Biotech’s hot property for Lang Walker

Lang Walker has a string of biotech investments, but one in particular is shooting the lights out.

Property billionaire Lang Walker is one of the most successful individual biotech investors in the country thanks to a stellar recent ASX float, Next Science.

The value of Walker’s biotech shareholdings is closing in on $300 million, meaning he could be a contender for a position on The List — Australia’s Richest 250, published by The Australian, with his investments in the sector alone.

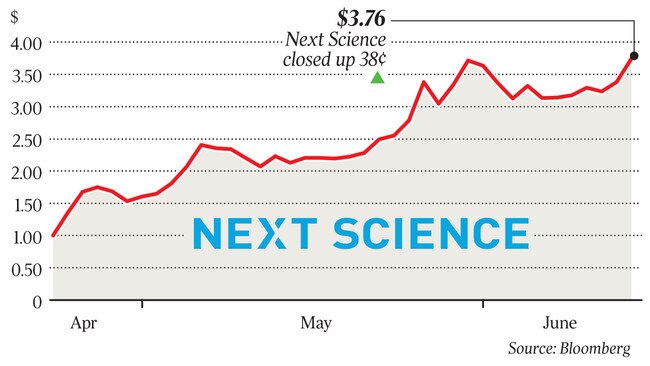

His biggest holding and quickest mover has been Next Science, a chronic infection specialist that only floated on the ASX in April and has since more than trebled in value. It has risen from a listing price of $1 on April 18 to as high as $3.71 in late May, and was trading at $3.48 on Monday.

But the bulk of Walker’s $3.58 billion wealth on The List is derived from his property business Walker Corporation, which has a mammoth $25bn worth of residential and commercial property projects rolling out over the next 15 years.

All of those should keep him among the billionaire ranks for some time yet, even if Walker is dabbling in other pursuits, such as spending $100 million to build the Kokomo luxury resort in Fiji and a 50 per cent part-ownership of new A-League soccer club Macarthur FC, which enters the competition next year. He has also long been a biotech investor.

Walker owns almost 43 per cent of Next Science’s shares, having been an investor before its stunningly successful float. That stake is now worth about $280m.

Next Science has developed patented treatments for biofilm-protected bacteria, which have a structure that effectively make it resistant to antimicrobials.

The company has four products approved for sale in the US aimed at treating chronic wounds and preventing infections after surgery. It is also targeting orthopaedic implant products, and plans to release an acne treatment in Australia within a year.

Walker also has about $20m worth of shares in Neuren Pharmaceuticals, which is developing drugs for brain injuries and neurological disorders. Neuren shares have fallen 17 per cent since the start of the year but they shot up almost 15 per cent in one day’s trading in May when the company revealed one of its drug candidates to treat neurodevelopmental disorders had shown early promise in two preliminary studies.

Walker also owns about 10 per cent of the small biotech investment firm BTC Health, which has fallen 28 per cent since January 1. BTC is a pooled development fund that looks for companies to invest in within the healthcare industry. Its latest deal was the $6.3m purchase of a hospital infusion business from Admedus.

Walker has also been a shareholder in the small mining explorer Nucoal and owns shares in Carbonxt Group, which provides products for emission control applications. Carbonxt shares are up about 13 per cent this year.

Walker also has holdings in some private companies that may one day become float candidates. One is Sydney biotech Atamo Diagnostics, which provides low-costs AIDS testing kits and has also been backed by the Bill and Melinda Gates Foundation.

Another is Australian Industrial Minerals, which owns garnet precious stone mining assets in the NT. It announced — but later withdrew — plans for a $5m raising ahead of an initial public offering earlier this year. Walker owns 8 per cent of the company, according to its prospectus.

Otherwise, Walker has a big range of property projects on the go, including the four-tower $2.7bn Parramatta Square project in Sydney and the $700m Festival Square project in Adelaide.

His Walker Corporation has about $2.9bn worth of investment property on its balance sheet, including $1.9bn in completed projects such as Collins Square in Melbourne Docklands, considered the second-biggest mixed-use project in Australia, incorporating several office towers and more than 200,000sq m of space that is fully leased.

While he has focused more on commercial projects than residential undertakings in recent years, Walker does have projects in Malaysia and southwest Sydney, where he has tens of thousands of subdivision lots to be rolled out on to the market in the coming decade and beyond. He also is in a joint venture building the Banksia Grove masterplanned community in Western Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout