Australian super funds urged to invest in Silicon Valley

US Ambassador Arthur Sinodinos says Superannuation funds could be invested in Silicon Valley giants Google, Microsoft and Intel in AUKUS ‘tech diplomacy’ push.

Australian Superannuation could be invested in Silicon Valley giants Google, Microsoft and Intel in AUKUS “tech diplomacy” push, according to US Ambassador Arthur Sinodinos.

Mr Sinodinos said Australia’s Superannuation funds are looking to invest in the United States’ new semiconductor plants as part of a “tech diplomacy” hedge against China.

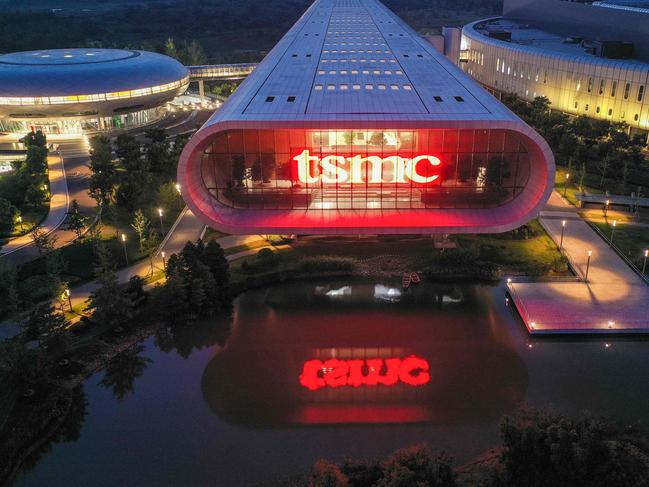

While Mr Sinodinos was careful not to mention China by name, the White House plan to move semiconductor manufacturing to the US is in direct response to China’s aggression towards Taiwan, which accounts for an estimated 92 per cent of the world’s most advanced semiconductor capacity.

“Our strategic circumstances have changed so quickly from a few years ago,” Mr Sinodinos said at the Bilateral Tech Diplomacy Series at Perdue University.

Amid the current “reorientation of supply chains”, Mr Sinodinos said Australia was looking at major investments in Silicon Valley giants like “Microsoft, Google, Intel, go through the list” as superannuation funds outgrow the Australian market.

About $140 billion flows into Australia’s Superannuation funds each year, giving Australia the fourth-largest store of capital in the world.

“This is a big pool that can’t all be invested in the Australian Stock Exchange,” Mr Sinodinos said.

“We’re looking for ways this can be deployed, consistent with our mandates,” he added.

Mr Sinodinos added that Australia’s trade Minister will return to Los Angeles next month to negotiate the Indo-Pacific economic framework.

“And the supply chain pillar of that is all about; how do we co-operate in areas where economic and national security increasingly overlap,” he said.

“This [tech diplomacy] is in effect what we are now working on together, how do supply chains look in this strategically more challenging world,” he added.

In January, Intel announced a new $20 billion factory outside Columbus, Ohio, to manufacture semiconductors in the US. Nearly $80 billion will be spent on factories by 2025.

Mr Sinodinos said that while Australia wouldn’t be involved in the whole supply chain of semiconductors, it could play a critical role in certain sections of its development.

The US’s recently passed “Inflation Reduction Act”, meanwhile, included provisions that materials in electric vehicles come from minerals from the US or free trade partners.

“That’s an incredible incentive for countries with lots of critical minerals like Australia,” Mr Sinodinos said.

“We’re well placed to provide critical minerals”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout