‘Can’t afford IVF? Use super nest egg’

A leading super fund has launched a controversial campaign about how members can pay for their fertility treatment.

A leading superannuation fund for teachers has rattled the industry fund sector with a campaign to “grow awareness” among its members on how to access money for IVF procedures.

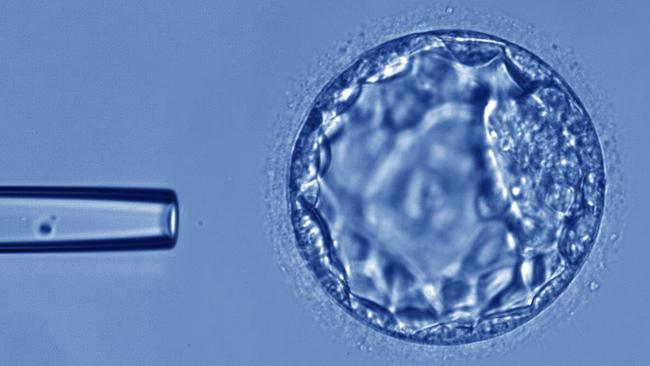

Superannuation savers tapping their retirement fund for health-related reasons has been steadily growing as a range of IVF companies including Monash IVF have been actively promoting super as a means of financing expensive fertility treatment services.

The $15bn NGS fund has launched an awareness campaign to a membership base that is largely women: many super savers are not aware the IVF can be accessed under special circumstances.

Superannuation is expected to be the next battleground after personal taxes between the Coalition and the Albanese government: Jim Chalmers has already launched a series of initiatives designed to keep super strictly for retirement purposes while the Coalition supports using super for first-home buyers.

Chief executive of NGS Natalie Previtera is adamant her members should be fully alert to the opportunity of using their super for IVF, regardless of the politics surrounding early super access.

In Australia, she said, one in six couples experience difficulties falling pregnant. Combine this with the current economic climate and many Australian couples trying to start a family may think fertility treatments are out of reach.

“NGS Super wants its members to know they can apply to access super early for medical procedures, including IVF. While specific conditions need to be met for the compassionate release of super, it’s comforting to know that help might be available,” she said.

Since the closure of the Covid early release program, accessing super can again be done only through traditional “hardship” applications. Yet it is also possible to access super on “compassionate grounds” where an applicant can prove their need for the money by offering a signed letter from two registered professionals, normally a doctor and a psychologist.

The success rate for compassionate-based applications has run high, without about three in five applications getting approved.

“For some women, the time to have a child may be crucial and waiting for the day when their finances are better might not be an option,” Ms Previtera said. She also said the fund would ensure anyone seeking to take out super early for IVF purposes would be given access to advice covering the impact of such a move on super balances, insurance and tax.

Naz Randeria, managing director of Reliance Auditing Services, warned strongly against accessing early super for any reason.

“It goes without saying that a simple consequence of withdrawing super early is potentially having a smaller balance at retirement. Your balance doesn’t only decrease by the amount withdrawn initially, but by any potential income or gains that sum could have earned over the remaining years until your retirement.”

In the case of NGS and its 15,000-strong membership base, the average age is 46, implying early super access applicants would miss out on nearly two decades of tax-protected compounding returns before retirement.

The federal Treasurer will be expecting industry super funds to support his efforts to block any growth in early access to super:

Most funds are determined to resist early super release for a range of reasons, including the need to maximise the size of funds under management. However, the NGS awareness campaign suggests not all industry funds are naturally aligned with the broader plan to tighten up super access.

Coalition figures such as Andrew Bragg and Tim Wilson have regularly pushed for super to be made available to help first-home buyers deal with the high price of entering the residential market.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout