Crash or no crash, ethical investing wins yet again

The pandemic sell-off tested ESG investing, and it came through with flying colours.

Like it or not, the ethical investing brigade have won again during the downturn with mounting evidence both ethical shares and bonds have done better than all rivals this year.

For the sceptics, this was not supposed to happen: a global sharemarket crash was expected to serve as the ultimate test, the time when the tough would get going and the genteel folk pushing environment, social and governance (ESG) issues got the kick in the pants coming to them all long.

But the numbers tell a different story. ESG-focused investments — especially in technology and healthcare — have outperformed in the first months of the year. In many cases this will mean doing “less worse” than mainstream choices, but a rational investor will know that is good enough under these coronavirus crisis conditions.

Putting bias to one side, if a certain investment approach you are not convinced by happens to win time and again, you risk being on the losing side of the trade.

Just to review the numbers: on a global basis, Dow Jones data shows 150 out of 200 ESG-focused share funds “outpaced the average return of a fund’s broader category” so far this year.

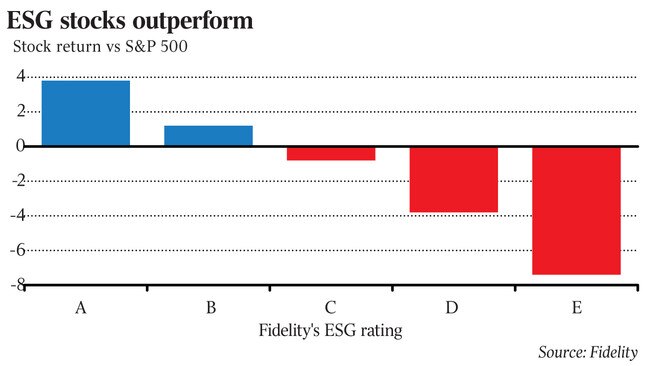

In what we now hope was the depths of the pandemic downturn (February 19 to March 26), as the US S&P 500 fell 27 per cent, Fidelity International monitored major stocks against their ESG scores.

Top-rated stocks did nearly 4 per cent better than the wider market index over the period, and the lowest-rated stocks did more than 7 per cent worse than the wider market.

Closer to home, where millions of Australians are now members of funds in the MySuper sector, the Rainmaker research group found “if a fund member invested in general balanced or growth options they would have been 1.5 per cent better off over the 12 months to the end of March if they chose ESG options”.

As Rainmaker’s Alex Dunnin said: “It reinforces the view that ESG funds seemed to have withstood the onslaught of the coronavirus crisis better than non-ESG funds.”

Why did the tough not get going?

Perhaps the tough are now inside the ESG camp. In simple terms, ethical investors won again in the crash because they held the right stocks — they held healthcare and technology such as CSL, Ramsay, Cochlear, NextDC and a string of related companies.

But they also held well-run miners such as iron ore specialist Fortescue, which consistently scores well in ESG surveys from groups such as Macquarie.

For international fund managers, the ESG-nominated companies that underpinned performance were the technology giants such as Microsoft and Alphabet (Google’s owner).

Equally important in achieving that outperformance were the stocks the ESG-focused investors avoided — the classic candidates here are in the oil market.

Since oil was arguably the single worst-hit sector in the world in the crisis, this meant the ESG investors missed the share price collapse in Exxon and BP, not to mention the horrors endured by ASX-listed Woodside, Santos and Oil Search, which all fell dramatically as the price of oil went negative at one point last month. Oil Search started the year near $8 and is now trading around $2.83.

For those who still harbour the view that this latest win for ethical investing is some sort of good fortune, that argument has run dry.

Perhaps the reason they outperform is not so much to do with box ticking — and there is a lot of that in this area — but a deeper explanation that gets to the heart of why one company is better than another.

Company resilience

“ESG investing is about deeply investigating the resilience of a company; it is as much about the social and governance issues as it is about climate policy,” says Alva Devoy, managing director Australia for Fidelity International.

“We just saw a very swift fall on global markets and it was the opportunity to test the ESG hypothesis in a bear market — over the time frame it proved itself.”

That’s the issue in a nutshell and it’s from inside a $US2.5 trillion fund manager, not a Byron Bay-based fundie operating in sandals out of a coffee shop.

The risk in ESG investing is no longer that it is a fad or that it will have its day, the risk is that you miss the golden era for this investment approach completely.

Each year, the ESG funds inflow continues to accelerate at managers linked with the Responsible Investment Association Australasia. Indeed, the reality is the association now says: “Responsible investment represents over half of all professionally managed funds in Australia.”

So will we see a day when every fund calls itself an ESG investor and the ethical sector dominates the scene to the point there is no longer a “premium”?

“I don’t think so. The issues are always changing, the work is never very fully done,” says Devoy.

Wealth editor James Kirby presents Your Portfolio, a free series of Facebook live Q&A sessions for The Australian each Wednesday at 7.30pm.

It must be infuriating for the rearguard faction that still sees ethical investing as a tree-hugging movement that will have its day.