A day of reckoning for dividends

Australian investors are about to pay a heavy price for an obsession with franked dividends.

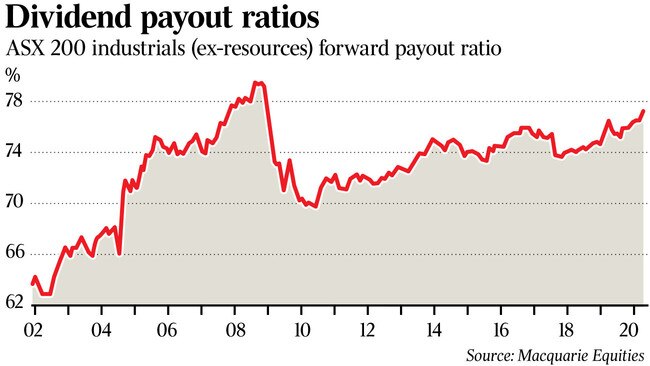

In the search for income, investors have pushed ever harder for ever bigger dividends from the sharemarket. In turn, the sharemarket has morphed into a dividend-paying machine. We have one of the highest dividend payout ratios in the world. The dividend yield on the ASX is twice as high as in the US.

Already the cost we will incur for this income obsession is being revealed: over the last week as global sharemarkets mounted a relief rally the rebound on Wall Street was literally double that of our market (12 per cent on the Dow versus 6 per cent on the ASX).

Our market is structured for paying dividends instead of creating profit growth which pushes the price of shares higher.

Australian investors now face a double threat: market leaders could be left petrified in the dead zone between trying to stage a profit recovery while safeguarding a reputation as “income stocks”.

Into this troubled mix the regulators have arrived with an unprecedented agenda to stabilise the financial system through demanding dividend cutbacks from the banks.

In making this landmark move the regulators have opened up what could soon become an issue that crosses over into national debate. Under these circumstances it is not just a matter of whether a company can pay a dividend, but whether it should.

The banks have been hit with this first, and they will not be the last. Should Coles and Woolworths pay a dividend when these giant groups are effectively being supported by the federal government’s stimulus package? Earlier this week, a debate flared in the British parliament about dividend plans at supermarket giant Tesco — similar debates may break out in our market very soon.

How big will cuts be?

Across the wider market, earnings reductions of at least 30-40 per cent are expected — we have to expect the same for dividends. In the GFC we saw payout ratios cut by 30 per cent or so across the board. Banks held up best with cuts of about 20 per cent while general industrials were cut by up to 80 per cent.

This time the picture will be different — banks are due to cut harder than in the GFC, and with the dramatic APRA intervention most banks will be in a tight spot for at least the rest of the year.

If the recession really turns out to be the worst since the 1930s (as the IMF warned on Friday) we have to expect even deeper cuts from the majority of listed companies.

To assess the damage we have to look not just at the absolute cuts but also how important any cuts might be to investors. If we hear that a random industrial stock is suspending its dividends, the issue is contained to perhaps thousands of investors. Banks on the other hand are the backbone of shareholder portfolios in Australia with millions of investors.

With solid franking levels the banks have been running with effective dividends of more than 6 per cent while cash rates are close to zero.

Put simply, bank dividends represent a third of all dividends paid across the entire market. CBA alone pays about 10 per cent of all dividend payments in Australia; then comes Westpac, NAB and ANZ. What can we expect from the majors now?

ANZ, NAB and Westpac are seen as likely to cut hard or suspend.

UBS, for example, expects those three not to pay their next dividend, due by May.

On the other hand CBA, the strongest of the banks, is seen as likely to reduce its dividend (due in August) by only 35 per cent. Others in the market go as far as to suggest CBA might not cut at all. (APRA has allowed wriggle room for banks to argue their case if they pass stress tests).

CBA’s capital level is well above the regulator’s demanded minimums and it could sustain its dividend payments.

If it did so, it would confirm the bank beyond all doubt as the premier financial blue chip in the market.

The question for CBA chair Catherine Livingstone would again be not what can the bank do but what should it do.

When you stand back from our market, the next biggest dividend payers after the banks are BHP and Rio — in fact BHP, not CBA, was the biggest dividend payer in the market last year, distributing almost 13 per cent of all dividends.

This is the moment for the miners and they know it. They have no APRA on their tail. They are not in the public eye in the same way as high-profile supermarket groups.

The hunt for yield is not going to stop during the recession.

Rio chair Simon Thompson confirmed earlier this week the miner would pay its interim dividend in full.

For diversified investors it’s a ray of light among the clouds. But for most investors, the day of reckoning has arrived on the great trade off that put dividends above profit growth.

Australian investors are about to pay a heavy price for an obsession with franked dividends. Perhaps we might have expected routine dividend reductions in the course of this impending recession, but what is now about to unfold is much worse than anything investors could reasonably have expected.