Defensive assets can save your nest egg

Investors can be swept up in market hype — they will be better served reviewing their defences.

Just days ago investment banks Goldman Sachs told clients that a near-term correction, in which the market slides at least 10 per cent from a recent peak, “is looking much more probable”.

The thinking: equity markets look “increasingly exposed” to disappointing earnings growth due to the new coronavirus outbreak, Goldman warned.

My background as an analyst means I tend to assess everything through a risk lens. I have been trained to consider what could go wrong, if and how an investment can lose money, but also how to protect clients and to assess and be prepared for worst case scenarios.

With this in mind I’ve penned a few pointers to help you — the investor — assess your portfolio and preparedness for a major disruption.

Defensive assets will have varying characteristics.

The best will have a government guarantee and be 100 per cent liquid. You will be able to access them without having to give notice and without loss of value.

Examples include deposits with authorised deposit-taking institutions (ADIs).

Deposits are guaranteed for up to $250,000 per entity per institution. This doesn’t just mean the four major banks — rather, around 140 ADIs that include domestic banks, foreign subsidiary banks and so-called neobanks. You can find the list on the APRA website.

Keep in mind the government guarantee is per capital per bank, so if there is more than $250,000 in cash it may make sense to spread those funds between different institutions. They are likely to be secure in the event of a major disruption.

Commonwealth government and state government bonds are also highly regarded ‘‘safe haven’’ investments. The commonwealth government raises taxes and can print money, so the promise to repay $100 face value at maturity is assured. State government bonds also qualify as ‘‘safe haven’’ investments but states cannot print money and have different degrees of indebtedness. However, they can raise taxes and if any one state got into financial difficulty, there is the possibility the Commonwealth government would step in to help.

Senior major-bank bonds outperformed in the GFC as investors sold out of other assets. Further, the government followed other global governments and stepped in to guarantee bank bonds. Since then, the banks have been required to boost capital and liquidity to be able to stand alone should there be a further significant disruption to financial markets. New requirements make the majors much more robust.

This is an important feature when thinking about defensive investments. The possibility of higher prices just when there is a downturn should be a compelling reason to add these bonds if you want to increase your defensive allocation.

Annuities that guarantee minimum payments for life are very defensive assets and rate highly. The market remains very limited, with the Challenger group controlling an estimated 70 per cent of the local market. However, there have been moves by major super funds — including industry funds — to develop their annuity offering so that newly retired workers can access a product that will pay them a set amount for life rather than walking away from work with a lump sum and no clear strategy for managing their money.

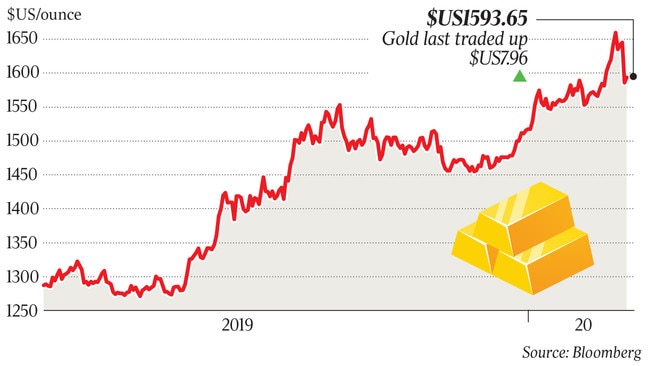

Gold is often thought of as a safe haven investment but it did see a brief slip in price during the GFC. The yellow metal then performed very well in the very slow markets of 2008 and 2009 while sharemarkets struggled.

Direct investment relies solely on the commodity increasing in value and remember there is no yield here — gold doesn’t provide an income. Other investments such as gold futures, direct investment in the miners or ETFs focused on gold offer an alternative avenue.

On balance, gold remains a worthy alternative store of value although there is no government guarantee.

To truly understand your defensive position would mean taking a deep dive into your superannuation investments.

Moving down the scale in terms of certainty, there are other investments that you may consider defensive. You just need to review what happened to the asset class during the GFC and discount similar losses on current investments to get a complete picture of your portfolio in the event of another major stress event.

I don’t consider shares as defensive, and that includes so-called ‘‘defensive shares’’.

For example, the S&P 500 dropped by more than 50 per cent from top to bottom over the course of the GFC.

In our own market highly reliable shares declined in tandem. For example, CBA shares fell by more than 50 per cent over the same period. Capital declines of that order simply don’t qualify those assets as defensive. But if you are convinced you own defensive stocks, go back and determine the declines during the GFC, then apply a similar discount to current holdings.

The same applies to other assets, such as different types of property, hybrids, derivatives and collectibles. For newer peer-to-peer loans you’ll need to try and source data around defaults; annual bank reports from 2008 and 2009 might help you understand the possible downside.

Defensive assets are there to help protect whatever you hold most dear — living expenses, family and lifestyle. Every investor will have their own required minimum sum that they want to protect and much will depend on your age and earning capacity. Retirees, without the prospect of returning to the workforce, will need a greater defensive allocation.

Better to understand your portfolio and the possible downside risk prior to a correction than to be scrambling around when the contagion hits.

Investment markets are running hard but there are always risks. The worries around coronavirus remind us that markets can turn very quickly and you need to ready for when that happens.