Trading Day: live markets coverage; plus analysis and opinion

The ASX retreats from a fresh two-and-a-half year high, while BofAML’s contrarian indicator show ticks up.

And that’s Trading Day for Thursday, November 2.

Samantha Woodhill 4.31pm: Stocks shy from 2.5-year high

The local share market finished the session relatively flat after hitting a two-and-a-half year high in early trade, as mining strength offset weakness in the banks.

The benchmark S&P/ASX200 was down 6.067 points, or 0.1 per cent, at 5931.699 points. The broader All Ordinaries index was down 3.286 points, or 0.05 per cent, to 6002.199 points at the close.

CMC Markets chief market analyst Ric Spooner said the banking sector weighed on the market as investors mulled the implications of National Australia Bank’s newly announced initiatives on returns.

“The main pull factor is that the banks are down, probably in reaction to the NAB’s profit report,” said

“I think it just reflects the fact that it makes the dividend a little bit more vulnerable if there’s more of a downturn in revenue than expected next year while they increase their expenditure.”

NAB lost 2.83 per cent to $31.95. Commonwealth Bank edged down 0.33 per cent to $77.41. Westpac ticked 0.6 per cent lower to $33.00 and ANZ lowered 0.83 per cent to $29.83.

More to come.

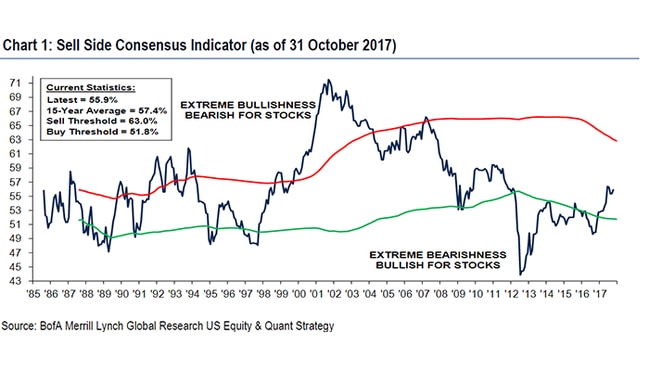

4.24pm: Contrarian Wall St signal stirring: BofAML

BofAML’s “Sell Side Indicator” — a measure of Wall Street’s bullishness on shares — remained near a six-year high last month, albeit with no sign of “euphoria”.

The indicator rose from 55.4 to 55.9, above the “Buy Threshold” of 51.8 per cent, but below the “Sell Threshold” of 63 per cent.

As such, the indicator remains firmly in “Neutral” territory — where it has been for the past 11 months.

But when the indicator has been this low or lower, returns over the next 12 months have been positive 94 per cent of the time, according to BofAML quants.

“The ongoing shift from scepticism to optimism likely reflects the march towards euphoria that we typically see at the end of bull markets and had been glaringly absent for most of this cycle,” they say.

The “Sell Side Indicator” is based on the average recommended equity allocation of Wall Street strategists as of the last business day of each month.

“We have found that Wall Street’s consensus equity allocation has been a reliable contrary indicator,” they add.

“In other words, it has historically been a bullish signal when Wall Street was extremely bearish, and vice versa.”

4.20pm: Rinehart tops rich list, wealth near doubles

Trevor Chappell writes:

Mining magnate Gina Rinehart is Australia’s richest person, after a recovery in iron ore prices boosted her estimated fortune to $US16.6 billion. Ms Rinehart tops the 2017 Forbes Australia Rich List, after her wealth increased by $US8.1bn, from $US8.5bn in 2016.

The list includes 50 people, who needed a minimum of $US700 million to be placed, up from $US500m in 2016.

Property tycoon Harry Triguboff takes second spot, after his fortune rose by $US3bn, to $US9.9bn.

Cardboard box king Anthony Pratt was third with a fortune of $US5.8bn — up by $US2.2bn.

The boss of iron ore miner Fortescue Mining, Andrew Forrest, enjoyed the biggest jump in wealth in percentage terms, with his fortune surging 255 per cent to $US4.4bn and pushing him up 16 spots to sixth position.

Elizabeth Redman 4.12pm: Mortage stress creeps up an echelon

Households are finding it even harder to keep up with their mortgage repayments, with the number of households in mortgage stress rising even for more affluent borrowers.

More than 910,000 households are in mortgage stress as of October, with little leeway in their cash flows as they try to meet ongoing costs, up from 905,000 the previous month.

Of these, more than 21,000 households are in severe stress and cannot meet their repayments from current income, meaning they could ask for hardship assistance or even sell their homes — a figure that has risen by 3000 from last month.

The figures from Digital Finance Analytics come in an environment of sluggish wage growth that has been outpaced by spiralling housing prices, meaning some borrowers have stretched themselves to get into the housing market.

More to come

Paul Garvey 4.10pm: Fortescue’s harsh winter headache

Andrew Forrest’s Fortescue Metals Group could be worth 70 per cent less than its present value if the current deep discounts for its ore persist, according to new analysis from Credit Suisse.

While Credit Suisse analyst Sam Webb continues to rate Fortescue a “buy” with a price target of $6.10 a share, he noted that Fortescue’s net present value would fall to just $1.40 a share if the current discounts are sustained.

The lower-grade iron ore predominantly produced by Fortescue has historically sold at a 10 per cent discount to the spot price of higher grade material, but the gap has blown out to around 30 per cent in recent months.

A crackdown on pollution in China which has forced the closure of numerous dirtier steel mills has been blamed for the phenomenon, with the remaining mills showing a clear preference for high-grade ore in order to maximise their steel output.

Fortescue had previously been vocal in its belief that the wider discount would be a short-term phenomenon, but conceded in its latest quarterly last week that the discount was taking longer to wash through than hoped. It formally downgraded its discount guidance from a range of 75 to 80 per cent down to 70 to 75 per cent.

In his latest research note, Mr Webb noted that if the current discount persisted through to the middle of next year, it would complicate upcoming decisions around capital spending, exploration and dividends. The company is weighing up how best to replace its depleting Firetail mine, and has flagged a formal decision by June next year.

Mr Webb said he was “wavering ever so slightly” in his view that the wider discount would be temporary, but warned against extrapolating out the current discount over the long term.

“The longer the cyclical v structural debate goes on the more we’re happy to concede that the latter’s argument gains more momentum,” he said.

“In the same breath however we think it’s worth noting that the discounting has primarily been a nine-month phenomena and our channel checks and data suggest discounts remain elevated but not materially worsening.”

Shares in Fortescue were up 4.6 per cent in early afternoon trade, while other iron ore heavyweights BHP and Rio Tinto were up 1.9 per cent and 2 per cent respectively.

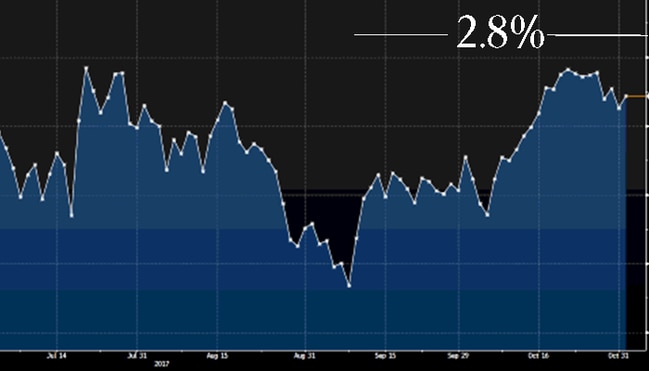

4.04pm: Banks’ big bad November: Bell Potter

Banks are on track for a bad November with NAB leading a further slide in the majors today.

Bell Potter’s Richard Coppleson warned Monday that a seasonal sell-off in banks was about to begin after the usual surge in October.

He pointed out that the average aggregate October rise in bank shares since 2000 is 3.9pc, whereas it has fallen 2.1pc on average in November and risen 1.4pc in December.

“Since 2000 the Bank Index, on average has been up 13 out of the last 17 years or up a huge 76 per cent of the time in October,” Mr Coppleson said.

“The reason, I believe, is that investors chase the banks for their dividends — since hardly any other stocks are going ex dividend in early November — they tend to see huge buying interest.”

He also noted that in the 13 years that the Bank Index closed ”up” in October, the average rise in those 13 years has been a 5.6 per cent.

The S&P/ASX 200 Banks index rose 2.8 per cent last month.

Christine Lacy 3.25pm: Seven board to appoint Dyson, Ziegelaar

The Kerry Stokes-controlled Seven West Media is set to appoint lawyers Teresa Dyson and Michael Ziegelaar to its board of directors.

The appointments are part of a process of renewal at the heavily scrutinised media group, following the departure of two of its female directors this year.

The new directors join the board just after a 20 per cent cut in directors fees takes effect.

Dyson is a well-regarded Brisbane-based law partner at McCulloch Robertson, while Ziegelaar is a partner specialising in mergers and acquisitions partner at Freehills in Melbourne.

Dyson is also chair of business law section of the Law Council of Australia and earlier this year joined the board of Energy Queensland.

The appointments are set to be announced as early as today — more to come from MarginCall

SWM last down 6.1pc on 62 cents

3.03pm: Farifax in Domain spin-off aftermath: Citi

As Fairfax Media shareholders approve the partial spin-off and listing of the Domain real estate listings business, brokerage Citigroup looks at what’s likely to happen to Fairfax.

Following the separation, the 60 per cent of Domain that Fairfax still owns should make up 72 per cent of Fairfax’s valuation (which Citi expects should be 74 cents a share). However Citi says Fairfax’s core newspaper businesses are facing continued revenue decline, and Fairfax is facing continued cost cutting to minimise the earnings decline.

“We expect management’s focus will switch to its remaining businesses once the Domain separation is finalised,” the brokerage notes.

Citi says with recent changes in media ownership laws changed, there is scope for cost synergies in combining the newspaper assets with a TV broadcaster.

“Although this is unlikely to change the downward revenue trajectory facing both industries,” it adds.

FXJ last down 0.2 per cent at $1.09, Citi’s current price target $1.10.

Turf Condon 2.44pm: Lendlease extends Italian job

Lendlease has struck a deal for the second stage of a major joint venture urban regeneration project in Milan as the group continues to expand its operations in Italy.

The development and construction giant is undertaking the Milano Santa Giulia project with its partner Risanamento SpA Group.

Lendlease chief executive for international operations, Dan Labbad, said the Milano Santa Giulia project was a major step forward for Lendlease in Europe. The company is targeting 17 global gateway cities for major integrated projects — read more

LLC last down 0.4pc on $16.20

Anthony Klan 2.05pm: NBN playtime over: ACCC’s Sims

The competition watchdog has launched a public inquiry into the National Broadband Network over its customer service levels with the view to introducing new minimum standards and fines if it does not comply.

The Australian Competition and Consumer Commission said it would investigate failures by NBN Co — such as flawed internet connections and missed appointments by installation contractors — and it was likely introduce new legislation to crack down on the growing problems.

ACCC chairman Rod Sims said the NBN monopoly was bound by the ACCC’s rulings on pricing, but it faced no regulation regarding the quality of service it provided.

“When the NBN was set up we set up a high-level pricing construct but did not set up standards, we left that up to the NBN and (telcos) to agree on,” Mr Sims told The Australian.

“But that doesn’t seem to be working very well and we are stepping in”.

Samantha Woodhill 1.52pm: Seven flags $105m savings

Seven West Media chief executive Tim Worner has flagged $105 million of cost savings over the next two years, partly due to job cuts, and is confident the company can deliver a financial result in line with consensus forecasts, despite soft market conditions.

At the company’s annual general meeting, Mr Worner said job cuts will deliver $25m in savings this year, adding to the $30m in cost savings already announced, to offset the step-up in AFL rights costs.

A further $50m in cost savings will be realised in 2019 from the roll-off of major sports rights, he said — read more

SWM last down 3pc on 64 cents.

Matt Chambers 12.52pm: BHP bullish on copper green streak

BHP Billiton says electric car production could boost global copper demand by half in the next 18 years, adding to the groundswell of excitement from miners and mining investors around the market potential of green technology.

Speaking at London Metals Exchange week, BHP Minerals America boss Danny Malchuk (who oversees the giant Escondida copper mine in Chile) said new technologies and the push for cleaner energy could significantly add to already growing commodities demand — read more

BHP last up 1.9pc on $27.46

12.40pm: Miners on demand high buoy ASX

The local sharemarket treads water, enduring choppy trade after hitting a two-and-a-half year high of 5961.5 earlier. The S&P/ASX200 index last traded 0.1 per cent higher 5938.5.

The heavyweights remain at a standoff, big banks trade in the red with NAB (-2.7pc) worst off, while miners surge as details from London Metal Exchange week emerge to buoy demand hopes.

“Base metals surged higher on the back of stronger fundamentals and increasing optimism about the impact electric cars will have on demand,” says ANZ head of FX research Daniel Been

“Nickel once again led the sector higher, surging another 4pc after strong gains earlier this week.”

SWING STOCKS:

Credit Corp (+6.4pc)

Boral (+3.9pc)

Fortescue (+4.2pc)

NAB (-2.7pc)

CYBG (-3.8pc)

Harvey Norman (-3.8pc)

Bank of Queensland (-2.2pc)

52-WEEK HIGHS:

Whitehaven Coal ($4.03)

South32 ($3.68)

Origin Energy ($8.19)

Santos ($4.62)

Seven Group Holdings ($13.80)

Boral ($7.45)

CIMIC ($49.38)

Michael Owen 12.23pm: SA parliament tussles over bank tax

An amended budget measures bill has been returned to the lower house of the South Australian parliament today without the Weatherill government’s controversial bank tax attached after the proposed impost was rejected by one vote in the upper house late last night.

But Treasurer Tom Koutsantonis said the state Labor government’s position “has not changed and expects the bill to be passed in full and as is”.

“The lower house will be sending the budget measures bill straight back to the upper house

this morning,” he said.

The Liberal opposition, independent John Darley and two Australian Conservatives locked in to block the measure last night, while the government could only count on the support of two Greens and Dignity for Disabled MP Kelly Vincent, who had done a deal with Labor to secure her vote.

More to come

12.14pm: NAB’s ‘spanner in the works’: Macquarie

NAB delivered a “solid” underlying second-half FY result, according to Macquarie, however the bank’s forecast of 5-8 per cent cost growth in FY18 surprised the investment bank’s analysts.

“NAB threw a spanner in the works by providing guidance on expenses,” says Macquarie, “by bringing expenses forward, NAB will essentially spend an additional $1bn over the next 3 years vs. our current forecast.”

“This will likely to put ongoing pressure on capital and dividends.”

NAB released its FY17 results earlier this morning, booking $6.64bn in cash profit over the period (vs. $6.67bn Bloomberg’s consensus estimate) and announcing a 99c-per-share final dividend in line with estimates.

NAB last down 2.6pc on $32.02

Ben Butler 11.57am: Westpac rate-rig case comes to an F

A judge has questioned why Westpac’s star trader Col “The Rat” Roden said he was going to “f**k the rate set” if he wasn’t intending to manipulate the benchmark bank bill swap rate (BBSW).

Mr Roden made the remark in a June 2010 phone call with another Westpac trader, Zac Sharma, parts of which were under scrutiny in the Federal Court this morning.

The Australian Securities and Investments Commission has accused Westpac of trying to rig the BBSW on 16 occasions between 2010 and 2012 — read more

WBC last 0.6pc on $32.99

11.40am: ACCC to launch NBN probe

The Australian Competition and Consumer Commission has begun an investigation to determine whether NBN wholesale service standard levels are appropriate, and to consider whether regulation is necessary to improve customer experiences.

The inquiry will focus on the ability to enforce appropriate service standard levels at a wholesale level, including redress arrangements when consumers seek compensation at a retail level when those wholesale standards are not met.

More to come.

11.38pm: Aussie dollar jumps on trade, buildings beat

The Australian dollar jumps from $US76.79 to $US77.01 in late-morning trade on stronger-than-expected building approvals and international trade data.

September building approvals rose 1.5pc month on month, whereas economists expected a 1.5pc fall.

The September trade balance was $1.745b vs. $1.2 billion expected.

AUD/USD last 0.7694

Supratim Adhikari 11.18am: Telstra flags short-term pain

Telstra boss Andrew Penn has warned that the next three years are going to see things get worse for the telco as the combination of the National Broadband Network and TPG Telecom continue to hollow out the incumbent’s earnings.

Speaking at Telstra’s investor day in Sydney, Mr Penn said that while Telstra was facing challenges on both the fixed and mobile fronts it had some solutions at hand to tackle the downward pressure — read more

TLS last down 1.4pc at $3.52

11.15am: WATCH: Akin CEO talks AI

Artificial Intelligence will become more and more common in both business and homes. Full interview: https://t.co/9IHO2eNsMh #Reimagination pic.twitter.com/56iG6hMWwm

— Sky News Business (@SkyBusiness) November 1, 2017

11.10am: ASX taps 2.5y high in early trade

Australia’s S&P/ASX 200 is up 0.3pc at 5952.6 after hitting a 2.5 year high of 5961.5 in opening trading.

Most sectors are up after further gains in global equities and commodities.

The materials sector is strongest, led by nickel miners as nickel continued surging on bullish demand forecasts relating to electric cars.

The energy sectors is also positive despite a fall in oil prices, with Oil Search bouncing 1.8pc.

However, the index is being restrained by falls in banks, Telstra, Woolworths, Amcor, AGL and Westfield.

International trade and building approvals data are due for release at 11.30am (AEDT)

10.45am: NAB ‘cost blowout’ sticking point: UBS

NAB’s FY17 result was “solid” with net interest margins stronger than expected, but market focus is on the cost blowout, according to UBS.

“Guidance would imply 2020 costs are $135m to $365m above current forecasts, which represents 1.5 to 4.0 per cent of NPAT,” UBS analyst Jon Mott says.

“Management expects this to be offset by stronger revenue, but the market may not incorporate revenue upside until there are signs of delivery.”

Mott has a “sell” rating and $32.88 target.

NAB shares fell as much as 3.3pc to a 2-week low of $31.81.

Yesterday they hit a 6-month high of $32.98.

NAB last down 2.4pc at $32.02.

Dana McCauley 10.34am: Fairfax investors back Domain spin-off

Fairfax Media has partially spun off its prized real estate asset Domain.

Shareholders voted in favour of the proposal at a scheme meeting ahead of the company’s AGM in Sydney this morning.

The separation, back by a united board, was approved almost unanimously by shareholders.

It will give Fairfax shareholders one share in Domain for every share they hold, with Fairfax to retain a 60 per cent stake in the real estate company.

No new capital will be raised as part of the separation, which was undertaken to address a perception within Fairfax that its share price did not fully reflect the value of Domain — more to come.

FXJ last down 0.2 per cent at $1.09.

10.18am: ASX posts gains, NAB shares fall

The S&P/ASX200 index lifts 7 points, or 0.1 per cent in early trade to 5944.7.

The big grinners are Credit Corp (+9.2pc), Boral (+3.1pc) and Fortescue (+3%), while the big groaners are NAB (-3pc), CYBG (-2pc), Harvey Norman (-1.8pc) and Bank of Queensland (-1.7pc).

9.58am: ASX eyes fresh six-month highs

Australian share market strength looks set to continue Thursday.

The S&P/ASX 200 share index is set to open up 0.3pc at 5955 based on overnight futures versus fair value.

That suggests the benchmark will hit a fresh six-month high. If it exceeds 5956.5 it will be the highest since 2015.

On Wall Street the S&P 500 rose 0.2pc and the Nasdaq fell 0.2pc, while in Germany, the DAX index surged 1.8pc.

The Fed left rates unchanged as expected while upgrading its economic growth assessment to “solid” from “moderate” and continuing to flag another hike in December.

Trump is due to name the new Fed Chair today and the Wall Street Journal says it will be Jerome Powell, which wouldn’t be controversial.

The Republican’s tax reform bill is also expected to be released later on Thursday.

Base metals were strong again last night with nickel up 4.1pc and copper up 1.7pc.

Meanwhile Brent crude fell 1.4pc and spot iron ore rose 1.4pc.

Index last 5937.8

9.35am: WATCH: Sky Business live

Today we're live from #Reimagination, featuring Australian and international tech leaders and trends. Tune in to @Foxtel channel 602. pic.twitter.com/UuRCGwCBcJ

— Sky News Business (@SkyBusiness) November 1, 2017

9.27am: Analyst rating changes

CSR raised to Overweight; 12m target price $5.15 — Macquarie

Myer target price (12m) cut to 72c vs. 74c — Citi

Amcor target price (12m) cut to $15.50 vs. $16 — Citi

Technology One target price (12m) raised to $6.00 vs. $5.50 — Bell Potter

Link Holding raised to Neutral — Credit Suisse

9.18am: Boral lifts FY18 domestic outlook

David Winning writes:

Building materials supplier Boral painted a bullish picture for its Australian earnings following unusually dry weather in its fiscal first quarter, but said a string of natural disasters had posed a challenge to its North American business.

Boral said it had benefited from “an unprecedented period of continuous, uninterrupted construction activity in New South Wales and Queensland” and financial results from both states in the three months through September had been well ahead of its initial hopes.

As a result, the company said it now expected earnings from Australia in the 12 months through June would be above the previous year, including any gains from property sales. That was more upbeat than in August when management said earnings before interest and tax in fiscal 2018 would likely be broadly similar with fiscal 2017 — read more

BLD last $7.13

Michael Owen 9.15am: SA bank tax rejected

The Weatherill government’s controversial bank tax has been rejected by South Australia’s upper house in a late-night sitting.

After days of political grandstanding, the MPs in the Legislative Council tonight voted to remove Labor’s bank tax from the government’s Budget Measures Bill.

The government lacked the numbers to secure its passage after the Australian Conservatives and independent John Darley locked in behind the opposition in blocking it.

9.09am: WATCH: Solomon Lew on Ticky

Premier Investments chairman Solomon Lew: The Myer board have absolutely no idea what they’re doing. MORE: https://t.co/PZoJoiakN0 #ticky pic.twitter.com/0zxxxCJerg

— Sky News Business (@SkyBusiness) November 1, 2017

Read: Umbers pleads for trust as Myer’s targets lowered, writes Eli Greenblat

9.05am: Telstra expects $3bn NBN loss

Telstra will book a $3bn earnings (EBITDA) once the NBN roll out is finished, according to the company’s latest estimate.

TLS last $3.57

9.01am: Agents on edge over Domain split

Ben Wilmot and Turi Condon write:

Antony Catalano, the head of Fairfax Media’s $1.9 billion real estate arm Domain, has held meetings with Melbourne agents to soothe concerns about the looming spin-out of the company that shareholders are due to vote on today.

Under the planned split, Domain will be carved off from Fairfax Media and run as a separate company, but a $36 million deal that will see the company take full control over the Review Property business from a clutch of blue-blood Melbourne real estate firms and high-profile agents has industry circles abuzz.

Note: Fairfax to hold an EGM and bring Domain spin-off plans to shareholders ahead of its annual general meeting this morning.

FXJ last $1.09

8.52am: AMP under pressure to split

Bridget Carter and Scott Murdoch write:

AMP is coming under intense pressure from major shareholders to split the $14.5 billion financial powerhouse into two companies as tensions between the company and investors near boiling point.

The financial company’s investment banks UBS and Macquarie Capital are said to have been exploring a spin-off of AMP’s New Zealand operations and its life insurance division.

But shareholders are fuming over the company’s decision not to proceed with the plans, as at least two of the major shareholders are calling for the resignation of chief executive Craig Meller and for the company to shelve its current strategy and instead proceed with the breakup plan — read more from DataRoom

AMP last $5.00

8.45am: Kidman chairman Lester to retire

Kidman Resources chairman Peter Lester has announced his retirement, the company appointing Brad Evans to the role on an interim basis while the company undertakes a search for a replacement.

KDR last $1.32

8.40am: FANG’s big F books 79pc growth

Deepa Seetharaman writes:

Facebook said third-quarter profit jumped 79 per cent on its continued dominance in online advertising, though the social media giant’s aggressive pursuit of growth drew scrutiny. Wednesday from politicians investigating alleged Russian propagandists’ activity on Facebook.

The company reported a third-quarter profit of $US1.59 a share, compared with the $US1.28 projected by analysts polled by Thomson Reuters, and up from 90 cents per share a year ago. The company also generated $US10.33 billion in revenue, more than the $US9.8 billion analysts predicted and up from $US7.01 billion in the prior year’s quarter.

Dow Jones Newswires

Eli Greenbat 8.37am: Umbers seeks ‘New Myer’ grace

Myer chief executive Richard Umbers is clinging to his “New Myer” strategy, despite the whirlwinds of the most volatile and challenging retail conditions in decades blowing him off course from hitting earnings targets.

And he is asking investors to trust him as he junks the old targets and sets new hurdles to match the gloomy retail sector.

But Mr Umbers yesterday pledged there would be no shirking of his responsibility or work effort and no easing up by his managers just because Myer’s near-term earnings targets had been weakened, as the former Australia Post executive and ex-British Army officer made his case to shareholders — read more

MYR last 73 cents.

8.30am: 6000 no cause for vertigo

It’s a round number that marked the top in 2015 before a savage pullback, but investors shouldn’t fear the 6000-point mark.

The broader All Ordinaries index breached the key level yesterday, touching a post-global financial crisis high of 6019.3. It later closed up 29.1 points, or 0.5 per cent, at 6005.5 points.

Meanwhile, the S&P/ASX 200 — the benchmark index that has been tracked by professional investors for nearly two decades — was not too far behind.

The S&P/ASX 200 on Wednesday had its best one-day gain in the past two weeks to close at a six-month high of 5937.8, after surging 0.5 per cent.

Although it got very close in early 2015, it has not been past the 6000-point mark since the GFC crippled the financial system in 2008.

Michael Roddan 8.20am: NAB in overhaul, books $6.6bn profit

National Australia Bank will show the door to more than 6,000 employees, or 18 per cent of its 33,400 wide workforce, as part of a strategy overhaul as it doubles down on its business banking credentials.

The overhaul, which will also see the bank hire around 2,000 new employees, comes as the banking sector undergoes a dramatic makeover with lenders stripping themselves of wealth management arms in a bid to refocus on mortgages and deposits.

NAB will establish a redundancy program for workers leaving the bank where employees can access support and resources for a period of up to six months after leaving the bank. NAB is planning to cut $1 billion in costs from the bank by 2020.

Note: NAB booked a 2 per cent increase in FY net profit to $6.64bn, slightly below Bloomberg’s consensus analyst estimate of $6.67bn. The company announced a final dividend-per-share of 99 cents, in line with estimates — read more

NAB last $32.88

8.05am: Trump to appoint Powell to Fed chair

Kate Davidson, Peter Nicholas and David Harrison write:

The White House has notified Federal Reserve governor Jerome Powell that President Donald Trump intends to nominate him as the next chairman of the central bank, according to a person familiar with the matter.

The president spoke with Mr. Powell on Tuesday, according to another person familiar with the matter who couldn’t describe what they discussed.

Mr. Trump had settled on Mr. Powell by Saturday, but people familiar with the process had cautioned that he could change his mind. The president plans to formally announce the decision Thursday before he leaves for a trip to Asia on Friday.

The Wall Street Journal

7.53am: Stocks set to edge higher

The Australian market looks set to open a smidgen higher after Wall Street mainly held on to modest gains following better-than-expected US private sector jobs data and the decision by the Federal Reserve to keep its interest rates unchanged.

At 7am (AEDT), the share price futures index was up four points, or 0.07 per cent, at 5,933.

In the US, the central bank pointed to solid US economic growth and a strengthening labour market while downplaying the impact of recent hurricanes, a sign it is on track to lift borrowing costs again in December. The ADP National Employment survey showed that US private employers added 235,000 jobs in October, surpassing estimates for 200,000 and setting up expectations for a strong US non-farm payrolls report on Friday.

The Institute for Supply Management (ISM) said its index of US factory activity slipped to a reading of 58.7 in October from 60.8 in September, which was the highest since May 2004. But, a reading above 50 indicates growth in manufacturing, which accounts for about 12 per cent of the US economy. The Dow Jones Industrial Average closed up 0.25 per cent, the S&P 500 had gained 0.16 per cent at the bell but the Nasdaq Composite closed down 0.17 per cent. Locally, in economic news on Thursday, the Australian Bureau of Statistics will release September’s international trade in goods and services data plus building approvals figures for the same month.

In equities news, National Australia Bank is slated to release its full-year results while Fairfax Media will have its Domain spin-off vote along with its annual general meeting while Seven West Media, Boral, Perpetual and Downer EDI have their AGMs.

The Australian market on Wednesday closed higher with gains in all but one sector and the All Ordinaries index closing above 6,000 points for the first time since the global financial crisis.

The benchmark S&P/ASX200 index rose 28.8 points, or 0.49 per cent, to 5,937.8 points.

The broader All Ordinaries index gained 29.1 points, or 0.49 per cent, to 6,005.5 points.

Meanwhile, the Australian dollar is higher against a strengthened greenback following the US economic data and the Federal Reserve’s decision to keep its interest rates on hold.

AAP

7.14am: Dollar lifts against US counterpart

The Australian dollar is higher against a strengthened greenback following strong economic data.

At 7.21am (AEDT), the Australian dollar was worth US76.72 cents, up from US76.62c on Wednesday.

The US dollar climbed on Wednesday as investor optimism about the greenback rose ahead of major announcements on US fiscal and monetary policy after strong economic data.

The Federal Reserve kept US overnight interest rates unchanged and highlighted “solid” economic growth at the conclusion of its two-day policy meeting. Analysts said the Fed’s statement indicated that a December rate rise is overwhelmingly likely.

The ADP National Employment survey showed private employers added 235,000 jobs in October, surpassing estimates for 200,000 and setting up expectations for a strong US non-farm payrolls report on Friday.

The Aussie dollar is also higher against the yen and the euro.

AAP

7.06am: Wall Street closes mixed

The Dow Jones Industrial Average climbed to start November, after major indexes posted a flurry of records last month.

Stocks inched slightly higher after the Fed left rates unchanged as expected but signalled it would consider lifting them before year’s end amid signs the economy was gaining momentum.

The Dow industrials added 58 points, or 0.3 per cent, to 23,435 after rising as much as 140 points early in the session. The blue-chip index posted its seventh straight monthly gain Tuesday, its longest streak since April 2012. The S&P 500 climbed 0.2 per cent, and the tech-heavy Nasdaq Composite swung between small gains and losses and closed down 0.2 per cent.

Dow Jones

6.24am: European stocks tap two-year high

European stocks posted their highest close in more than two years Wednesday, boosted by resource stocks after solid Chinese manufacturing data and car makers following strong US sales figures.

The Stoxx Europe 600 index climbed 0.4 per cent to 396.77, for its highest close since August 2015, according to FactSet data.

Germany’s DAX 30 index rallied 1.8 per cent to 13,465.51, for another all-time closing high. Trading in Germany was closed Tuesday for the Reformation Day holiday. France’s CAC 40 rose 0.2 per cent to 5,514.29, and the U.K.’s FTSE 100 slipped 0.1 oer cent to 7,487.96.

Dow Jones

6.22am: Oil prices dip after tapping two-year highs

Prices for the US oil benchmark settled with a modest loss Wednesday, as a brief foray into the highest intraday levels in more than two years fizzled, on concerns that US crude producers will find incentive to ramp up output.

Prices for the West Texas Intermediate crude, as well as the global benchmark Brent crude, had seen solid gains earlier in the session, buoyed by optimism surrounding OPEC efforts to rebalance the oil market and across-the-board weekly declines in U.S. crude and product stockpiles.

December West Texas Intermediate crude shed 8 cents, or less than 0.2 per cent, to settle at $US54.30 a barrel. It climbed to as high as $US55.22 in early trading, the highest intraday level for a front-month contract since early July 2015, according to FactSet data. Prices on Tuesday logged their highest settlement since February.

Meanwhile, Brent oil for January, the international benchmark, fell 45 cents, or 0.7 per cent, to $US60.49 a barrel, a day after ending at the highest since July 2015.

Dow Jones

6.14am: Fed keeps rates on hold

Fed Leaves Rates Unchanged, Cites ‘Solid Rate’ of Economic Growth

The Federal Reserve left short-term interest rates unchanged Wednesday, but signalled it would consider lifting them before year’s end amid signs the economy is gaining momentum.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout