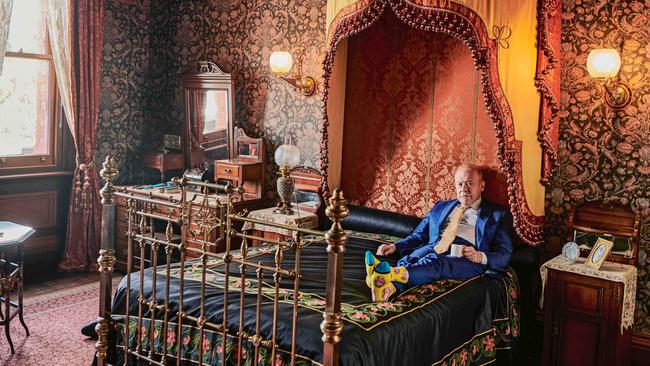

Australia’s Richest 250 #1: Anthony Pratt

Being the richest person in Australia has opened plenty of doors for Anthony Pratt. And he’s learnt plenty from his powerful friends.

Anthony Pratt quotes 1980s rocker David Lee Roth and an old French expression when asked what it is like to be named the richest person in Australia. He’s a voracious collector of anecdotes and pithy comments from famous people that he can apply to his businesses, the cardboard box maker and recycling giant Visy in Australia and Pratt Industries in the US, which have doubled in size and profits in a decade under his stewardship.

FULL LIST: Australia’s Richest 250

Van Halen lead singer Roth, Pratt tells The Australian with a laugh, once said “Money can’t buy you happiness, but it can buy you a yacht big enough to pull up right alongside it”.

His favourite French expression, meanwhile, is “noblesse oblige”, which is generally used to imply that with wealth comes responsibility, or in Pratt’s telling, “From those to whom much is given, much is expected”.

“We’ve made a $US2 billion pledge in Australia and a $2 billion pledge in America to create 10,000 jobs. Having the opportunity to do things like that is what makes it good to be wealthy. But being wealthy also means you get to choose who you work with.

“When you have a big business you can afford to pay more for talent, and philanthropy. So that’s why I’m not a big fan of selling parts of the business. You need a certain amount of critical mass in cash. Hannibal ran his elephants through his opponent’s walls, so there is something to be said for size, which being small … can’t achieve, and it enables a business to take body blows.”

Pratt’s number-one position in the inaugural edition of The List — Australia’s Richest 250, with a fortune estimated at $13.14 billion, is the result of 10 years of relentless work expanding his business quickly in the US while protecting and then growing market position in Australia after the death of his billionaire father Richard in April 2009.

In that period, Pratt has gone from being virtually unknown in his home country to having the ear of powerful people in business, politics, and even sport and the arts. He has become a favourite of US President Donald Trump, thanks to building factories in the US rust belt and Republican heartland, and speaks regularly to Australia’s Treasurer, Josh Frydenberg.

Pratt sponsors and appears at The Global Food Forum in Australia and America, and convenes superannuation investment forums starring Paul Keating. He has had shadow treasurer Chris Bowen as a lunch guest, dines with Warren Buffett and Bill Gates, and hangs out at Trump’s Mar-a-Lago club in Florida with Gina Rinehart and US business identities such as Michael Lindell of “the pillow guy” fame and Home Depot billionaire Bernard Marcus.

He had fellow billionaire and hedge fund manager Michael Hintze, Domino’s chief executive Don Meij, New York Post page-six columnist Cindy Adams and Fox News star Lou Dobbs among his New Year’s Eve guests at the club — where he also mixed with First Lady Melania Trump and other members of the President’s family.

Pratt has become, in the words of one of those guests, “not only a big fish in the small Australian pond but now a fish in the US ocean too. What amazes me was how integrated Anthony has become with the US glitterati. They all not only know him but admire him for his achievements.”

‘What is the big long-term trend in your industry? You can learn more from that question than anything else’

Being the richest person in Australia has helped open plenty of doors and brings those people within his sphere of influence, Pratt explains. But he also uses such meetings as an opportunity to glean lessons from successful people that he could apply to his own business.

“I’ve also been lucky enough to meet more people as a result of being number one, and it gives me more convening power,” he says. “One thing I always ask anyone I sit with, whether it is Rupert Murdoch or Don Meij, is what is the big long-term trend in your industry? You can learn more from that one question I think, than anything else. In my industry, it is light-weighting of paper so you can produce more. I put that question to every business person I’m with and it’s amazing what you can learn. What is does is encapsulate ‘what are you going to invest in?’”

For Pratt, that means delivering on those pledges and the acceleration of a relentless expansion program, particularly in the US, where Pratt Industries has box-making contracts with huge clients such as Amazon, Home Depot, Diageo and Unilever.

Visy, whose ownership he shares with sisters Heloise Pratt and Fiona Geminder (mother Jeanne Pratt is the family matriarch), combined with his Pratt Industries made a record pre-tax profit of more than $1.2 billion last year and will make even more in 2019. Pratt wants to keep growing and growing, especially in the US, where his company has a market share of about 6.5 per cent.

“My goal is to go from building a paper mill every 15 years to [one] every three to four years, and with each goes another 10 factories,” he says. “I don’t look at percentage growth but shortening the distance between construction. So you end up with an additional 100 factories that generate another 20,000 jobs and a lot more philanthropy.

“What keeps me motivated is my children and my legacy, but I also enjoy the process of building what I call the Sistine Chapel. It took seven generations to build the Sistine Chapel, and it is like knitting — the enjoyment of creating. There’s row after row. I believe in the phrase ‘keep going’. You only get one shot and I believe I’ve been given a rare opportunity. There’s a Scottish saying that my father used to tell me: ‘If you get to it and don’t do it, may you never get to it again.’”

Another goal is to make his company more digitally savvy. That means selling more boxes to online-sales focused companies such as Amazon and others in the direct-to-consumer packaged goods sector. He also wants to ramp up the operations of Pratt Plus, an online business that sells boxes, paper, strapping, shipping and handling products direct to customers. “It is about broadening the mind to say: how can we make our existing core business digital?” he says. “That is a huge point, and you know what I love about it? Low capital. And as a private company that is really important.”

Having disruptors such as Amazon as customers is seen as positive, but when asked what would happen if a huge client started making its own boxes, Pratt says: “No one has a mortgage on being right, and no one is safe in the world of the internet. But I will say this: it costs a lot of bloody money to start up. It’s a very capital-intensive industry, and as I always say to people when they threaten to enter my industry: ‘come in, the water’s fine’.”

Pratt is quieter when discussing what worries him about the business. Seared in his memory is one of the last things his father said to him, imploring him to not let earnings before interest, tax, depreciation and amortisation (EBITDA) ever slip below $40 million per month or the debt/EBITDA ratio go above 2.97:1. “Why that exact number? Well, then you remember it,” says Pratt. It reminds him never to take on too much risk.

“Debt is the only thing that can send you broke,” he says. “I quote Bill Gates to my eight-year-old daughter, Lilly. ‘We are only ever two years away from bankruptcy,’ Gates said once. And she replied, ‘Well if you’re always only two years away then you’ll never go broke.’ It’s a good point, but you still worry.”

One way to mitigate the risk is to keep operating in both Australia and America — “if nothing else, psychologically you feel you are hedged; if one country goes communist you’ve still got the other one” — and he is determined to keep his businesses in private hands. He knocked back an approach from private equity giant David Bonderman of TPG Capital soon after his father’s death, and relies on raising money from long-term debt markets and superannuation funds rather than a stock market listing

Ultimately, Pratt says he is a believer in staying in the same industry and bringing as many influences and lessons to it as possible. “I know it is not cool or sexy to say that,” he says. “But look at the Mars family: they didn’t go into real estate or technology; for them, it is chocolate. And they have brought all those trends in the world into chocolate. I’m more about when you’re on a good thing, stick to it and if it’s not broken don’t fix it. It has made me realise how rare something going well is, and therefore not to take it for granted and throw it away and look for something else.”

For iOS device users, if you are unable to reach The List via the link above, paste https://www.theaustralian.com.au/business/australias-richest-250 into your web browser.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout