Trading Day: live markets coverage; Wesfarmers shares erase $2bn; plus analysis and opinion

A global market downturn worsens Wesfarmers’ steep fall as the local titan’s UK Bunnings venture leads a $1.3bn writedown.

And that’s the Trading Day blog for Monday, February 5.

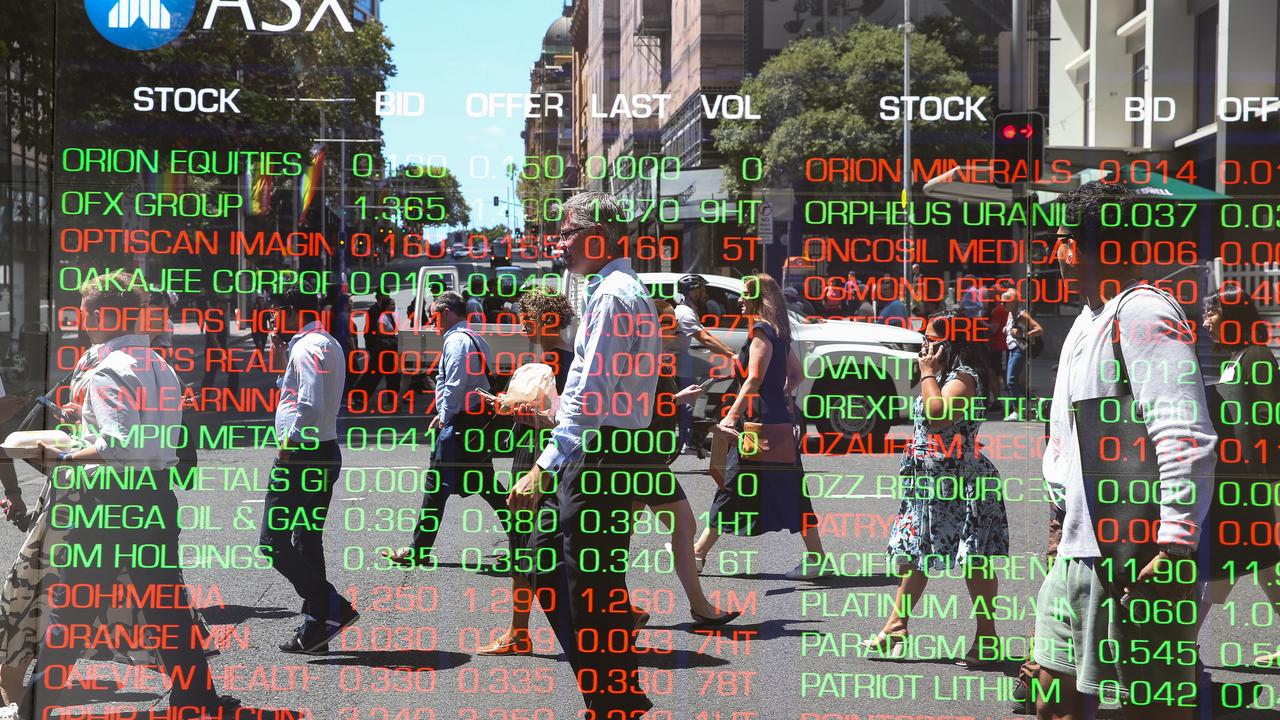

Samantha Bailey 4.43pm: ASX dive raises ‘sinister’ risk

The local share market ended the session lower in its worst one-day-fall in seven months, erasing $28bn in market capitalisation after Wall Street investors spooked by increasing rate hike pressures sparked a sell-off in the session prior.

At the close of trade, the benchmark S & P/ASX200 was down 95.190 points or 1.56 per cent at 6026.199 points. The broader All Ordinaries index was down 101.448 points or 1.63 per cent, at 6128.4 points.

Morgans’ Christopher Macdonald said what emerged as the weakest of session of the year is likely to be followed by further falls this week, but the market will likely only see a small and relatively short-lived correction.

“It was really set off by that sell-off on Wall Street, as fears around rising inflation and bond yields gripped the markets,” he said.

“In terms of the week ahead, we do have the Dow pointing to a further fall tonight, so it will be a more volatile ride this week as investors try to ascertain if this is a healthy self-correction or something a little bit more sinister.

Scott Murdoch 4.11pm: Immersion sells $100m Aconex stake

British hedge fund Immersion Capital today sold out of construction software group Aconex in a deal worth nearly $100 million.

The trade was for 12.5 million shares, which represents about 6.5 per cent of the stock, at $7.685 per share.

The transaction was carried out by UBS today and the company told the ASX that Immersion Capital was no longer a significant shareholder.

Aconex’s has recommended shareholders accept an offer from Oracle made in late December at $7.80.

Eli Greenblat 3.23pm: Wesfarmers laments DIY errors

Wesfarmers chief executive Rob Scott has refused to target when he believes his loss-making Bunnings UK business will emerge profitable and has admitted to a string of “self-induced” errors, including poor range in the kitchen and bathroom categories, an excessively paced stripping out of popular concession brands and shoppers not warming to a new pricing model.

“What we are mindful of is that a lot of the issues we are dealing with today have been, to be frank, self-induced,’’ Mr Scott conceded this morning.

Describing the $1.3 billion in writedowns flowing from Bunnings UK and a still problematic retail chain Target, Mr Scott described the impairments as “terrible” and “confronting” news but signalled he wouldn’t allow Bunnings UK to drag on for years and rack up billions in losses as Woolworths did with its failed Masters hardware experiment — read more

WES last down 4.8 per cent on $42.04, erasing over $2bn in market capitalisation.

3.04pm: CHARTS: ASX bounces off day’s low

Australia’s S & P/ASX 200 share index has pared its intraday fall to 1.5 per cent after falling 1.8 per cent earlier.

What would have been the worst fall since the US election might now only to be the worst fall since just June 30 last year.

Still, it’s a sharp fall in any case, particularly in the context of the extremely low volatility to which investors have become accustomed.

While the index is still below its 50-DMA at 6037, it would need to break the Jan 22 low at 5991.9 to generate a downtrend on the charts.

A fall below that level would ring some alarm bells and the initial target would be 5951 — the 38.2 per cent retracement of the June-Jan rise.

2.43pm: Property’s sluggish year-to-date

Christian Edwards writes:

Sydney’s continuing home price slide kept capital city values largely flat last week, while auction activity has increased.

The number of home auctions rose to 779 in the week to February 4 — almost triple the number of a week earlier — but that was down on the 881 in the same period a year ago, data from property analytics group Corelogic show. The percentage of homes which found a buyer was also down, with the preliminary clearance rate of 67.7 per cent across the combined capital cities well below the previous week’s 72.8 per cent, and lower than the 68.8 per cent rate at the same time in 2017.

Sydney’s average home value fell 0.2 per cent, as prices remained limp around the capitals over week, with Perth prices down 0.1 per cent and Melbourne, Adelaide and Brisbane values steady.

Over the 12 months, Sydney’s average prices gained 1.0 per cent, while top performer Melbourne’s lifted 7.9 per cent.

The average price for a house in Sydney is now $800,000, while the median cost of a unit is $650,500.

In Melbourne, the Harbour City’s closest rival, a house on average costs around $680,000 and a unit $491,000.

Adelaide and Melbourne enjoyed the highest clearance rates, at 76.7 per cent and 72.8 per cent, respectively, while Melbourne was the only capital city to grow auction volumes from the same time in 2017.

Brisbane had the fewest buyers with just 46.6 per cent of homes put to auction selling.

CoreLogic said that with auction activity just starting up, the next weeks should help clarify whether auction sales will fall back to the low levels seen ahead of Christmas.

AAP

2.19pm: ASX in worst post-Trump era fall

The local sharemarket is on track to book its worst session since the US election in 2016 should the S & P/ASX200 index close below 1.66 per cent lower.

The benchmark index last hit a new intraday low of 6013.2 per cent, down 1.8 per cent for the session.

Strong US wage growth in December gave bears cause for concern over potential Fed hike haste in response to speculated economic overheating, paving the way for an anticipatory rise in rates of return for equity alternatives.

“It’s actually a healthy result for sharemarkets in the US and globally to see a pullback, [it’s been] 404 days since we’ve seen a pullback of this magnitude,” said CMC chief market strategist Michael McCarthy.

Read: Market’s safehaven shelter caves

1.53pm: S & P500 to 2686 by 1Q: BofAML

US equities and risky assets globally generally are vulnerable to a further pullback after sentiment became too bullish last week according to the latest research from Bank of America Merrill Lynch.

BofAML’s “Bull & Bear Indicator” surged from 7.9 to 8.6 points on Jan 30, triggering a “contrarian sell signal for risk assets”, the US investment bank’s Chief Investment Strategist Michael Hartnett says.

The sell signal in BofAML’s market sentiment model was triggered by record equity inflows, bullish hedge fund risk appetite and global equity index breadth.

Mr Hartnett now predicts it will fall to 2686 points by the end of March, implying a further 2.8 per cent fall from Friday’s close.

“As per last week we forecast a decline in the S & P 500 to 2686 by the end of Q1,” he says.

It comes amid sharp falls in regional share markets today with Australia’s S & P/ASX 200 share index diving as much as 1.7 per cent to 6018.1 points.

S & P500 futures trade tips a 0.5 per cent decline at the commencement of US trade overnight.

1.28pm: ASX hits new session lows

Local shares hit new intraday lows as Asia-Pacific trade enters full swing, markets around the globe feeling the pinch of heightened expectations of US rate hike haste revealed in the session prior.

The S & P/ASX200 index last traded at the session’s low of 6018.1, down 1.7 per cent.

BHP and Rio Tinto lead falls, 3 per cent and 2.3 per cent respectively.

SWING STOCKS

+ Infigen Energy (2.9pc), Speedcast International (2.4pc), Spark Infrastructure (1.3pc), James Hardie (0.7pc), Retail Food Group (0.4pc)

— Resolute Mining (8.2pc), Syrah Resources (7.5pc), Orocobre (6.2pc), Wesfarmers (5pc), Downer EDI (4.9pc)

Andrew White 1.09pm: Lofty Argo unfazed by pullback

Argo Investments says it is not overly concerned about the pullback in the market, noting that it has risen strongly for the past year and was due for a pullback.

“It has had a really good. run,” said managing director Jason Beddow, “we put on seven per cent in the December quarter and I think its likely we are going to end the year flattish, definitely in the financial year.”

Mr Beddow said company dividends have reached a point where they are unlikely to grow without earnings improvement, as opposed to external drivers such as those recently enjoyed by resource companies from commodity price strength.

Industrials are likely to deliver mid-single digit growth, while banks were likely to show mid-to-low single digits earnings growth, according to Mr. Beddow.

Argo reported 6.2 per cent interim earnings growth to $110.5m this morning, the result fuelled by a rebound large-capitalisation resource stock dividends.

Argo’s own interim dividend increased from 15c a share to 15.5 cents.

ARG last down 1 per cent on $8.28

12.52pm: Fallout hits China, Taiwan markets

A global stock market sell-off claims yet more victims in the Asia-Pacific region, China’s benchmark Shanghai Composite down 1.1 per cent at the open, Hong Kong’s Heng Seng remains 1.8 per cent lower in early trade, while Taiwan’s TAIEX slumps over 2 per cent.

Read: Stocks reprieve fails to surface

Read: Asia-Pacific sell-offs multiply

Richard Gluyas 12.42pm: Henderson for bank grilling role

Liberal Party MP Sarah Henderson is the frontrunner to succeed colleague David Coleman as chair of the House economics committee.

The committee has grilled the major-bank chief executives every six months since September 2016, playing a significant role in some of the big industry reforms.

Paul Garvey 12.27pm: Market’s safehaven shelter caves

Not even gold miners have been spared amid the carnage sweeping the market today.

Gold often stands out as a safehaven at a time of market volatility and the price of the yellow metal is holding steady, but the same can’t be said for the big gold stocks.

Evolution (EVN), the nation’s second-biggest gold miner, and copper-gold producer OceanaGold (OGC) are both down more than 3 per cent in early afternoon trade. Newcrest Mining (NCM) and Northern Star (NST) have each fallen more than 1.5 per cent.

Many of the local gold names have been trading at or near multi-year highs recently, with the bulk of the sector enjoying handsome margins and carrying little to no debt.

12.04pm: Stocks reprieve fails to surface

Local shares remain underwater after a sharp opening fall as the Asia-Pacific region follows a plunge in US and European counterparts the session prior.

The S & P/ASX200 index last traded down 1.3 per cent on 6044.3.

SWING STOCKS

+ Spark Inftrastructure (1.7pc), Brickworks (1.7pc), Infigen Energy (0.8pc), AGL Energy (0.5pc)

— Syrah Resources (5.6pc), Western Areas (5.2pc), Independence Group (4.7pc), Wesfarmers (4.8pc), BHP (2.6pc), Rio Tinto (1.9pc)

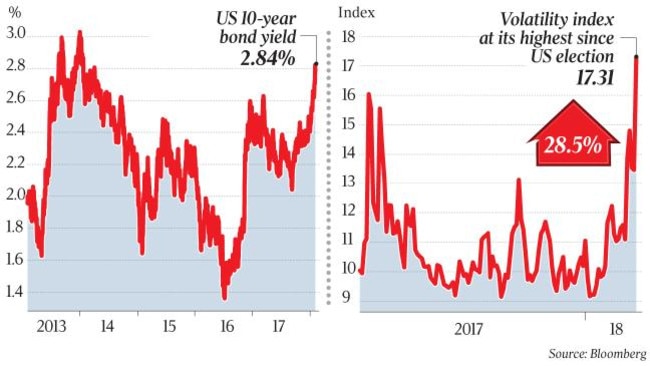

Alan Kohler 11.48am: Why the market cracked

US interest rates have been rising for two years now. The Fed funds rate (their equivalent of our RBA cash rate) has been raised five times since December 2015 and the 10-year bond yield — the key interest rate that’s set by the market — bottomed in July 2016 at 1.36 per cent and has been rising ever since.

After that first Fed rate hike, the S & P 500 corrected 10 per cent, but since then the sharemarket has been completely unconcerned about interest rates. The S & P 500 has put on 55 per cent since January 2016, with only a brief pause when the bond rate got up off the floor 18 months ago.

So, why the worry among share traders on Friday when the bond rate popped up from 2.72 per cent to 2.84 per cent in response to a better than expected employment report for January?

One reason that the S & P 500 dropped 2.1 per cent and the Dow Jones 2.5 per cent on Friday, apart from the obvious fact that valuations have become stretched and a correction is due, might be that Friday saw the first outflow from ETFs of the year ($US3.7 billion).

11.41am: Loan switching gathers pace: Westpac

Westpac says another $8.6 billion of mortgages switched from interest-only to principal and interest in the first quarter following repricing of its loan book.

The lender also says 22 per cent of new home loans in the three months to December 31 were interest-only, less than half the level of a year ago and well below the 30 per cent limit set by the Australian Prudential Regulatory Authority.

Mortgage lending to investors grew by 5.1 per cent, below APRA’s 10 per cent cap.

AAP

Samantha Bailey 11.34am: Job ads lift in January: ANZ

The number of vacant job advertised jumped in January, following a slight retreat in December.

According to research by ANZ, job advertisements hiked up a seasonally adjusted 6.2 per cent in January compared to the previous month, reversing the 2.7 per cent fall in December.

Job ads are up 13.8 per cent on an annual basis, the report found, compared to the 11.4 per cent year-on-year rise in December.

11.25am: Wesfarmers signals bleak outlook: Bell

Straight from the desk: video snap analysis from @JuliaLeeAU on the $WES impairments to the UK/Ireland Bunnings business pic.twitter.com/gDokLLf42O

— belldirect (@belldirect) February 4, 2018

11.16am: Asia-Pacific sell-offs multiply

Selling pressure in Asia-Pacfic markets grows as Japan’s benchmark Nikkei extends early losses to as much as 2 per cent, while South Korea’s benchmark KOPSI index falls as much as 1.8 per cent in opening trade.

China trade is yet to commence.

Read: ASX losses steepen as volatility reins

10.55am: Mitsui takes lead in AWE race

Mitsui & Co has moved to pole position in the pursuit of oil-and-gas producer AWE after rival suitor Mineral Resources opted against lifting its bid and AWE’s board rejected an offer from state-owned China Energy Reserve & Chemicals Group Co.

Having secured the unanimous support of AWE’s board, the Japanese company said Monday it would push ahead with a takeover offer that values AWE at $602 million — read more

AAP

AWE last 98 cents

10.43am: Miners cop brunt of ASX sell-off

The benchmark S & P/ASX200 remains 1.3 per cent in the red as the dust settles after the opening bell, last 6041 in a near complete reversal of a three-day win streak that closed out the prior trading week.

“European investors suffered as well in the cross asset class sell-off,” says CMC chief market strategist Michael McCarthy, “the German DAX mirrored moves in the US S & P 500 and both major indices shed 4pc or thereabouts over the week.”

A similar performance this week would put both globally important markets close to the technical definition of a market correction, according to Mr. McCarthy.

SWING STOCKS

+ Brickworks (1.9pc), Iress (1.2pc), Infigen Energy (0.8pc), Woolworths (0.2pc)

— Western Areas (7.2pc), Independence Group (5.3pc), Wesfarmers (4.2pc), BHP (2.7pc), Rio Tinto (2.2pc)

10.28am: McGrath shares clipped early

McGrath shares fall as much as 9 per cent in early trade to 43 cents after founder John McGarth vehemently denied rumours surfacing over the weekend of a $16 million gambling.

MEA last down 4.6 per cent on 44 cents.

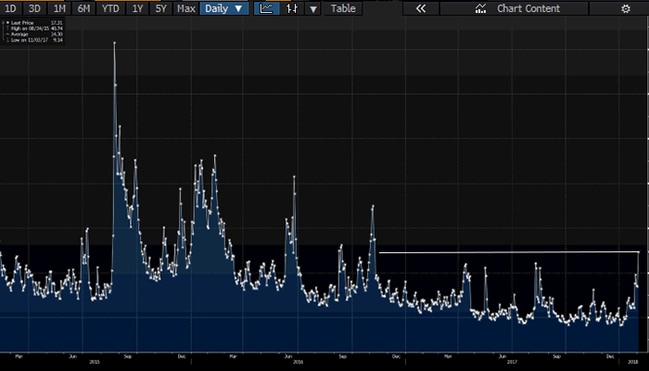

10.06am: ASX losses steepen as volatility reins

The S & P/ASX200 index opens down 1.4 per cent to 6036.1 following a 2 per cent Friday slump on Wall Street in its worst session since US President Trump’s election.

Strong US wage growth in December gave bears cause for concern over potential Fed hike hastening, the inflation pressure playing havoc with both bond and equity markets in the world’s largest economy.

“Investors should at least be contemplating the implications of a US ten year yield in the 3.0pc to 3.5pc range in our view,” says UBS strategist David Cassidy.

“It may be [more] problematic for stocks if the adjustment plays out over 3-6 months.”

Mining, real estate and utilities stocks lead losses as returns in fixed-income alternatives lift.

A correction in global markets has been overdue, according to AMP Capital’s Shane Oliver says, however the damage may be curbed.

“In the absence of an aggressive 1994 style back-up in bond yields or a US recession — neither of which we expect — the pull back in shares should be limited in depth and duration to a correction,” says Dr. Oliver.

“However, it’s likely to be a more volatile year than last year.”

The market’s favourite read on volatility, the VIX index, hit its highest level since November 2016 following the Wall Street sell-off.

9.32am: Services sectors extends hot streak

James Glynn writes:

The Australian Industry Group Australian Performance of Services Index lifted by 2.9 points to 54.9 in January, an 11th consecutive month of positive results and at an accelerating rate of expansion compared with late 2017.

“The strength with which the services sector has opened 2018 is another sign that confidence and momentum are building across the domestic economy, says AIG.

“Conditions are generally looking better in the business-oriented sub-sectors than in consumer-oriented sub-sectors. Business confidence and orders from business customers improved in January.

Dow Jones Newswires

9.21am: Argo books profit growth

Argo Investments’ first-half profit has risen 6.2 per cent to $110.5 million, driven by improved dividends from its BHP Billiton and Rio Tinto holdings.

The company’s revenue also rose in the six months to December 31, up four per cent to $118.9m, while earnings per share grew 4.6 per cent to 15.9 cents.

Argo said it will pay a fully franked interim dividend of 15.5 cents per share, up from 15 cents a year ago — AAP

ARG last $8.36

9.14am: Analyst rating changes

Primary Health cut to Hold — Morningstar

Independence Group raised to Hold — Morningstar

Premier Investments cut to Neutral — Credit Suisse

James Hardie cut to Neutral — Credit Suisse

Harvey Norman cut to Underperform — Credit Suisse

GTN started at Outperform; $5.20 target price — Credit Suisse

Mirvac cut to Neutral — UBS

GPT cut to Neutral — UBS

IAG cut to Hold — Bell Potter

Brickworks raised to Buy — Bell Potter

Elders cut to Sell — Wilsons

Steadfast resumed at Outperform — Macquarie

Ben Wilmot 9.04am: McGrath investor nerves surface

Shares in listed real estate group McGrath may come under pressure this morning in the wake of weekend media reports that company founder John McGrath was alleged to have incurred a $16.2 million gambling debt.

McGrath, who is slated to become executive chairman of the estate agency after the remainder of his board flagged their departures last month, has slammed the reports as “ridiculous”.

The veteran Sydney agent said in a Saturday email to staff that the coverage was “clearly designed to damage me”.

McGrath shares have already come under pressure this year due to the poor trading of the real estate firm’s company-owned offices.

Mr McGrath and another major shareholder, Shane Smollen, have recently rebuffed suggestions that they are planning to return the embattled company to private hands.

MEA last 47 cents

8.53am: Wesfarmers UK, Ireland chief to retire

Wesfarmers United Kingdom and Ireland boss Peter PJ Davis will retire after 25 years with the group.

The announcement comes alongside the news of a $795 million before-tax impairment relating to Wesfarmers’ Hombase brand, a $136m writedown relating to stock and store closures and a $92 million writedown on deferred tax assets.

An additional $306 million non-cash impairment is related to Target, an arm the company says has stabilised but remains at risk from difficult trading conditions.

Mr Davis took extended leave late last year amid circulating rumours of potential writedowns.

“PJ has been instrumental in driving the growth and success of Bunnings for the past three decades and in the establishment of the Bunnings Warehouse format in Australia in the 1990s,” said Wesfarmers Managing Director Rob Scott.

“The Homebase acquisition has been below our expectations which is obviously disappointing. In light of this, a review of BUKI has commenced to identify the actions required to improve shareholder returns” — with AAP

WES last $44.15

8.43am: Tightening grip to hit stocks

Local investors are bracing for a potential correction of the two-year bull run in shares after surging US bond yields triggered the biggest Wall Street sell-off since 2016.

A 2.1 per cent drop in the S & P 500 share index on Friday — the worst day for the US benchmark since September 2016 — came as signs of faster-than-expected jobs growth there pushed the global benchmark US 10-year Treasury bond yield to a four-year high of 2.84 per cent.

Wall Street’s weekend tumble will send a shockwave through global financial markets that have until recently tolerated rising bond yields and growing expectations of faster US interest rate hikes in response to synchronised economic growth and early signs of inflation, which mark the end of an unprecedented era of monetary stimulus since the global financial crisis.

8.24am: Westpac in $750m capital raising

Westpac is seeking to raise $750m in a capital notes offer — more to come

WBC last $31.70

8.17am: Fairfax to push NZ merger bid

Fairfax Media says it will appeal a decision by the New Zealand competition watchdog to block a merger between its subsidiary NZME and Stuff Ltd.

Fairfax contends the NZCC’s estimation of fiscal public benefit from the deal is conservative, and that it over-estimates the potential loss of media pluarity arising from the deal.

FXJ last 72 cents

7.43am: ASX set to slide more than 1pc

The Australian share market looks set to open more than one per cent lower after Wall Street’s two key indexes plunged more than two per cent in their last session.

At 7am (AEDT), the share price futures index was down 65 points, or 1.07 per cent, at 6,006.

In the US, fears of how a tightening job market would impact inflation and a surge in bond yields sent investors fleeing equities with the Dow Jones Industrials Average swooning almost 666 points, for its biggest daily percentage loss in 20 months.

It was the biggest daily point fall in the Dow since December 2008 during the financial crisis.

With Friday’s rout, Wall Street’s three major indexes logged their biggest weekly losses in two years, after closing at record highs the previous week. The S & P 500 and Dow saw their worst weeks since early January 2016 while Nasdaq had its worst week since early February 2016, Reuters said.

The Dow Jones Industrial Average fell 2.54 per cent, the S & P 500 lost 2.12 per cent, and the Nasdaq Composite dropped 1.96 per cent, to 7,240.95. Locally, in economic news on Monday, the ANZ’s monthly job ads figures, the Ai Group’s Australian Performance of Services Index, and the CoreLogic capital city house prices survey for the week just ended are all due out. In equities, Argo Investments is expected to release its half-year results. The Australian market on Friday made solid gains after a surge in energy stocks and improvements for the big banks turned around a mixed overnight lead out of the US.

The benchmark S & P/ASX200 index rose 31.3 points, or 0.51 per cent, at 6,121.4 while the broader All Ordinaries index was up 31 points, or 0.5 per cent, at 6,229.8 points.

Meanwhile, the Australian dollar has slipped against its strengthened US counterpart, and is back below US80 cents.

The local currency was trading at US79.12c at 7am (AEDT) on Monday, from US80.01c on Friday.

AAP

7.15am: ASX tipped to tumble at open

The Australian sharemarket can a expect a rough start to the week due to fairly hefty falls at the close of business on Wall Street.

Despite a strong close to the Australian stock market on Friday, factors from the US Federal Reserve including higher bond yields and higher interest rates affected markets over the weekend.

The Dow Jones lost 665.8 points — a 2.5 per cent decline — on Friday, the S & P 500 was down 2.1 per cent and Nasdaq closed 2 per cent down. European shares also fell 1.5 per cent on Friday.

“This will be reflected in our market on Monday,” said AMP Capital’s chief economist Shane Oliver.

“It looks like a fairly rough start,” he said ahead of the opening of Monday’s Australian sharemarket.

The S & P/ASX200 futures index fell 65 points. or 1.1 per cent, pointing to a 60-70 point decline at the opening of Monday’s market.

AAP

7.10am: Local dollar slips under US80c

The Australian dollar is back under US80 cents as the downward movement in the US dollar seems to have stopped and weaker metals prices offered no help. At 6.35am (AEDT), the Australian dollar was worth US79.14c, down from US80.01c on Friday.

Analysts at Brown Brothers Harriman said the US dollar index had risen for the first week since the weekend ending December 15.

“The 0.15 per cent gain is nothing to write home about but the sharp downside momentum has been arrested,” they said in a morning note.

“The US dollar turned in its best week so far in 2018 ...” Meanwhile, the local currency had put in a respectable performance, despite its decline from Friday.

The Australian dollar is also lower against the yen and the euro.

AAP