Trading Day: live markets coverage; Stocks flat as caution prevails; plus analysis and opinion

The ASX closes flat as investors exercise caution in the wake of a sudden halt to Wall Street’s run of records.

And that’s the Trading Day for Tuesday, October 24.

4.30pm: Stocks end flat as caution prevails

The local share market ended the session flat as investors took note of Wall Street caution in the lead up to a much anticipated US Federal Reserve chair appointment.

The benchmark S & P/ASX200 was up 3.638 points, or 0.06 per cent, at 5897.60 points. The broader All Ordinaries index was up 5.317 points, or 0.09 per cent, at 5962.5 points.

Short a definitive catalyst, investors were torn between the prevailing caution and strength in Chinese steel and iron ore futures trade, according to Ric Spooner of CMC Markets.

“I think there is a little bit of nervousness about the fact that US stocks fell quite sharply last night, certainly in relation to the sort of moves we’ve had over the last few weeks,” he said.

“It just gives the market a room for pause I think particularly as we’ve had such a good rally over as well ourselves, so I think the market sees itself on hold to some extent.”

Mr Spooner said the market is waiting for US President Donald Trump’s Federal Reserve chair appointment as well as inflation data due out this week.

In financials, NAB edged down 0.09 per cent to $32.54. Commonwealth Bank ticked 0.04 per cent lower to $78.66. Westpac lowered 0.06 per cent to $33.39 and ANZ lost 0.23 per cent to $30.47.

John Durie 4.15pm: Nufarm boss bags a big one

For much of his 30 months in charge of crop protection group Nufarm, Greg Hunt has talked up the chance of picking up some offtakes from the big multi-billion dollar chemical mergers happening offshore and today he finally bagged one.

A smaller clean up deal is also in the offing and could be unveiled by the end of next month.

The $627 million Century Portfolio came courtesy of a forced divestiture from the European Union to clear the ChemChina-Syngenta deal — read more

NUF last $8.73

4.05pm: Morgan Stanley’s best bets on building

Australian infrastructure and broader US construction are the most attractive exposures for the Australian building materials stocks, according to Morgan Stanley.

In contrast, it says it sees “a sharp Australian housing construction correction playing out in coming years.”

“While we expect much of this decline to come in the multi-family segment, we believe that the detached segment will also be affected. CSR is most exposed to a housing correction.”

The broker has initiated coverage of Boral (BLD -0.7pc) at “overweight”, Fletcher Building (FBU 0.0pc), James Hardie (JHX -0.2pc), Adelaide Brighton (ABC 0.0pc) at “equalweight” and CSR (CSR -0.3pc) at “underweight”.

3.55pm: What tickles the Queen’s risk appetite

Valentine Low writes:

She has famously never won the Epsom Derby but if it is any compensation, the Queen has made nearly £7 million ($A12m) from her racehorses over the past 30 years as an owner.

Since 1988 she has won 451 races from 2,815 runs, according to research by the website myracing.com, at an average of 15 race wins a year, and a success rate of 15.9 per cent.

Last year was her best in recent decades when her horses earned her £557,650 ($A942,288). The total for the past 30 years is £6,704,941 ($A1.13m) or an average of £223,498 ($A377,655), according to the website — read more

The Times

3.41pm: ASX takes shreds from paper stock

Hygiene, health and wellbeing take a back seat in local trade today as investors tear into Asaleo Care, shares in the company behind Sorbent, Libra and Handee Ultra product joining Aussie grime in the dustbin.

Credit Suisse analysts haven’t helped the mess, warning clients in a note earlier today that China bans on recycled paper has led demand seeping out into other crevasses of the market, namely inflating the price for a core Asaleo input: pulp.

“We were previously modelling a decline in AUD pulp costs for AHY in 2018. We now had to reverse that and grow pulp costs by A$10mn,” says Credit Suisse. “hence the large downgrade.”

The investment bank downgraded the stock to “neutral” from “outperform” and slashed its 12-month target price 15 cents to $1.55 ahead of the open.

“[We believe] that pulp price relief may come in December as China must ultimately relax import restrictions to avoid a shortage of paper products,” the analysts qualify.

AHY down 8.2 per cent on $1.46 in late trade.

Paul Garvey 3.31pm: Stakes raised in Tolga’s New Century

Credit Suisse has jumped back on board the Tolga train. The investment bank, which was an early and prominent backer of Tolga Kumova’s graphite venture Syrah Resources, has now initiated coverage of the former broker’s new big play, New Century Zinc, with a lofty price target.

Credit Suisse analysts have set a $2.40 target price on New Century, which is aiming to retreat the old tailings at the mothballed Century zinc mine in Queensland. That’s compared to the company’s share price at the time of the research report’s release of $1.43.

“New Century, in our view, presents an opportunity to acquire equity in a low capital, low cost, and low operating risk zinc mine, at an entry price well below our assessed intrinsic value,” the analysts wrote.

Credit Suisse’s analysts were the first of the big firms to start detailed coverage of Syrah, and the bank ended up picking up a stack of work raising several hundred million in equity for the company.

There may not be the same opportunity for Credit Suisse this time around though. New Century recently announced that big North American resources fund Sprott had offered it $US45m in debt funding, which should cover much of the forecast restart costs.

Shares in New Century hit a fresh all-time high of $1.545 in early afternoon trade, taking its market capitalisation to as much as $460 million.

NCZ last up 6.3pc on $1.52

Rowan Callick 3.15pm: Trump to face Asia’s new world order

Shinzo Abe’s resounding electoral victory is reverberating awkwardly around a jumpy region already on constant high alert thanks to the unremitting aggression of Kim Jong-un’s North Korea.

This sets the stage for Donald Trump’s first visit to Asia as US President early next month, an extended tour that would be challenging at any time but now demands especially brilliant diplomacy and leadership if it is to succeed in enhancing American respect and authority.

Paul Garvey 2.55pm: Miners’ obsessive supply pressure: Goldmans

The lowest level of exploration spending in almost thirty years and a fixation on dividends is setting up the next resources super cycle, Goldman Sachs says.

Goldman Sachs analysts led by Craig Sainsbury have found that the percentage of revenue being reinvested in exploration by the world’s miners has fallen to its lowest level since 1990.

That lack of investment could see supply struggle to keep up with demand in the years ahead.

“Exploration success is the genesis of the mining industry — assets can’t be mined until they are found — and thus the underspend on new project discovery may be sowing the seeds for future production challenges,” the analysts said.

The analysts also found that the obsession of today’s mining companies with returning cash to shareholders was coming at the cost of capital expenditure in their businesses, which coupled with the drop in exploration spending could further exacerbate any future supply shortfall.

“The allocation of money to capital returns has been more than double the amount of incremental cashflow we see being allocated to capex,” the analysts said.

“With miners still appearing to be focused on a period of returning excess capital to the market, we do not believe that we will see any significant new industrywide mine development in coming years.”

Goldman Sachs said the issue of underinvestment was most acute in aluminium and coking coal, with the lack of spending to keep prices higher for longer even if demand remains steady.

The team’s top mining picks are South32 (S32), Alumina Ltd (AWC), Norsk Hydro and Glencore.

2.25pm: READ: Exclusive Myer transcript on Lew

When Solomon Lew and incoming chairman Garry Hounsell locked horns they turned to The Australian and an interview with retail reporter Eli Greenblat over whether a meeting ever had taken place.

On October 10, Eli Greenblat interviewed Myer chairman Paul McClintock and deputy chair/incoming chair Mr Hounsell. He asked Mr Hounsell a number of times if he will meet with Mr Lew.

The Australian reporter at that time was unaware a meeting had in fact taken place between Mr Lew and Mr Hounsell on October 6.

Now the Lew camp claim Hounsell ‘’inferred’’ in the interview a meeting had never taken place. Myer argues this is not the case, and Mr Hounsell did not mislead the reporter.

We go now to the transcript of that interview:

Eli Greenblat: Garry, there has been a lot of back and forth about meetings and will people speak to Lew or will he speak to Paul or will there be a chance to meet and talk. At this stage, will you pick up the phone and call Lew to organise a meeting?

Garry Hounsell: Eli, we have developed a program as you would expect of meeting with all large and important shareholders, in fact a cross section of all shareholders meeting up now to the AGM, and in fact we have had some meetings with some shareholders which I don’t want to go into, but I can tell you those meetings were cordial, they were productive, I did a lot of listening, and between now and the AGM there will be a series of further meetings …

EG: With your biggest shareholder?

GH: um, with all shareholders.

EG: OK, I think, I suppose we all know what we are getting at, I mean, I suppose, I understand what you are saying, absolutely, you’ve met with other shareholders, absolutely understand that, part of this whole friction in the last few weeks has been one claim that Lew wanted to meet with Paul, or that he wanted to meet with the board and it didn’t happen, and that’s a kind of a ‘he said, he said’ argument, I understand that.

But Garry, now that you are about to come into the chair, between now and the AGM will you meet with your biggest shareholder, Solly Lew?

GH: Look Eli, I will meet with all of our shareholders, anybody that would like to meet with me, I will meet with them ….

EG: So you are open to meeting with Solly? If Solly were to pick up the phone …

GH: Absolutely … Investors Mutual or any other shareholder call me then I will meet with them, and in fact we will be proactive so this is not a matter of someone picking up the phone and ringing me, I mean, we will be proactive across our shareholder base we will be listening. I’m focusing on the future, Im not focusing on the past, and I don’t want to get into the past, I want to focus on the future so to me all shareholders are important, whether they own 1000 shares or 10 per cent of the company — every single shareholder is important to me and I will speak to all of them …

EG: Including Mr Lew?

GH: Including Mr Lew, including the Investors Mutual, including any other shareholder …

EG: yeh, but will you, it’s a bit unclear, but, will you proactively pick up the phone to speak to Lew or is it a case that if Lew calls you, you will meet with him? Because they are very different aren’t they?

GH: Both.

EG: Both? So you would reach out, so if I want to say that you are now saying you will happily reach out to Premier or Lew or his people to have a meeting, you would do that? That is correct for me to say that?

GH: Eli, I think I have answered that, I will talk to all of our shareholders both proactively and if they pick up the phone and call me.

1.45pm: CBA cuts international transfer fees

Commonwealth Bank has cut customers’ international transfer fees by as much as 70 per cent.

Customers making an international money transfer using the bank’s mobile applications will now pay $6 on exchange transfers equal to or under a $1000 threshold and $12 for those over, down from a blanket $22 previously.

The move comes shortly after CBA along with other major lenders cut ATM fees for non-customers.

CBA remains the focus of a federal-court case centred on allegations of noncompliance with money laundering measures brought against it by financial intelligence agency Austrac.

CBA last flat at $76.68.

Samantha Woodhill 1.23pm: Fletcher hits pause for sweeping review

NZ-based Fletcher Building is in a trading halt ahead of an announcement that may result in significant writedowns and pending the announcement of the company’s chief executive appointment.

The financial performance of two of the company’s largest building and interiors projects and the impact of that performance on its earnings guidance for the financial year are currently being reviewed.

In its 2017 financial results, reported an 80 per cent earnings after tax drop to $NZ105 million. But Fletcher’s operating earnings plummeted 62 per cent, dragged by the Building and Interiors business unit, which recorded a $NZ292 million operating loss — read more

FBU last $7.22

Stephen Bartholomeusz 1.05pm: Prepare for Lew, Myer trench warfare

Solomon Lew has formally declared war on the Myer board and ensured some level of confrontation and tension at this year’s annual meeting.

Given the private sabre-rattling and public criticisms of Myer and its strategies that had emanated from the Lew camp, the formal announcement that Lew’s Premier Investments will vote its 10.8 per cent Myer shareholding against the three directors facing re-election, including incoming chairman Garry Hounsell, on 24 November wasn’t unexpected.

What Premier did do was, for the first time, to disclose the demands it has made of Myer — read more

MYR last $0.74

12.25pm: Tokyo stocks’ longest win streak pauses

Tokyo’s bellwether Nikkei stock index opened lower Tuesday, taking a breather after its longest winning streak in its nearly 70-year history and retreats from record levels on Wall Street.

The Nikkei 225 index, which on Monday logged its 15th consecutive rise, lost 0.20 per cent, or 42.73 points, to 21,653.92 in the first few minutes of trading.

The broader Topix index slipped 0.05 per cent, or 0.94 points, to 1,744.31. “Selling to lock in profits is likely to lead the market in the morning as investors are well aware that the Nikkei had gained more than 1,300 points over the past 15 trading days,” Okasan Online Securities said.

But drops will be limited, the brokerage said in a commentary, noting there were investors who are ready to buy on the dips.

AFP

12.03pm: Rio Tinto faces US class action

Rio Tinto is facing a class-action suit lodged by shareholders of it’s American Depository Receipts in a US district court over allegedly “false and misleading statements” around the true value of a unit in Mozambique, according to Bloomberg.

Rio and two former executives were charged by the US Securities and Exchange Commission in US Federal Court last week, the body bringing forward allegations in relation to the impairment of Mozambique assets bought by the company for $US3.7bn and later sold for $US50m — read more

RIO last down 1.1 per cent on $68.47

Damon Kitney 11.50am: Governments ‘failed on energy’

Productivity Commission chairman Peter Harris has accused state and federal governments of failing to fulfil their ultimate responsibility to offer certainty for public and private sector investors to invest in the nation’s energy sector.

In a discussion with University of Melbourne vice-chancellor Glyn Davis on the university’s “Policy Shop podcast”, Mr Harris also said the Council of Australian Governments process had fundamentally failed and mused that some involved in it believed COAG “is the place where good policy goes to die”.

11.20am: ASX200 extends gains to 0.2pc

The local sharemarket ticks higher in late-morning trade, the S & P/ASX200 index up 0.2pc at 5903.2 after a hesitant start as Wall St records came to a jarring halt.

Major bank share price action reverses to head back toward flat, while the bourse’s largest real estate stock Scentre leads the sector with gains over 1.5 per cent.

The Australian dollar trades 0.1 per cent higher at US78.13 cents ahead of September inflation data due tomorrow from the Australian Bureau of Statistics.

Michael Roddan 11.05am: Future Fund beats annual target

The $135 billion Future Fund has easily outstripped its annual return target, despite missing its quarterly return target over the last three months.

The fund, which was created by the Howard government in 2006 to meet unfunded public service retirement liabilities, has grown to $134.5 billion from its initial $60 billion funding.

Over the three months to September, the fund achieved a return of 0.8 per cent, below its target of 1.4 per cent.

However, the fund booked a 7.9 per cent return over the year through September, above its annual 6 per cent target.

10.35am: ASX200 ekes out slim gains

Australia’s S & P/ASX 200 rose 0.1pc to 5899.5 after falling 0.2pc in early trading.

Japara Healthcare jumped 8pc after Moelis bought a 10pc stake.

Saracen rose 6.3pc after Ballieu Holst and Canaccord upgraded their ratings.

Asaleo Care fell 7.3pc after Credit Suisse cut its rating.

Rio Tinto fell 0.7pc after a class action was filed in US district court on its Mozambique coal dealings, according to Bloomberg.

But a majority of sectors are now positive despite overnight falls on Wall Street.

Eli Greenblat 10.20am: Lew’s war on Myer gets personal

Myer and its incoming chairman Garry Hounsell have just found themselves in the middle of a war with retail billionaire Solomon Lew, and it has got very personal very quickly.

Mr Lew, significantly ratcheting up the heat and the language, has labelled the Myer board as out of touch and arrogant.

And in a personal letter to Myer shareholders — also released this morning — Mr Lew has proudly promoted that he has worked his entire life in retail industry and has always admired Myer as an Australian retail icon.

“At its height, it was a well-run business that understood what its customers wanted to buy, and delivered it with great service, Mr Lew said in his letter.

“Sadly, those times are long gone” — more to come

MYR last

9.55am: ASX set to fall as Wall St stalls

Australia’s S & P/ASX 200 is expected to fall slightly after modest declines on Wall Street.

Overnight index futures imply a 0.1 per cent fall in the S & P/ASX 200 after the S & P/500 fell 0.4pc.

US declines were magnified by a 6.4 per cent fall in GE amid fears of a dividend cut but all sectors fell except utilities.

The S & P 500 formed an exhaustion gap and a bearish key reversal or engulfing pattern on daily charts.

This suggests a dip to the 50-day moving average (now at 2500 points) is likely in coming weeks.

But will much will depend on Donald Trump’s Fed chair appointment, expected in coming days.

“There seems little inspiration from the overnight leads to buy the market here, but we live in strange times and the downside — if it does eventuate — will be driven by profit-taking above all and I would not be overly surprised to see the index fall from 5890 on open, although I don’t expect a collapse,” says IG chief market strategist Chris Weston.

Index last 5893.9

Sarah-Jane Tasker 9.48am: MedAdvisor eyes hospital expansion

Digital medication management company MedAdvisor is set to announce today a $9.5 million investment boost from EBOS Healthcare, a move chief Robert Read says will turbocharge growth.

Mr Read said the money from EBOS would accelerate growth plans at MedAdvisor, which helps people manage their medication, and is said to drive adherence by up to 20 per cent.

“It is a significant transaction, which can turbo charge our business,” he said.

MDR last $0.036

9.44am: Mirvac maintains FY18 targets

Property developer Mirvac has reaffirmed its guidance for earnings to grow by six to eight per cent in the current financial year.

Operating earnings per share is expected to be 15.3 to 15.6 cents per stapled security, while distribution is likely to increase six per cent to 11 cents per security.

The company, in a first quarter operational update, says it has maintained solid metrics across its office, industrial and retail portfolios, while earnings in the residential segment will be skewed to the second-half of the fiscal year — AAP

MGR last $2.32

9.35am: Moelis grabs Japara slice

Moelis Australia managed funds has bought a 9.96 per cent stake in Japara Healthcare, its recent aged-care fund capital raising upsized due to strong investor demand.

Japara’s market capitalisation at last close stood at $490m, Moelis at $2.7bn.

JHC last $1.86

9.25am: Domino’s Europe ambition a trip-wire?

Domino’s European target is “too optimistic’ according to Deutsche Bank.

The broker has cut its target to $46 vs. $48 and reiterated its “sell” rating.

“We now also have concerns about Management’s target for 2,600 stores in Europe by 2025 which would entail building or buying c. 1,600 stores over the next 8 years,” Deutsche analyst Michael Simotas says.

“Our analysis suggests that even with relatively rapid organic store openings, Domino’s would need to add an additional about 700 stores through acquisitions to achieve its 2025 target of 2,600 stores.”

“The problem is that we believe there are only about 470 chain stores which could come up for sale and history suggests that only about 70 per cent of acquired stores are successfully converted to the Domino’s format, leaving a material shortfall.”

He adds that growth by acquisition is also expensive, with converted stores costing DMP about $800,000 each.

DMP last $49.53

9.15am: Nufarm buys $627m European crop assets

Nufarm has struck a deal to buy a $627m crop portfolio from Adama Agricultural Solutions and Syngenta Crop Protection.

Assets include over 50 crop protection formulations and more than 260 registrations in European markets, while Nufarm will also purchase additional inventory for $64 million.

European vendors initiated the divestment following Syngenta’s recent acquisition by ChemChina and in accordance with European Commission requirements, says Nufarm.

The deal is subject to approval by the Commission and regulatory clearance by relevant European authorities — read more

NUF last $8.73

8.58am: Japara block changes hands

A 10.1m block of Japara Healthcare shares have traded hands this morning for $2.00/share, representing almost 4 per cent of it current market capitalisation.

JHC last $1.86

8.52am: Analyst rating changes

Western Areas cut to Hold — Bell Potter

BWX cut to Hold — Bell Potter

Vocus raised to Hold — Morgans

Livewire cut to Hold — Morgans

Saracen Mineral raised to Buy — Canaccord

Rio Tinto cut to SectorPerform — RBC

Oil Search cut to Hold — Shaw & Partners

Lend Lease raised to Outperform — Shaw & Partners

New Century Resources initiated at Outperform — Credit Suisse

Asaleo Care cut to Neutral — Credit Suisse

Domino’s price target cut to $36.00 from $38.00; Sell rating kept — Deutsche Bank

CSR initiated at Underweight; 12-month price target $4.00 — Morgan Stanley

James Hardie initiated at Overweight; 12-month price target $20.00 — Morgan Stanley

Boral iniated at Overweight; target price $8.50 — Morgan Stanley

Adelaide Brighton initiated at Equalweight; 12-month price target $6.00 — Morgan Stanley

Fletcher Building initiated at Equalweight — Morgan Stanley

Ben Wilmot 8.45am: Scentre joins sky-high rush

Shopping centre giant Scentre is refining its plans for a landmark office tower in Parramatta CBD as it joins the rush of commercial landlords developing in the area.

The group has drafted architects Woods Bagot for advice on its proposed building, the Argyle Tower, above Westfield shopping centre. The tower is to span about 100,000sq m of office space in 40 levels above the centre, and Scentre has already spoken to prospective tenants — read more

SCG last $3.99

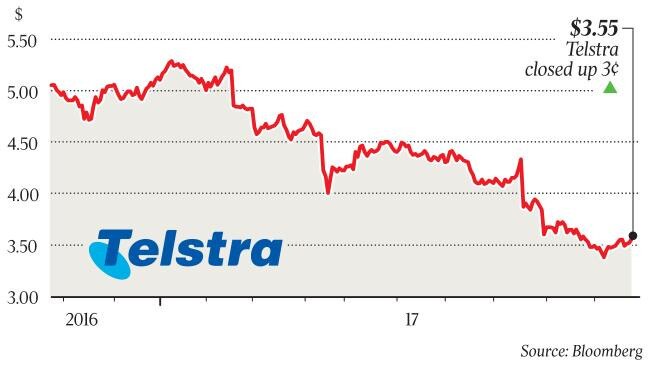

Supratim Adhikari 8.40am: Rare Telstra win in roaming battle

The competition regulator has buried Vodafone Australia’s bid to roam on Telstra’s regional mobile network for good, saying that “declaring” domestic roaming won’t fix the poor service received by consumers in rural Australia.

It’s welcome news for Telstra’s anxious retail shareholders, who have already seen the telco’s existing financial position come under increasing threat, with the National Broadband Network cutting into its fixed-line margins and TPG Telecom getting ready to raise the stakes in the mobile market — read more

TLS last $3.55

8.30am: Domino’s buys out Japan JV partner

Domino’s Pizza has struck a deal to buy out its Japan joint venture partner Bain for $42 million at discount to its $46.4 million book value last recorded in July this year.

Domino’s says its expects the purchase to be earnings accretive and completion on the 27th of this month — read more

DMP last $49.77

8.20am: MetLife dampens ANZ sale hopes

Bridget Carter and Scott Murdoch write:

The headwinds facing the sale of ANZ’s life insurance business are getting stronger.

MetLife may be walking away and could struggle to justify a purchase given its own valuations in the US.

The bank ramped up the likelihood a month ago that it would press ahead with a “capital markets solution’’ as an indication the sale was under pressure.

ANZ sold the wealth management business to IOOF for $975 million after it was unable to attract a buyer for the combined business.

ANZ has been trying for more than a year to offload the life insurance division but was hampered by CBA’s swift sale of CommInsure to AIA and a number of other assets coming on to the market — read more from DataRoom

Paul Garvey 8.14am: Iron ore discount entrenched

The looming season of weaker iron ore demand from China will only further entrench the wide discount between high-grade and low-grade materials, Rio Tinto iron ore chief executive Chris Salisbury has said.

China last week announced that half of the steel production in the country’s northeastern provinces would be closed over the winter, as part of ongoing attempts to curb air pollution.

While the shutdown should ostensibly hurt iron ore demand, given China is by far the world’s largest consumer of the material, Mr Salisbury told The Australian the closures would add to an appetite for its higher-grade iron ore production.

Ben Butler 8.10am: ANZ blinks on rate-rigging claim

The corporate regulator has settled landmark Federal Court litigation over alleged rigging of the key BBSW interest rate benchmark with one of the banks in its sights, ANZ, and was last night close to a deal with a second, NAB.

Westpac, the third bank the Australian Securities & Investments Commission has accused of rate rigging, was yesterday also in talks with the regulator, although these were brief and broke up without any resolution.

7.40am: ASX set to open marginally lower

The Australian market looks set to open marginally lower, after Wall Street retreated from fresh record highs, weighed down by a drop in technology and industrial shares.

At 7.35am (AEDT) on Tuesday, the share price futures index was down five points, or 0.09 per cent, at 5,870.

In the US, stocks declined as each of the major Wall Street indexes retreated from a record, weighed down by a drop in technology and industrial shares.

The Dow Jones Industrial Average fell 0.23 per cent, the S & P 500 lost 0.40 per cent and the Nasdaq Composite dropped 0.64 per cent.

Locally, in economic news today, the ANZ-Roy Morgan Consumer Confidence weekly survey is due out.

In equities news, Vocus, Sirtex Medical, Southern Cross Media, Bega Cheese and Dexus Property Group have annual general meetings while Mirvac is expected to provide a first-quarter operational update.

The Australian share market yesterday pulled back from earlier gains to close below 5,900 points, handing back strong gains posted at the end of last week. The benchmark S & P/ASX200 index fell 13 points, or 0.22 per cent, to 5,894 points.

The broader All Ordinaries index lost 11.4 points, or 0.19 per cent, to 5,957.2 points.

AAP

7.10am: US rally stalls

US stocks slipped after major indexes finished last week with a trifecta of records.

A flurry of earnings reports released before the opening bell sparked swings in individual stocks. With nearly 200 S & P 500 companies on this week’s earnings calendar, according to FactSet, analysts and investors expect corporate news to continue to drive much of the action in the coming days.

“Listening to companies on their earnings calls, I think the general trend is still looking pretty positive,” said Jeremy Bryan, a portfolio manager at Gradient Investments.

While some sectors like the insurance industry are expected to report weaker results than in previous years, partially because of damage from hurricanes earlier this year, “we’re looking through the one-time hits and still expecting robust growth into 2018,” Mr. Bryan said.

The Dow Jones Industrial Average fell 55 points, or 0.2 per cent, to 23274. The S & P 500 lost 0.4 per cent and the Nasdaq Composite edged down 0.6 per cent.

All three indexes had closed at fresh highs Friday.

Australian stocks are tipped to fall at the open. At 7.10am (AEDT) the SPI futures index was down 10 points.

On Wall Street, Hasbro shares shed 8.6 per cent after the toy maker posted earnings and sales results that beat analysts’ expectations, but gave a downbeat projection for sales in the key holiday period. Shares of Mattel, a rival toy maker, dropped 3.2 per cent.

General Electric slid 6.3 per cent, its biggest one-day percentage decline since 2011 after several analysts cut their price targets for the stock following the company’s latest earnings report, which slashed 2017 projections.

Investors this week will be watching closely for the European Central Bank’s plans to announce the fate of its giant bond-buying program at its meeting on Thursday night (AEDT).

This “may be a potential turning point in the timeline for withdrawing accommodation,” said Holly MacDonald, chief investment strategist at Bessemer Trust, noting the European Central Bank is facing constraints on continuing its program of quantitative easing.

Still, with the decision well-telegraphed to markets and no interest rate increase on the horizon for some time, the ECB’s October meeting is unlikely to ruffle bond markets much, she said.

US government bonds strengthened, with the yield on the benchmark 10-year US Treasury note falling to 2.375 per cent from 2.381 per cent on Friday. Yields fall as bond prices rise.

Dow Jones Newswires

6.55am: Dollar lower

The Australian dollar has fallen against the US dollar. At 6.35am (AEDT), the Australian dollar was worth US78.05 cents, down from US78.31 cents yesterday.

Westpac’s Imre Speizer says risk sentiment had remained elevated pushing equities to fresh record highs while the US dollar rose.

“The US dollar index is up 0.3 per cent on the day ... (while the) AUD slipped from 0.7834 to 0.7797,” he said in a Tuesday morning note.

With no economic data to report, the key event risk for Tuesday would be US and European manufacturing and services activity data.

He said he thought the Australian dollar today had the “potential to move below .7800 if the US dollar’s recent recovery persists”.

AAP

6.45am: Oil prices mixed

Oil prices fluctuated as investors tried to gauge the potential for supply disruptions resulting from tensions in the oil-rich Kurdish region of Iraq.

US crude futures settled up 6 cents, or 0.12 per cent to $US51.90 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell 38 cents, or 0.66 per cent, to $US57.37 a barrel on ICE Futures Europe.

A drop in the number of rigs drilling for the US last week helped lift the US benchmark — a sign that supplies in the U.S. will be tightening, analysts said — US crude prices have risen in nine of the past 11 trading sessions. The gap between the two price benchmarks has been relatively wide, helping to spur a surge in exports of crude from the U.S., and some expect the difference to narrow in the coming weeks.

Dow Jones

6.40am: Global stocks firmer

The American dollar climbed against rivals, helping to push up European and Japanese stock markets, while share prices in the US moved modestly higher at the start of a heavy week of corporate earnings report and a much-anticipated European Central Bank meeting.

Key earnings reports were expected from many of the biggest US companies, including Google parent Alphabet, ExxonMobil, McDonald’s and Boeing.

Earnings growth has been generally solid through the early part of the reporting season, with few companies reporting a significant hit from the US hurricanes.

Investor attention was also focusing on the ECB’s policy-setting meeting on Thursday, at which the central bank is expected to announce a scaling back of its easy money policies that have provided support to the eurozone economy in recent years.

Earlier in Asia, Tokyo’s main stocks index extended its longest winning streak in its nearly 70-year history on the re-election of Shinzo Abe as prime minister.

In Europe, stock markets pushed higher with the exception of Madrid. And the euro struggled with the fallout from Spain’s Catalonia crisis after the national government imposed direct rule on the region following a controversial independence vote.

London ended up 0.02 per cent, Frankfurt closed up 0.1 per cent and Paris was 0.3 per cent higher at the close.

AFP