Bank for the rich – where do Australia’s wealthiest put their money?

Sydney-based banks are winning over the nation’s wealthiest as new data analytics allows them to pinpoint special products for rich customers.

Every bank wants the rich, but which bank has most of them on the books?

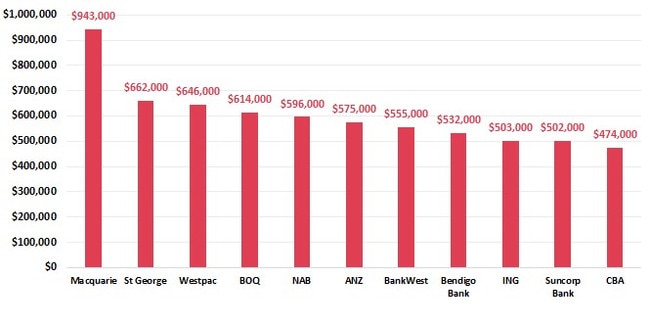

Macquarie wins the big prize while Westpac comes out on top among the big four.

A new Roy Morgan report reveals the numbers – based on net wealth per capita – just as banks are leveraging new data analytics to capitalise on their richest customers.

ANZ rattled the market earlier this year when it exploited its ability to leverage its richest customers by distributing special mortgage deals to those who have an income of $400,000 or more. The bank has pinpointed the target market to 145 of the nation’s 3,333 address zones.

Industry analysts expect the ANZ move will trigger a fresh hunt for richer customers among all the banks.

With an average customer worth $943,000, Sydney-based Macquarie – primarily an investment bank – has been pushing hard into the deposit market in recent years. The strategy is clearly getting results with the bank customers having higher incomes than other banks and more likely to own their own home.

Similarly, Westpac is collecting the wealthiest Australians, its in-house brand St George is second only to Macquarie while Westpac itself ranks third.

ANZ remains well down the list when it comes to luring the nation’s wealthiest – NAB and Bank of Queensland rank higher in terms of customer wealth.

Meanwhile, the nation’s biggest bank – CBA – is revealed as the exception, ranking at the very bottom of the list with an average customer worth $474,000.

According to Roy Morgan CEO Michelle Levine: “The two banks with the greatest proportion of customers living in Sydney are the two banks with the wealthiest customers – Macquarie and St George. While 21 per cent of Australians live in Sydney, 29 per cent of Macquarie customers live in Sydney and 53 per cent of St George customers do.”

Banks are fighting it out for top-end customers partly in response to tighter new banking regulations, which ANZ CEO Shayne Elliott claims are “locking out Middle Australia”.

Elliott recently suggested the banking industry “is skewing towards the wealthy”.

The figures also reflect nationwide dependence on the value of residential property – net wealth covers wealth minus liabilities. Older Australians who own their own home – especially in the more expensive cities – are the wealthiest customers.

CBA’s low ranking on the list will be partly explained by its history as the “people’s bank”, which inherited many social welfare customers before privatisation. At just $474,000 per customer the bank’s net wealth per customer today is still lower than the national average for all Australians, which sits at $503,000.

More recently, the Roy Morgan figures also show that CBA customers are more likely to be in gen Z.

“Being younger they have not had the same opportunity to accumulate wealth as the other large banks,” the report says.

Though banks have pulled back from offering financial advice to mainstream customers in recent years, there has been plenty of competition at the top end of the market to service richer Australians.

At the richest level there has been a boom in family office services, indeed there are now more people employed in the family office space – families with fortunes over $200m – than there are financial advisers in the wider market.

Major banks have joined the competition by pushing their private banking units where customers may be expected to have around $2.5m or more in so-called “investable assets” or an annual income above $400,000.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout