MetLife US position dampens ANZ hopes for insurance sale

The headwinds facing the sale of ANZ’s life insurance business are getting stronger.

MetLife may be walking away and could struggle to justify a purchase given its own valuations in the US.

The bank ramped up the likelihood a month ago that it would press ahead with a “capital markets solution’’ as an indication the sale was under pressure.

ANZ sold the wealth management business to IOOF for $975 million after it was unable to attract a buyer for the combined business.

ANZ has been trying for more than a year to offload the life insurance division but was hampered by CBA’s swift sale of CommInsure to AIA and a number of other assets coming on to the market.

The business would still attract a $3 billion price tag but the process is glacial.

There were suggestions last night that MetLife, the last remaining player in the race, was no longer a keen participant and was re-evaluating its position.

One theory is that MetLife had been in talks with IOOF about teaming up and splitting the assets but the pair did not progress to be close to a deal.

MetLife’s current trading position in the US is considered to be a sticking point. It is trading on an eight times forward earnings basis and some say swallowing ANZ, which wants around 12 times earnings, would be a tough task.

The US group would have to raise equity and the differential in earnings would make it a challenging sell to investors.

It is thought MetLife has become frustrated by the internal process and feels ANZ has not been ultra accommodative in answering some of its technical questions.

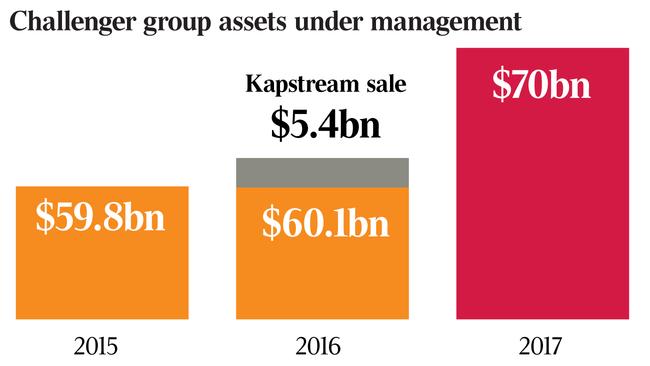

Also in the financial services sector, Challenger and Macquarie are reportedly keen to grow their international businesses and could be in competition to buy a British funds management group.

The two Australian businesses are in the hunt for a division of Old Mutual Global Investors.

The takeover of the business would be worth about £550 million ($927m) and Old Mutual has appointed Goldman Sachs to oversee the sale.

Macquarie and Challenger are reportedly in the race with TA Associates but the Australian businesses would have the firepower to make the buy.

A move by Macquarie would be consistent with the bank recently increasing its appetite to make offshore acquisitions.

It has taken control of the Green Investment Bank after public and political pressure, so an expansion into Britain would not trouble the bank.

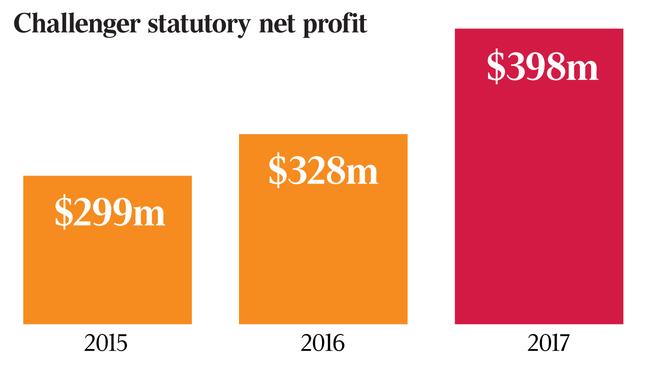

The company last week reported that its sales of life insurance products rose 45 per cent compared to the previous year, hitting $1.6bn for the September quarter.

The Australian group has struck a deal with Japan’s Mitsui Sumitomo Primary Life Insurance which has allowed Challenger to grow aggressively in long-dated annuities.

Japan accounted for 38 per cent of sales in the past quarter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout