As the Albanese government finally detailed its long-promised “shared equity” scheme for home buyers, a UK government scheme – which has 200,000 homes under shared ownership – is now facing severe criticism.

A UK parliamentary review said the scheme “inflated house prices” while noting it was least effective in more expensive locations such as London.

Despite support for the shared equity scheme in the local housing market – especially among building groups – it has obvious flaws, especially in relation to what happens when the time comes to sell the co-owned property.

Under the terms of the scheme, announced after the national cabinet meeting last week, the state will hold up to 40 per cent of the ownership of new homes and 30 per cent of existing homes.

When the property is sold, the government will receive a pro-rata proportion of the ultimate sale price – assuming, that is, the property sells for a profit.

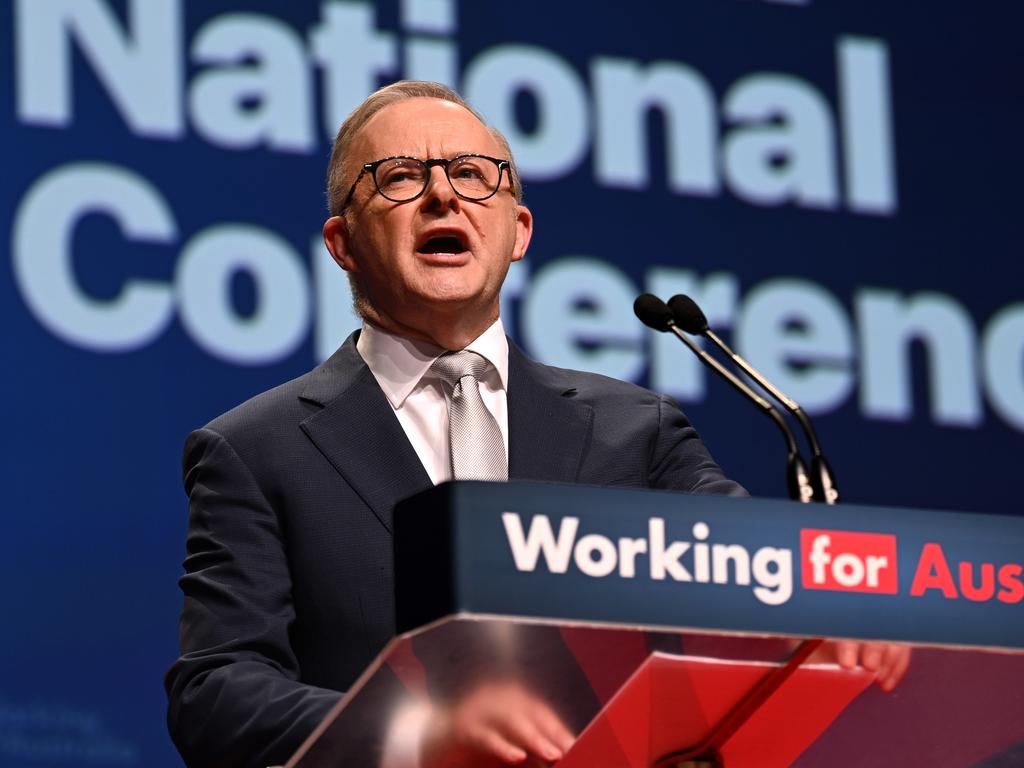

The launch of the Help To Buy scheme pits the ALP in a head-on policy battle with the Coalition over how to encourage housing. The Coalition is not supportive of shared equity arrangements. Instead, it supports using a person’s super to fund home purchases, while the ALP is against this concept.

In the UK, a decade-old scheme now faces a variety of problems. A recent review found that between 2013 and 2018, 38 per cent of all new-build property sales had been supported through the scheme.

However, nearly one in ten participants in the scheme have lost money.

Reports on the UK policy strongly suggest shared equity schemes are at best partially effective – helping those in regional locations to get into the housing market and working best if the buyer remains permanently in the home.

There is also criticism that such schemes discourage maintenance of homes (participants in the scheme must pay all maintenance charges) and discourage job mobility because there are salary caps for scheme users.

Applicants must also be able to pay for all costs – including stamp duty relating to the scheme.

Due to commence in 2024, applicants for the federal scheme can only have a maximum salary of $90,000, or $120,000 for couples. Applicants also only need a 2 per cent deposit of the home price – an arrangement that could easily lead to applicants buying a house for a lot more than they would have considered otherwise.

With the government restricted by the Greens in its social housing policy and facing pressure from the ongoing rental crisis, the Help To Buy plan represents a substantial policy development. There are 40,000 places tagged for the scheme over four years. The most popular of the existing government grant schemes, the Home Guarantee Scheme, has just 50,000 places to date.

The scheme is to be rationed across the regions with a complex scale of caps depending on the location of the home. For example, homes under $950,000 are eligible in Sydney or a major regional centre in New South Wales. In the rest of NSW, the maximum property price allowed is $750,000.

UNSW associate professor of finance, Mark Humphery-Jenner, says: “Considering some of the ideas that have been around such as rent controls this is not the worst concept – it may work to a degree, I don’t believe it will be able to do much for supply, especially in the cities. But if the government can learn from the unintended consequences that occurred overseas – and it is carefully managed – there could be progress.”

Key groups such as the Grattan Institute support the concept. The think-tank put forward a shared equity plan in 2022 while the Real Estate Buyers Association of Australia president Cate Bakos said “the range of priorities announced after the national cabinet will be well received by the wider industry”.

The Help To Buy scheme has been announced as part of a wider package where the government has promised 1.2 million new homes through offering state and local councils $3.5bn to accelerate the supply of new buildings.

The government’s newly announced Help To Buy scheme risks pushing up house prices and is least likely to be successful where it is most needed – in the major cities.