Hobart and the Rydges Hotel at Mount Panorama, on the site of the famous annual Bathurst 1000 Supercars race.

The Rydges Hotel at Bathurst reportedly cost $8.35m in 2012, having cost $50m to build by its previous owners who had run into financial issues.

BagTrans, which has a fleet of small and medium-sized trucks, had revenue of $65m in the 2018 financial year, according to financial records lodged with the Australian Securities & Investments Commission. It made a $758,000 loss that year, its annual report revealed.

Schwartz has been a member of the RBA board since February 2017 and is also the founding chair of the Women’s Leadership Institute Australia and chairs social entrepreneurship body Our Community.

Ms Schwartz declined to comment for this article.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout