Aussies making a slow transition to retirement

More Australians are transitioning into retirement over a few years, with more working past the age of 65.

Retirement used to be a clearly demarcated milestone in the life of working Australians. Cake and speeches on a Friday and on the next Monday you started your life as a retiree.

That’s not so simple any more. More Australians transition into retirement over a few years. Let’s explore the growing cohort of Australians who work past the age of 65.

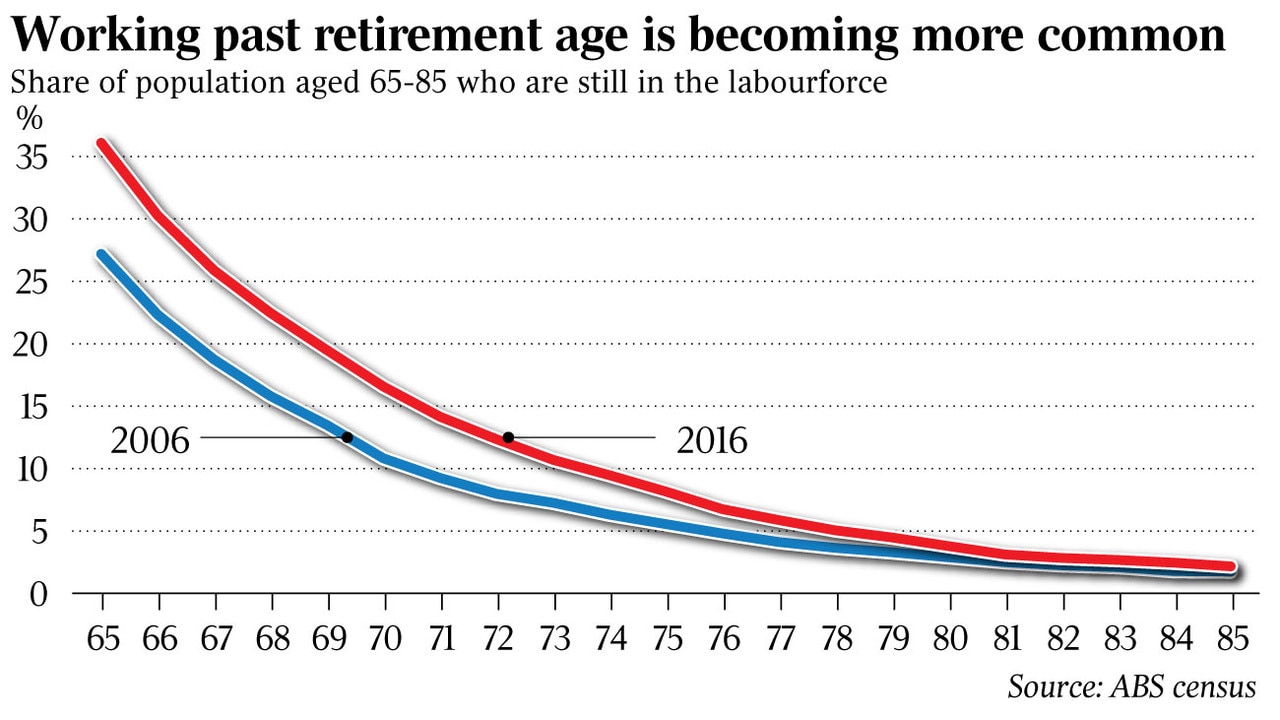

A decade ago 10 per cent of all persons between 65 and 85 were part of the labour force. At the last census this number had increased to 15 per cent. A total of 417,000 workers older than 65 help to keep our economy going.

With old age the nature of work changes and part-time work becomes more common. Between the ages of 22 and 65 more than 50 per cent of workers are employed full-time (peak full-time work is age 29, with 75 per cent).

From age 52 the slow transition from full-time to part-time work starts. At 52 a solid 72 per cent work full-time, by age 65 this is down to 53 per cent. From the mid-70s the share of the remaining workers that works full-time stabilises at around 34 per cent.

As a general trend, workers reduce their workload every year as they grow older. The 80,000 workers aged 65 worked on average 33 hours every week. The remaining 1400 workers aged 85 put in 26 hours. No rest for the wicked.

So, in what industries are our un-retired retirees working in?

While retail and hospitality are typical industries for people’s first job, they aren’t common last jobs. The most dominant industries are health care and social assistance (58,000 workers over 65), agriculture (44,000), education (40,000) and professional services (37,000).

Agriculture deserves a special mention here. Only 2.6 per cent of all Aussies work in agriculture but 35 per cent of workers aged 85 are working in the field (no pun intended). Besides financial necessity or pure passion, we see yet another reason why elderly people might stay in employment — succession planning. Farm aggregations are common as the younger generations choose not to continue to run the family farm. As a result, the old farmers just hang in there and continue to manage their farms until it becomes physically impossible to do so. They might need the income, they might be passionate about farming, but mostly they simply can’t bear the thought of having to sell the farm to a large agribusiness.

Many of the 1500 farmers over the age of 85 would have probably been all too happy to hand over the farm if only their kids had shown some interest.

For the fortunate well-paid workers (often in knowledge industries) retirement increasingly turns into a slow transition. They gradually reduce their weekly working hours over several years. For them, working past retirement age is a lifestyle choice rather than a financial necessity.

Workers in this group are truly financially independent, likely to own their own home and have well-stocked super accounts. This growing class of lifestyle workers are excellent consumers as they are both cash and time rich. This group is of large interest to cruise companies and luxury travel agencies among other high-end service providers.

Another group of grey-haired workers are not that lucky. Their superannuation accounts haven’t been topped up enough. Their savings simply don’t allow for a comfortable retirement yet. At this end of the spectrum work simply is a financial necessity.

The preparation for retirement starts early, with picking your future profession. Once you are in the hamster wheel of work your financial planning efforts determine whether you will be free to choose your own destiny at age 65.

If you played your cards right (and lived in prosperous times and didn’t fall victim to negative external influences) you will be free to choose whether to prolong your career and become a lifestyle worker or not.

If you fear you might not be able to retire comfortably in the future, seeking financial help now might be the first step to get you on your journey for a comfortable retirement. You will want to enjoy a Friday of cake and speeches after all.

-

This is the first in a four-part series by The Australian and The Demographics Group looking into retirement in 2030.

The series has been created in partnership with MLC, part of the NAB Group. Read our policy on commercial content here.