ASX braces for correction after Wall Street sell-off

Local investors are bracing for a potential correction after surging US bond yields triggered a Wall Street sell-off.

Local investors are bracing for a potential correction of the two-year bull run in shares after surging US bond yields triggered the biggest Wall Street sell-off since 2016.

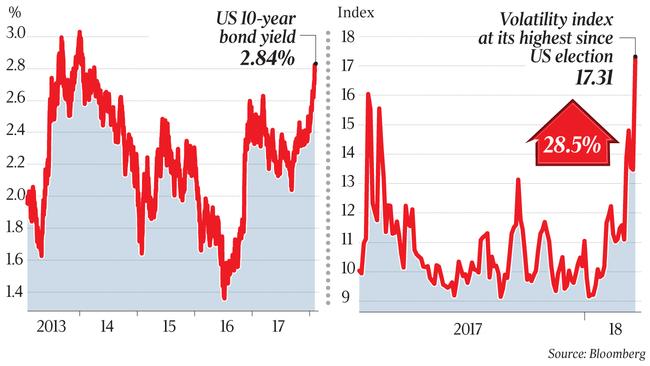

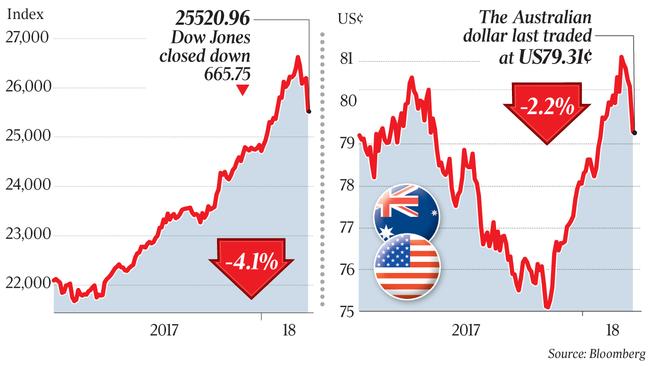

A 2.1 per cent drop in the S&P 500 share index on Friday — the worst day for the US benchmark since September 2016 — came as signs of faster-than-expected jobs growth there pushed the global benchmark US 10-year Treasury bond yield to a four-year high of 2.84 per cent.

Wall Street’s weekend tumble will send a shockwave through global financial markets that have until recently tolerated rising bond yields and growing expectations of faster US interest rate hikes in response to synchronised economic growth and early signs of inflation, which mark the end of an unprecedented era of monetary stimulus since the global financial crisis.

While ASX 200 share price index futures index fell just 1.1 per cent over the week, the Australian sharemarket may initially be more vulnerable than regional benchmarks owing to its high exposure to dividend yield plays like real estate investment trusts and utilities and the fact it rose strongly last week.

“The correction likely has further to go as the market adjusts to higher bond yields and more Fed tightening than currently assumed and this will impact most major sharemarkets, including the Australian market, which is vulnerable given its high exposure to yield plays,” said Shane Oliver, AMP Capital’s head of investment strategy.

However, the US dollar rebounded from a three-year low on Friday, pushing the Australian dollar down to a three-week low of US79.19c, benefiting exporters and potentially cushioning an Australian share sell-off.

Despite deteriorating trends in global markets, the benchmark S&P/ASX 200 rose 1.2 per cent last week.

Just last month, the S&P/ASX 200 touched a 10-year high at 6151 points but it was subsequently restrained by jitters about the royal commission faced by the major banks, selling of the so-called “bond proxies” in the property and utilities sector in response to higher bond yields, and profit-taking on the resources stocks before their results this month.

“After a strong start to the year and very low volatility last year US and global shares had become overbought and overdue for a decent correction, and this now seems to be unfolding.”

Still, calmer heads should prevail in Australia, said IG chief market strategist Chris Weston.

“The sell-off in the US and other markets that have had exceptionally strong upward momentum was magnified by a capitulation by systematic funds as volatility spiked,” he said.

The so-called fear index, the CBOE VIX volatility index, surged to 17.31 per cent on Friday, the highest since the US election.

“With the long end of the US bond market finally pushing up last week, real bond yields hit the highest levels in years, volatility spiked and all the systematic funds which have trillions of dollars invested in short volatility positions have been forced to dump stock. That will probably be the same today and Tuesday but Australia just hasn’t seen that kind of momentum or the extent of long positioning by risk-party funds based on low volatility. It’s artificial selling,” Mr Weston said.

Similarly, JPMorgan’s head of cross asset strategy, John Normand, said: “Rising bond yields should not sustainably derail equities, since over the past 15 years there was a positive correlation between equity valuation multiples and bond yields, and the valuation cushion remains significant.

“Furthermore, weakness in bonds might bring about a reallocation of flows out of fixed income and into equities. We continue to believe that dips should be bought into as the fundamental growth backdrop remains supportive for equities. Earnings remain another key support.”

US fourth-quarter earnings have been robust so far with 81 per cent of S&P500 companies beating earnings forecasts, the highest in seven years, he added.

Energy was the worst-performing US sharemarket sector on Friday as Chevron and ExxonMobil slumped after their fourth-quarter earnings disappointed investors. The high-flying tech sector also dived with Apple and Alphabet both down more than 4 per cent.

The sell-off in shares — which pushed the S&P 500 down to its lowest point since January 10 — capped a week-long decline of 3.9 per cent that marked the worst week for the US benchmark in more than three years and the biggest retreat since the November 2016 US election.

Sparking the rout was US non-farm payrolls data for January, which showed average hourly earnings in the world’s No 1 economy rose 2.9 per cent year on year, the fastest wage growth since 2009.

This came on the heels of a swath of bullish US economic data, which saw the Atlanta Fed lift its “GDPNow” GDP forecast to a four-year high of 5.4 per cent last week, as well as recent US dollar weakness that has loosened US financial conditions to the most stimulatory position since 2000.

But the strength of the US wages data was the tipping point that fuelled expectations that the Federal Reserve will tighten by more than the three 25 basis point rises indicated by its projections. Economists expect the first hike could be as early as March.

“With the US economy so strong and inflation risks shifting to the upside as evident in a pick-up in wages growth to 2.9 per cent, year on year in January, we see the Fed raising rates four or possibly even five times this year, which is still more than the three the market is now allowing for,” AMP Capital’s Dr Oliver said. “Reflecting this we see more upside for bond yields ahead.”

But providing the rise in bond yields isn’t too abrupt, Dr Oliver said the correction in global sharemarkets should be “limited”, with “reasonable gains” likely this year.