Richard Umbers pleads for trust as he lowers Myer targets

Myer chief executive Richard Umbers is clinging to his ‘New Myer’ strategy, despite challenging retail conditions.

Myer chief executive Richard Umbers is clinging to his “New Myer” strategy, despite the whirlwinds of the most volatile and challenging retail conditions in decades blowing him off course from hitting earnings targets.

And he is asking investors to trust him as he junks the old targets and sets new hurdles to match the gloomy retail sector.

But Mr Umbers yesterday pledged there would be no shirking of his responsibility or work effort and no easing up by his managers just because Myer’s near-term earnings targets had been weakened, as the former Australia Post executive and ex-British Army officer made his case to shareholders.

“I wouldn’t say that we are going to work any less hard,’’ Mr Umbers said. “Conditions have changed significantly and we are going to work extraordinarily hard, just as we would have done under the previous metrics that matter, and deliver the best possible result that we can.’’

In a crucial, day-long strategy update, Mr Umbers — flanked by his management team — dazzled analysts with talk of building in Myer stores new fleets of restaurants and cafes, men’s barbers and grooming services, beauty salons and even testing a children’s play centre.

But he conceded that modest earnings targets set just two years ago would need to be rebased.

Underlining just how tough the retail sector is at the moment, Myer also released its first-quarter sales one month early, bending to demands from its biggest shareholder, billionaire Solomon Lew, to issue them before the AGM. The figures showed that sales for the 13 weeks to October 28 were down 2.8 per cent at $699 million.

Sales on a comparable-store sales basis were down 2.1 per cent — now the fourth consecutive quarter of sliding sales growth, with Myer not producing an uptick in same-store sales since the first quarter of 2016.

Mr Lew, who has been fighting a public and increasingly bitter campaign against the Myer board for a month to secure at least two board seats, last night on Sky News Businessattacked the retailer over its new strategy update.

“Everybody knew that the strategy wasn’t working. They have made no major changes to the strategy,’’ said Mr Lew, whose Premier Investments is Myer’s largest shareholder, with a stake of 10.8 per cent. “It looks as if there is nobody that’s been made the fall guy for this particular strategy. The board has absolutely no idea of what’s going on.

“They have no retailers on the board and it’s just going to get worse.’’ He also said he thought the strategy update was “woeful”.

Mr Lew said he had also briefed lawyers about possibly taking action against Myer for what he viewed as misleading the market over its recent financial performance.

Recent carnage in the retail sector, which has seen a spate of collapses including the demise of the part-Myer owned Topshop chain, had finally prodded Mr Umbers to water down his New Myer sales and profit targets, first laid out to investors in 2015 under his grand plan that was meant to resurrect Myer’s profitability by 2020 after two decades of flatlining earnings.

Mr Umbers yesterday said Myer would now target greater than 10 per cent improvement in sales per square metre between 2017 and 2020, down sharply from the original target of more than a 20 per cent. An initial sales target of greater than 3 per cent growth between 2016 and 2020 was dropped completely, while return on funds employed would now aim for greater than 10 per cent by 2020, against an initial hurdle of 15 per cent.

Under his 2015 version of New Myer, Mr Umbers had pledged to aim for EBITDA growth ahead of sales growth by 2017. Yesterday that was altered to underlying earnings per share improvement of at least 5 per cent (compound annual growth rate) between 2017 and 2020.

Mr Umbers, backed by his chief financial officer Grant Devonport, said the targets first issued in 2015 needed to “evolve” and had been “reframed” to reflect the significant erosion in the health of the retail sector over the past two years, reflected in sagging retail sales and shrinking foot traffic in shopping centres.

“When we put out the original targets we obviously had no idea how the market was going to unfold and I think if we were putting those targets out again, knowing what we know now about the evolution of market-competitive conditions, I think we would have framed them in a different way,’’ Mr Umbers said.

“So it is logical as conditions change so too should our strategy, and that’s why we are looking to evolve it, to reflect that changing market. And as you change the strategy logically the things we need to look at and the performance measures we use to judge us by should also be evolving at the same time.’’

Mr Umbers said these worsening conditions in retail were reflected in the fact that when New Myer was created in 2015 national retail sales were growing at 5-6 per cent a year. But by 2016 that had fallen to 1-2 per cent.

He called on shareholders to back his New Myer vision and see for themselves the changes made in the stores.

“I’m hoping shareholders are already seeing signs of progress,” he said. “There has been a lot of change on our shopfloor for the positive.”

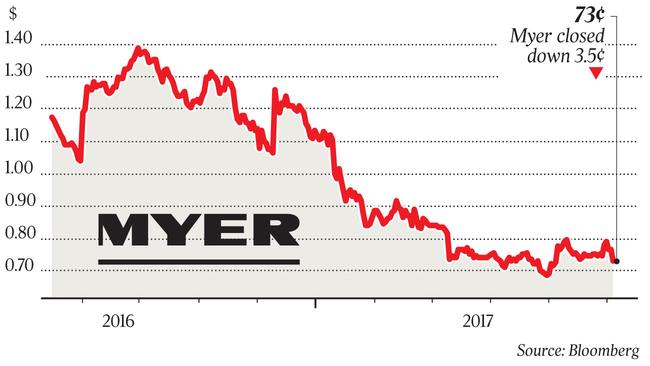

Shares in Myer fell 3.5c to 73c, with the Myer board and Mr Lew set for a bruising AGM showdown on November 24.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout