Briscoe’s Rod Duke sounds retail warning from New Zealand experience

Unless the government gets on top of it then ‘people are going to be awfully afraid to go into stores’, says Briscoe boss.

If the experience of Rod Duke is anything to go by, there is some light at the end of the tunnel for Australia’s embattled retailers grappling with COVID-19, with stores closed in Victoria and trading down almost everywhere else.

But Duke, the boss of New Zealand retail giant Briscoe, has a warning. Briscoe’s sales have surged since his country’s hard lockdown ended in May, but he says consumer confidence can easily plummet.

“I can tell you our experience here: it’s probably all about COVID. Unless the government gets on top of it then people are going to be awfully afraid to go into stores.”

That fear, in New Zealand at least, appears to have subsided. With the country experiencing little or no coronavirus cases among its residents after closing its borders and instituting a hard lockdown, the retail recovery since doors reopened in May has been much greater than Duke forecast.

“It has been way, way higher. Certainly given the length of time we were shut, from when we opened on May 14, we ought to have been pretty buoyant. But even now that demand is still high,” he tells The Australian.

“Between May 14 and the end of July, in that period my sales were up 38 per cent like-for-like (from a year earlier). Online sales in the first half of our (financial year) doubled and it is currently running at about 16.5 per cent of overall sales.”

Duke describes that doubling as “abnormal” and even the 16.5 per cent is above what he thinks the trend will be. He thinks the online number will “settle back at about 14 per cent”, even if COVID has permanently accelerated his customer’s digital buying habits. Briscoe’s operations include the homeware retailer of the same name, Rebel Sport’s New Zealand business, the Living and Giving chain and a large stake in Kathmandu — a retail brand Duke once attempted to take over.

He attributes the big rise in spending since mid-May to pent-up demand among New Zealand consumers, who this year have not been able to spend their money anywhere else.

“They have not been able to travel this year. So in terms of expenditure there’s all this pent-up demand after lockdown when people had all these savings and were still being paid their salaries (the government had a wage subsidy scheme) but nowhere to spend it.

“They’d been cooped up and so maybe they went to Rebel Sport and bought a new pair of runners or they went out and bought a new dinner set. They had cash and they’ve been treating themselves.”

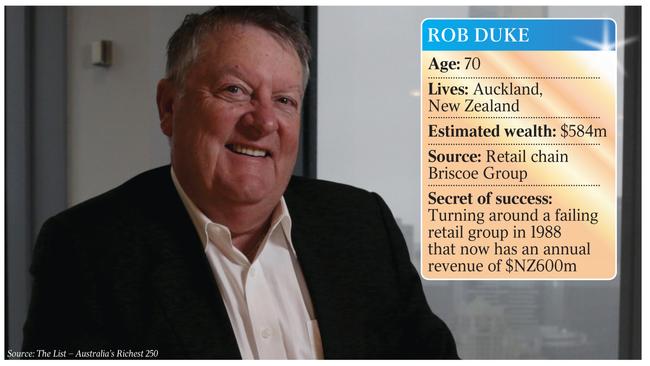

Duke is a member of The List — Australia’s Richest 250 thanks to his majority shareholding in Briscoe, which he joined in 1988 after two decades working for Australian retailers.

His mission was to try and turn it around for its then Dutch owners. Two years later Duke executed a buyout and he now owns about 77 per cent of the New Zealand Stock Exchange-listed group.

It was trading at close to record highs in January before falling along with the rest of the market in March.

The second-largest shareholder in Briscoe, which also trades on the ASX, is the Australian billionaire retailer Gerry Harvey. Briscoe shares have risen about 49 per cent since late March.

Still, Duke says it was a long 50 days with stores closed and there are still doubts about how New Zealand’s overall economy will recover in the longer term.

Like most retailers — and just about everyone in business in New Zealand — Duke feared the worst when Prime Minister Jacinda Ardern instituted a hard lockdown in March that saw just supermarkets and petrol stations open, and little else.

Duke elected not to take a salary and his senior staff and directors all took pay cuts. He also cut the Briscoe dividend that would have seen about $27.5m distributed to shareholders.

The company would, he says, end up receiving about $NZ11.5m from the New Zealand government’s wage subsidy scheme for Briscoe’s 2600 workers. Also helping were generous rental clauses more favourable to store operators when their doors were closed.

Duke admits the pandemic will have both wider and more specific repercussions. He fears many businesses will shut when the wage subsidy finishes in September and that industries reliant on tourism “may never quite be back in the same way as before”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout