Deep trouble now facing city centre commercial property

For the year ahead, analysts cannot work fast enough revising their estimates upwards.

You won’t get terms like that very often from property executives.

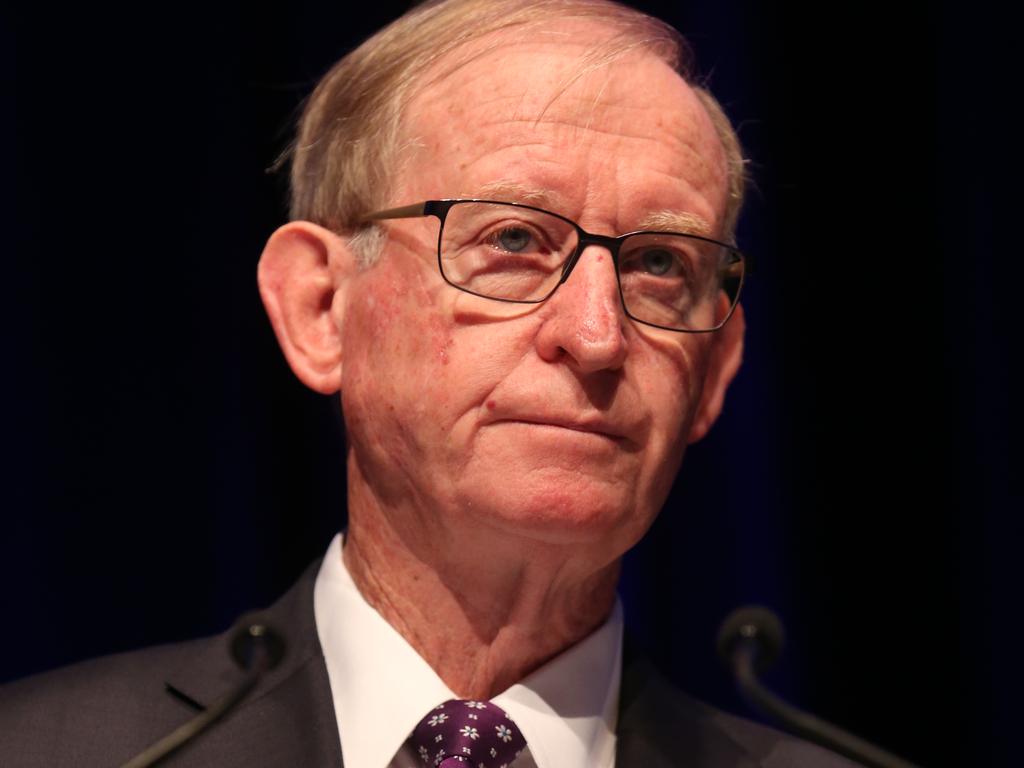

But Seymour should know more than anyone the deep trouble now facing city centre commercial property.

Though many property stocks remain buoyant thanks to the continued bidding up of income streams by investors, we are now looking at what you might call the Prime Property Paradox: Top notch high-rise assets are now among the most troubled in the wider market.

Sydney and Melbourne office districts had vacancy rates of near 7 per cent going into the crisis which was already on the high side - for the year ahead analysts cannot work fast enough revising their estimates upwards.

City centre vacancy rates are now heading for 12 per cent, the highest in almost three decades. In the smaller cities the picture is even worse - in Perth the vacancy rate is set to go to 20 per cent.

Consider that number for a moment: one in five offices empty.

Seymour is not spinning an encouraging picture, but neither is he a catastrophist. He says the biggest investors are taking a wait-and-see approach as the world tries to adjust to a seismic shift in working and shopping patterns brought on by the Covid crisis.

As Seymour says, retail is a basket case while there are pockets of strength in the industrial sector.

It only takes a sideways glance at the ASX to see markets have been signalling these views for months.

At the start of this year GPT, the blue chip office tower group, was trading well north of $6, and it is now at $3.77.

When are people going to return to those office towers, even if they are prime property?

The paradox is spelled out in a new report from Equiem, the property technology group, which found that while 75 per cent of landlords expect it to be business as usual by the end of the year, but 60 per cent of workers will not return to the office until “it feels safe”. (The report also found Australians working from home believe they are more productive than before the lockdown, in contrast to the US and the UK).

As for retail property on the ASX, the Scentre shopping group (Westfield) was trading at nearly $4 earlier this year, it is now at $2.25.

Scentre has taken on the role of a forward battalion in the war against retailers who will not pay rents. In recent days it closed down outlets belonging to both the Noni B group and the Strandbags group in a stand-off watched with intense interest by landlords and tenants throughout the market.

In marked contrast to office and retail, the industrial property scene is bustling and market leader Goodman is going from strength to strength.

Goodman peaked at around $16.50 before the crisis hit and today it is at $18, thanks to properties underpinning the online retail boom.

Maria Lee, property economist at BIS Oxford economics, says: “It’s clear that retail is probably the toughest part of the market and industrial is the strongest, but the picture in commercial is mixed.

“We have had to lift our vacancy rate forecasts, but there is a lot of confidence among the major investors, they are sitting it out just now to try and see how things turn out.

“Looking across the metropolitan property market I think there will be big changes — people will adapt, they may get more space for a keener price in the CBD, the crisis might give a boost to more modest suburban office space where people may feel more comfortable: it’s all about the public health outlook.”

What a refreshing blast of calling a spade a spade from property developer, Kevin Seymour: talking to John Stensholt the industry veteran says elements of the commercial property market are “diabolical”.