Australian IT, healthcare stocks look expensive by world standards

Two trends being noticed in the COVID-19 crisis are the phenomenal take-up of technology and its fast-tracking. We have seen years of development occurring in just months. In equity markets, when looking at performance, there have been clear winners and losers.

I saw a report highlighting a “blink and you have missed it” point. That was when the S&P 500 made a new all-time nominal high on the 21st August. After recording a 34 per cent loss in just 24 trading days, the S&P 500 made an astounding recovery, gaining over 50 per cent in value. I want to highlight three key points here.

The first point that stands out — and which brings us to the Main Street versus Wall Street theme — is that we’re seeing sectors such as technology, healthcare and utilities clearly coming out as winners, especially in a domestic Australian context.

The second point is that style has been crucial. Growth has dramatically outperformed value. This may reverse but I do not see that happening in the foreseeable future.

The third key point is the geographic dispersion in returns.

Much has been written about the strong outperformance of the FAATMAN (Facebook, Apple, Amazon, Tesla, Microsoft, Alphabet and NVIDIA) stocks. The importance of FAATMAN stocks is shown by the fact that at one stage, during the quarter just passed their combined value exceeded that of Japan’s TOPIX index.

In comparison, Australia’s market has lagged substantially, due to its large index being

underweight to technology and overweight to banks.

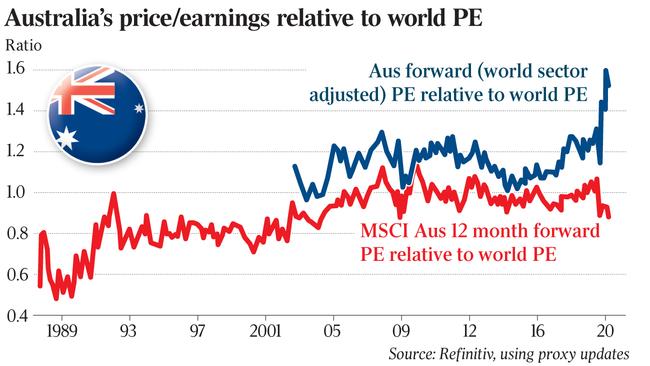

The Heuristic Investment Services chart shows just how Australia came into this crisis earlier in 2020: at over a 5 per cent premium on an overall price/earnings or PE basis. It is now at a 10 per cent discount to the MSCI World index, near the bottom of its 15-year range.

In late 2019, I cautioned that our market was at an all-time high sector-adjusted for MSCI World index weightings at 25 per cent.

Even though the correction earlier this year saw this premium retrace to just above its long term average at around 15 per cent, when adjusting by attributing global weightings to the domestic index, we have blown out to a 55 per cent premium. It is by far the largest premium gap we have experienced.

With IT in Australia at 2.4 times its global valuation, healthcare at 2.2 times, industrials at 2.0 times and utilities at 1.6 times, these sectors appear very expensive against their global peers to the extent that they can be compared.

Damien Hennessy from Heuristic Investment Services says that while the composition of these sectors can be quite different from global, more diversified sectors, Australian IT, healthcare, industrials and utilities stocks appear very expensive.

The market fell in the first quarter of 2020 on the back of the virus, rose in the second quarter on better news, and is correcting again on fears of a second wave.

Capital Economics in London noted earlier this month that while it forecasts that equity markets will make further ground in the next few years, the rapid increase in COVID-19 cases in Europe poses a downside risk to its projections.

If equities continue their sell-off it will be because the virus stages a true “second wave” towards the worse end of fears. If bonds sell off, it will be because the virus for some reason comes swiftly under control.

Investors have ignored the growing gap that exists between Main Street and Wall Street. Colossal levels of government stimulus have been pumped into economies and this makes it difficult to determine the true state of the economy.

I continue to advocate a prudent approach to asset allocation for the near future.

Considering the strong disparity between winners and losers, and that this looks set to continue — as the chart shows — I strongly advocate exposure to equities with conviction-style management. There are clear winners and losers in the markets at the moment.

Will Hamilton is the managing partner of Hamilton Wealth Partners, a Melbourne-based wealth manager.

will.hamilton@hamiltonwealth.com.au

How should investors be looking at markets at the moment in the light of the upswing in indexes in Australia and globally?