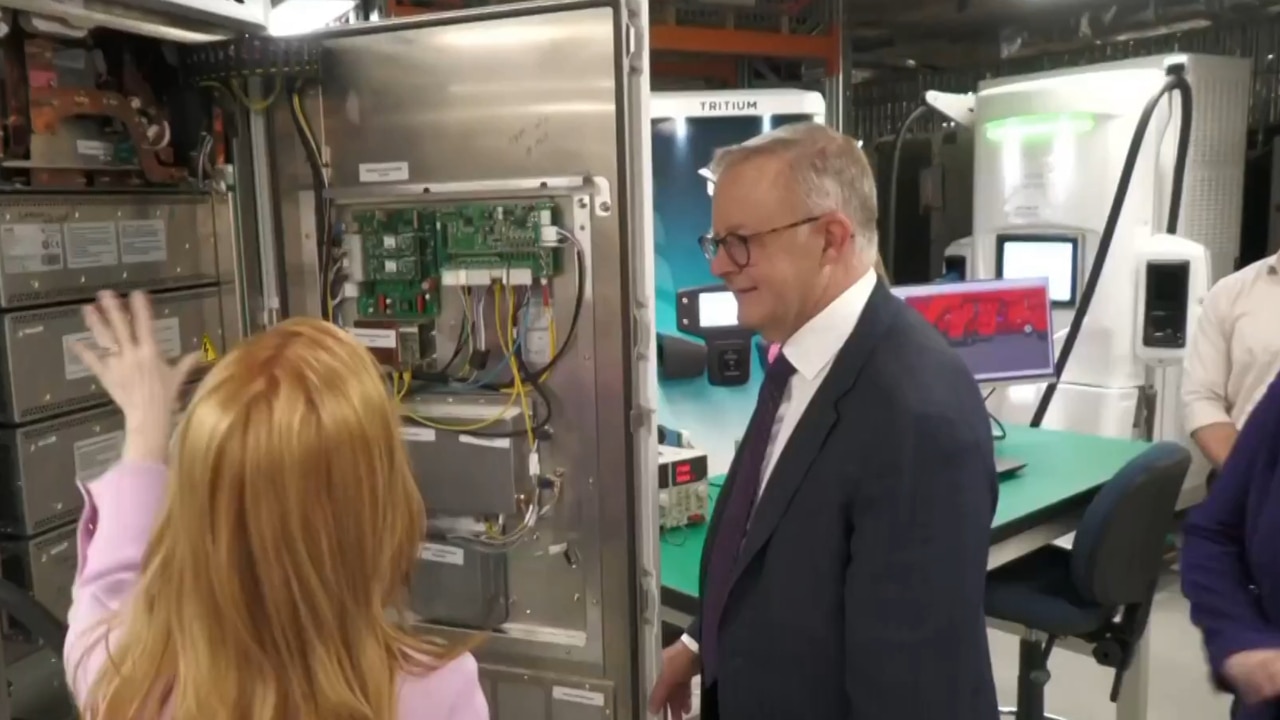

Tritium runs out of charge as $90m lifeline sought

Brisbane EV fast-charging company Tritium is seeking a $90m financial lifeline after racking up huge losses to expand manufacturing in the US.

Brisbane EV fast-charging company Tritium is seeking a financial lifeline after racking up almost $190m in losses in the past year to expand its operations in the US.

Nasdaq-listed Tritium, which includes richlister Trevor St Baker among its major shareholders, has reportedly approached the Queensland Government for a $90m equity stake tied to guarantees to keep its Brisbane factory open.

A spokesman for Queensland Treasurer Cameron Dick said the government was “in dialogue with a number of companies about incentive measures, all of which are assessed to ensure they provide value for money for taxpayers”.

In 2020, the Queensland Government invested $200m in Virgin Australia to ensure the embattled airline remained in the Sunshine State for at least the next decade. Tritium’s increasing exposure in the US, where it plans to do the bulk of its manufacturing from a huge factory in Tennessee, is likely to weigh against any forthcoming support from the state government. Tritium listed on the Nasdaq two years ago with a $US2bn ($3.15bn) valuation but now has a market capitalisation of less than $US40m. The shares closed at US18c on Monday, down from $US9.62 in 2021.

President Joe Biden last year praised Tritium in an announcement at the White House along side the company’s chief executive Jane Hunter.

“The US will lead the world in electric vehicles ... with easy access to quick and easy electric charging stations made by Tritium with American parts and labour,” said President Biden.

Ms Hunter said at the time that investment by the Biden Administration had encouraged the company to pivot to manufacturing in the US. She added that despite the increasing global focus of Tritium, Brisbane would remain the engineering hub for the company.

When contacted for comment on Tuesday, Ms Hunter said: “This not the right time for us to comment on speculation about the business.”

Tritium posted a loss of $US120.3m last financial year with net liabilities of $US134m, sparking a warning from auditor PwC that there was significant doubt about the company’s ability to continue as a going concern.

In a financial report lodged with ASIC, PwC said Tritium had sought a number of waivers from its financiers after failing to meet requirements for minimum cash liquidity.

Mr St Baker’s private company Sunset Power provided a $US20m loan to Tritium in December last year that was drawn down in full the same month. The company also sought to raise $US75m through a preference share arrangement with institutional investors.

PwC said Tritium required the successful conversion of the institutional investor preference shares to ordinary share capital as well as additional capital in the short term to fund future operating and financing cash flows. Tritium was founded in 2001 by three PhD graduates who won a solar-powered car competition.

Last year, Ms Hunter boasted Tritium was set to expand its global manufacturing capacity and was poised to overtake engineering giant ABB as the world’s biggest EV charger maker. The Tennessee factory was expected to house up to six production lines for Tritium’s fast chargers.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout