ASIC warns of dangers in one-stop property shops’ SMSF advices

A stunning 90pc of advice given when investors open self-managed super funds is not compliant with the law.

A stunning 90 per cent of financial advice given when investors open self-managed super funds is not compliant with the law, as controversial “one-stop” property shops boom, according to a survey from the Australian Securities & Investments Commission.

ASIC said financial advisers were targeting aspiring property investors who often had little or no knowledge of the risks and demands of running their own super.

The regulator suggested naive investors, who are often cold-called by salespeople, were lured by the promise that property was “a safe bet”.

Releasing the report, “SMSFs, Improving the Quality of Advice and Member Experiences”, ASIC said: “Many members said they felt property one-stop shops took away the hard work of having to deal with the details of setting up and running the SMSF.”

SMSFs have been able to borrow to buy assets including property since 2009, when the major banks began to create products in the area. The activity has flourished as property prices lifted strongly in recent years.

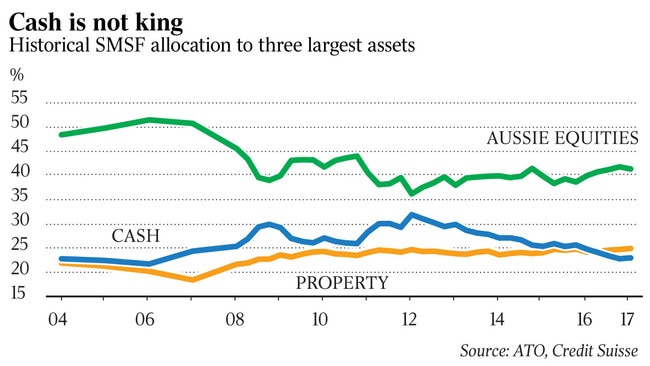

Though geared property remains a small segment of SMSF assets, property is ranked by the ASIC survey as the primary area where new SMSF members wish to invest. There are roughly one million Australians in SMSFs at present.

Larger super funds have suggested borrowing for property should now be restricted, while AMP chairman David Murray has campaigned to have it banned.

The SMSF sector is already under pressure from a recent Productivity Commission report that found funds holding less than $1 million are disadvantaged due to high administration costs. SMSF funds have also been regularly criticised for lacking diversification

ASIC’s report also found that:

● 29 per cent of survey respondents mistakenly believed SMSFs had the same level of protection as retail and industry funds, which are protected by prudential regulation against fraud.

● 38 per cent of respondents found running an SMSF more time-consuming than expected.

● Running an SMSF fund was more expensive than expected for 32 per cent of respondents.

● 33 per cent did not know the law required an SMSF to have an investment strategy; and

● One in five SMSF funds are at risk of “financial detriment” due to a lack of asset diversification.

ASIC is now planning to work in tandem with the tax office to stamp out “unscrupulous behaviour” among advisers.

New co-operative efforts between ASIC and the ATO will include sharing data and intelligence prior to enforcement.

Self Managed Super Fund Association chief executive John Maroney said the association was “very concerned about these ‘one-stop shops’ and are keen to see the regulators intensifying their efforts in his area”.

Mr Maroney also welcomed the renewed effort by regulatory authorities to police SMSF advisers. However, the regulatory action may be too late to hold back the strong lobbying effort by leading institutional super funds to have borrowing in super banned — a move that would be a major setback for the SMSF sector.

A recommendation in Financial System Inquiry — led by AMP’s Mr Murray — was that rules allowing SMSFs to borrow should be reversed. The government did not accept this recommendation initially but it could yet be accepted. Though the Productivity Commission did suggest smaller SMSF funds are disadvantaged by relatively high costs of administration, the report did not back calls to ban borrowing in super.

The commission said the prevalence of borrowing in super, split between residential and commercial property, is not of a sufficient scale to create instability in the super system.

Supporters of the SMSF sector believe the best reforms for SMSFs should focus on adviser standards and qualifications.

The SMSF Association is calling for advisers to complete a compulsory specialist course if they wish to advise on SMSFs.