Troubled Tritium to close Brisbane factory to cut losses

Troubled fast-charging manufacturer Tritium will close its Brisbane factory that employed 400 people and consolidate operations in Tennessee to survive mounting losses.

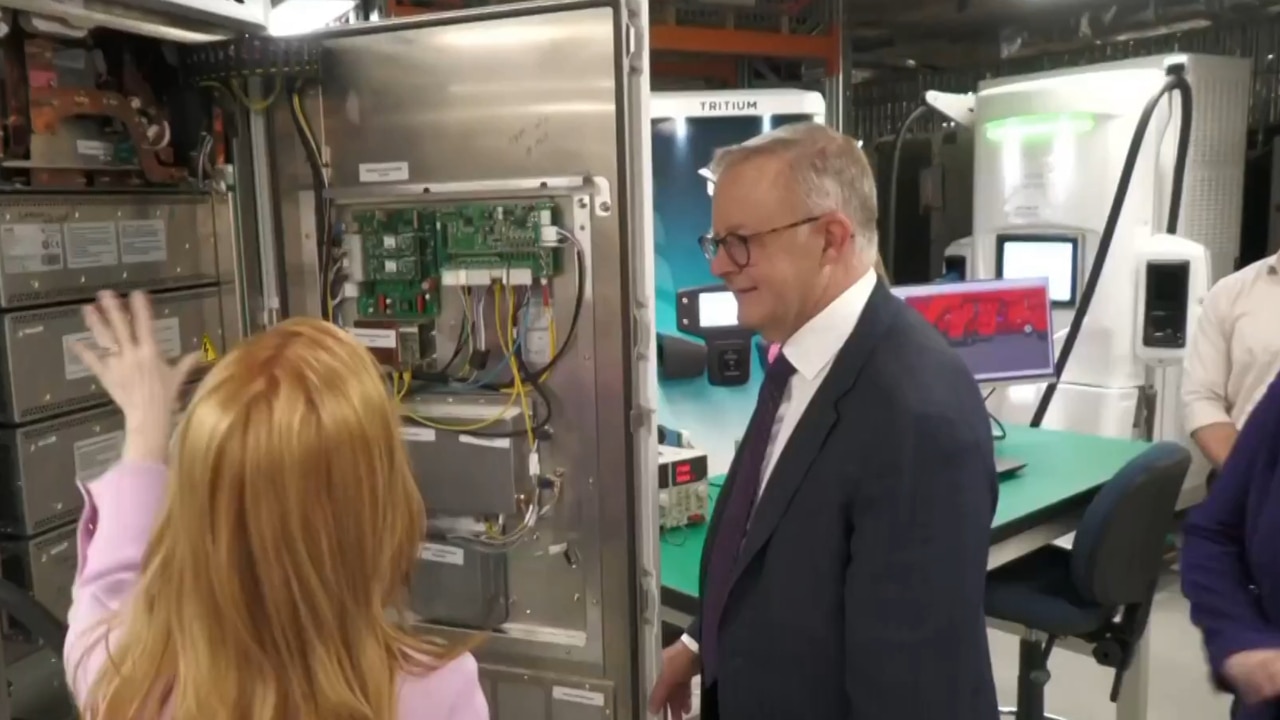

In a blow to the Albanese Government’s advanced manufacturing ambitions, loss-making fast-charging firm Tritium will close its Brisbane factory and consolidate operations in the US.

Tritium said the closure of the factory, which employs about 400 people, was part of a turnaround plan to achieve a “path to profitability in 2024 and reduce external capital requirements.”

Tritium chief executive Jane Hunter said that while the company continued to build on recently reported financial results, which include achieving record revenue and gross margins, the strategic restructuring of the business was “necessary to drive both profitability and shareholder value.”

Nasdaq-listed Tritium, which includes richlister Trevor St Baker among its major shareholders, was last month rebuffed by the Queensland Government for a $90m equity stake tied to guarantees to keep its Brisbane factory open.

Tritium has racked up almost $190m in losses in the past year to expand its huge factory in Tennessee, but at the same time incurred costly overheads in keeping its Brisbane factory operational. Its shares have sunk almost 90 per cent so far this year.

Tritium said it plans to retain and expand Tritium’s more than 200-person research and development team and world-class test facility in Brisbane, along with its global services team and salesforce.

“This transition is aligned with the company’s plan to be profitable in 2024,” said Ms Hunter. “The implementation of this plan, including the closure of the Brisbane factory and consolidating our manufacturing operations in Tennessee, supports the ongoing market competitiveness and positioning of the company as a world leader in its category.”

Tritium posted a loss of $US120.3m last financial year with net liabilities of $US134m, sparking a warning from auditor PwC that there was significant doubt about the company’s ability to continue as a going concern.In a financial report lodged with ASIC.

PwC said Tritium had sought a number of waivers from its financiers after failing to meet requirements for minimum cash liquidity.

Tritium said consolidating its global manufacturing operations in Tennessee would help reduce general and administrative expenses by cutting jobs and professional fees.

“The plan supports the ongoing market competitiveness and positioning of the company as a world leader in its category, driven in part by the highly successful scale-up of our US plant,” Ms Hunter said. “These changes reduce our capital requirements and hasten the timing of the company becoming earnings positive.”

Tritium opened its giant Tennessee plant in August last year as it took advantage of the Biden Administration’s Buy America Build America and the $5bn National Electric Vehicle Infrastructure (NEVI) Formula Program which funds fast chargers every 50 miles along American highways.

But the closure, which could cost hundreds of jobs in Brisbane, is an embarrassment for the Albanese Government which had spruiked Tritium as a poster child for advanced manufacturing in Australia.

Tritium, founded in 2001 by engineers David Finn, James Kennedy and Paul Sernia, has won deals with BP and Shell, among others, to supply fast-chargers across the world.

But as the same time as Ms Hunter shared a White House podium with Mr Biden last year, Tritium was losing millions of dollars as it attempted to grab market share in an increasingly competitive market.

Tritium has conceded its operating model has risks in a fast-changing market. Tritium has so far focused exclusively on developing public DC fast-charging stations as well as charging stations for government and corporate fleets.

However, many of its competitors offer cheaper home-based AC charging equipment, which may in the long run reduce demand for Tritium’s public charging stations.

Another competitive threat comes from EV giant Tesla, which has a large public DC charging network in the US using its North American Charging Standard (NACS).

Billionaire Brian Flannery, who owns about 5 per cent of Tritium, said last week he would not be investing any more money into Tritium after declaring its Brisbane factory could never make any money given high energy and labour costs in Australia. Mr Flannery said similar EV chargers could be made in China or Estonia for a fraction of getting them made in Australia, and that Tritium should have shifted its manufacturing to the US earlier.

A Queensland Government spokesperson said it was always disappointing when a company makes a decision to move operations interstate or overseas - especially one that is homegrown.

The Queensland Government will provide support to any of the impacted workers that need it, the spokesperson said.