Bingo Industries woes shows housing sector is weakening

Expect the sharp decline in national building approvals to be followed by an equally sharp decline in activity.

As for the national apartment boom, it’s over as we wait for 54,000 new apartments commenced in Sydney during 2018 and 2019 that will be completed by the end of the year.

And while property investors in these apartments can expect high vacancy rates and poor near-term yields, it’s the second and third order impacts that may interest share investors.

One company with heavy exposure to the property boom — and now the bust — is, or will be, Bingo Industries.

In February the company announced “a faster than anticipated softening in multi-dwelling residential construction activity across Bingo’s key markets in NSW and Victoria”, adding: “Volumes in our building and demolition collections business were above the previous corresponding period, but have not grown as much as initially forecast. In addition, competition in the B&D collections market has put downward pressure on pricing, impacting our margins.”

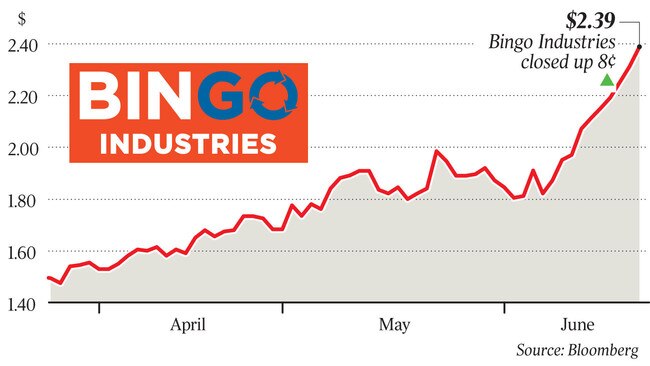

It was a double whammy that caused the share price to fall almost 50 per cent in a single day, from a high of $2.30 to a low of $1.17. Bingo’s shares have since bounced 90 per cent to $2.39.

Indeed, builders including AV Jennings, Villaworld (which has received a takeover bid), Stockland and Mirvac have all seen strong share price performances since their first-quarter lows. Building material suppliers such as CSR, Boral and James Hardie have also recorded strong bounces in share prices.

No doubt these performances have been at least partly attributable to relief following the Coalition victory at the federal election. However, the building game has always been a cyclical one. While investors have done well buying shares in listed builders when they are trading at a discount to their net tangible assets and selling when they revert back to a premium, one must ask whether the recent bout of enthusiasm is justified.

Discussions with the staff of some of Australia’s largest home builders, many of which aren’t listed, reveals a 30-50 per cent decline in the pipeline by Christmas if significant changes aren’t seen.

And that brings us back to Bingo. In February, Bingo simply announced that its previous forecast of a 15-20 per cent increase in profits would be unlikely and its 2019 profit would more likely reflect the previous year’s number. The share price halved.

When the company offered its 2019 updated guidance, national housing approvals were already slumping but building activity remained at record levels. That’s still the case today — building activity remains at near all-time highs. But that is changing fast. At this stage, I expect the sharp decline in national building approvals to be followed by an equally sharp decline in activity. That means less Bingo bins being required at fewer building sites.

With Bingo raising $420 million to fund its recent acquisition of Dial-a-Dump (according to its half-yearly balance sheet), which in turn gave the vendors of Dial-a-Dump $378m in cash and about $200m in Bingo shares at the time, it is likely returns on equity for Bingo shareholders will fall.

The extent of that fall remains to be seen, but if the company is reporting flat profits at best in 2019 with more than double the equity it had at the end of 2018, it is reasonable to expect the return on equity to at least halve. A business that is twice the size but earning half as much, in terms of profitability, isn’t really worth a lot more, irrespective of what the share price does.

With that in mind, caution should be applied to the company’s recent share price enthusiasm, especially since the fall in dwelling approvals is yet to be fully felt.

Roger Montgomery is founder and chief investment officer of the Montgomery Fund.

The slump in dwelling approvals has now been well documented. At the peak an estimated 280,000 dwellings were approved for construction. That number has now declined almost 40 per cent, to about 170,000 dwellings.