Cooper takes a shine to technology

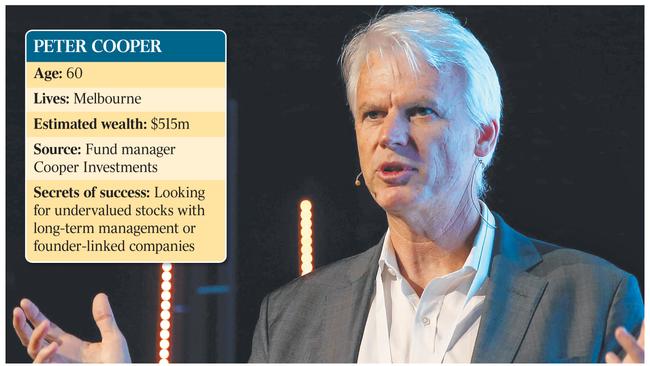

Fund manager Peter Cooper is reaping the rewards of patience.

Fund manager Peter Cooper is reaping the rewards of patience, and he and his stock-picking firm are finally starting to like the look of software and technology industries as more companies in those sectors become aligned to what describes as “our values and way of thinking”.

His Cooper Investors has more than $13.5bn in funds under management and is coming off a bumper 2019 in which the firm made a net profit of $29.m, up from $25.7m a year earlier.

Most of the profits were paid to its owners, Cooper and his staff, in the form of fully franked dividends worth $28m, according to latest financial reports lodged with the corporate regulator.

The firm has just launched a Family and Founder fund with a criterion of investing in companies having average insider ownership of at least 20 per cent and an average management tenure or family involvement of 40 years or more.

Cooper has long been known for his Australian equities funds, but in recent years has allowed for his global funds to be opened to retail investors and has been giving more of an insight to his investment strategy.

In the latest commentary for the Cooper Global Equities Fund (Hedged), which is now open to retail investors, Cooper noted a shift in his firm’s sentiment towards global tech stocks.

Previously, the firm has concentrated on stocks such as fintech firm Fiserv, which is listed on the Nasdaq and has risen by 35 per cent in the past year, due to its dominance in its niche area of having mostly financial institutions as clients.

Or it has preferred a company such as health tech firm IQVIA Holdings, which has increased 19 per cent in 12 months.

But the Cooper Global Equities Fund could be on the hunt for more emerging stocks as their financial situation matures, after a recent study trip to the US. “In the past our observation was that many software businesses that were growing rapidly had suboptimal earnings or financial quality — excessive stock options or lack of capital deployment prowess deterred us from many stocks,” Cooper told its investors in a note.

“However, with the growth and development of the technology industry and the companies in it we are starting to see more management teams and boards value the same dynamics as we do.”

Those dynamics operate under Cooper’s “VoF” discipline when it comes to picking stocks, where “V” stands for value latency — meaning assessing companies for their ability to provide upside by generating more cash back than they outlay; “O” for operating, industry and strategic trends; and “F” for focused industry and management behaviour.

The Cooper Global Equities Fund has averaged a 13.03 per cent rolling return over the past decade and has returned 383.66 per cent cumulative since inception in December 2004.

It has about 47 per cent exposure to the US, 19 per cent to Europe, 13 per cent to emerging markets, 12 per cent Britain, 5 per cent in developed Asian countries and 4 per cent Japan.

That geographical spread may stand the fund in good stead in terms of withstanding any market downturns that unfold as a result of the coronavirus outbreak in China.

In the short-term the fund has several winners already this year.

Danaher Corporation, a NYSE-listed conglomerate with investments in diagnostics, life sciences and environmental solutions companies, is up 4.8 per cent since January 1 and about 60 per cent in 12 months. Stockmarket indices and information company S&P Global, also listed in New York, is up 7.5 per cent in about a month, while healthcare company Baxter International has risen 6.7 per cent in the same time.

Risk and reinsurance firm AON is up 5.74 per cent, and London-listed Halma, which makes safety and health products, has risen about 50 per cent in the past 12 months.

Yet while the Cooper Global Equities Fund mostly has avoided Chinese stocks, there was one notable exception it picked up towards the end of 2019.

The fund bought shares in Yum China Holdings, which is listed on the NYSE but headquartered in Shanghai. It is one of the largest restaurant groups in China with more than 6000 KFC outlets and 2000 Pizza Huts.

Cooper’s fund was impressed by Yum China’s “stable, simple and cash-generative business model run by a highly driven owner-operator culture”.

But like many China-related stocks, it has been hit hard by the coronavirus outbreak. Its shares are down 10 per cent since January 1.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout